(Bloomberg) — Across much of China, warehouses and industrial parks that once attracted international investors are suffering from an alarming slowdown in business activity.

Most read articles on Bloomberg

Logistics centers built in anticipation of a long-term boom in e-commerce, manufacturing and food storage are losing tenants, forcing building owners to slash rents and shorten lease terms. Shares in real estate investment trusts that own Chinese commercial property have plummeted, and some managers are expecting further declines in rental income.

Average vacancy rates at logistics facilities in eastern and northern China are approaching 20%, the highest in years, according to real-estate consultancy firms. Rising warehouse construction is exacerbating the problem. “We’re seeing an oversupply of logistics and industrial space in China,” said Xavier Li, an equity analyst at Morningstar who covers real estate.

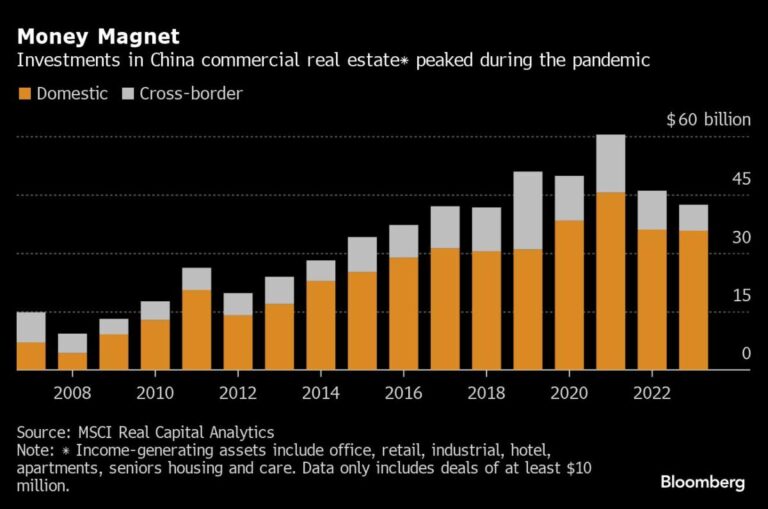

The downturn is disappointing for property owners who were banking on China’s economic recovery this year.Over the past decade, global institutional investors have collectively pumped more than $100 billion into warehouses, industrial buildings, office buildings and other commercial real estate in China, according to data from MSCI Real Capital Analytics.Overseas investors include Blackstone, Prudential Financial Inc.’s PGIM, Singapore’s GIC Pte. and CapitaLand Group Inc., among many others.

Some lenders are considering selling off their worst-performing assets before rents fall further. Others are waiting out the downturn in hopes of realizing profits in the long term.

“The best locations remain resilient,” said Hank Xu, CEO and co-founder of Forest Logistics Properties, which owns warehouses and distribution centers in transportation hubs in major Chinese cities including Beijing, Shanghai and Wuhan.

The six-year-old company manages about $2.5 billion in assets from investors including private equity firms, insurance companies and pension funds. Clients include Chinese e-commerce giant JD.com, courier service SF Express and multinational consumer goods companies.

Xu said recent market weakness had not hindered the company’s expansion plans, and it plans to build a new logistics facility in the southern Guangdong port in the coming months. “We will continue to inject capital into China in the next one to two years because we see it as a great opportunity,” he added.

Reduce spending

China’s commercial real estate sector was a bright spot for much of the housing market downturn that began in 2021, but is now feeling the effects of spending cuts by consumers and businesses.

The weakness in the logistics and industrial sectors is happening in tandem with a slowdown in office real estate in big cities like Beijing and Shanghai, both of which are the result of overbuilding driven by the huge amounts of money that flowed into commercial real estate when interest rates, borrowing and construction costs were low.

Warehouses built to house e-commerce fulfillment centers, giant refrigerators for refrigerated or frozen produce and space for companies to store parts and manufactured goods aren’t being used as much as their owners had hoped. Growth of e-commerce in China has slumped as shoppers have become more frugal. Online penetration of the country’s retail sales is already relatively high, at 30%.

Rising geopolitical tensions are pushing companies to move some of their manufacturing overseas to meet the needs of end customers who want to reduce their reliance on China, while a slowdown in cross-border trade is also reducing companies’ demand for storage facilities in mainland China.

High number of vacant seats

Warehouse vacancy rates in eastern China, where logistics facilities are concentrated, rose to 19.2% in the first quarter, according to data from Cushman & Wakefield, while the national rate was 16.5%, helped by strength in the south.

The situation in China contrasts with other logistics markets in the United States and Asia. In the United States, industrial and warehouse vacancy rates are rising in some parts of the country, but they are still in the mid-single digits and below historical averages, and rents are still rising. In Asia, logistics occupancy rates are high and rents are rising in South Korea, Japan and Australia.

Of the 20 major Chinese cities tracked by Cushman, 13 saw logistics rents fall quarter-over-quarter in the first quarter, with Beijing and Shenzhen leading the way with declines of 4.2% and 3.9%, respectively. China is set to complete an additional 33 million square meters of new supply by the end of 2026, the firm said.

CapitaLand China Trust, which owns properties including shopping malls and business parks, bought four logistics parks in Shanghai, Wuhan and other cities for a total of 1.68 billion yuan ($231 million) in late 2021. Occupancy rates across its logistics portfolio fell to 82% at the end of 2023 from 96.4% a year earlier.

Shares in the Singapore-listed REIT have fallen 27 percent so far this year, while the benchmark Straits Times Index has risen 2.7 percent. “We are actively in discussions with potential buyers to further improve occupancy rates for our logistics properties,” a CapitaLand China Trust spokesman said.

packing

China’s industrial parks, designed as science and technology clusters with office buildings and manufacturing facilities, are seeing multinational and local companies pull out. Overall vacancy rates in Beijing’s business parks were 20.5% in the first quarter, according to Colliers data.

In Guangzhou, China’s southern manufacturing hub, a disappointing post-pandemic recovery has led some multinational companies to close factories and change their business strategies.

Swiss healthcare manufacturer Lonza Group AG announced earlier this year that it would close its pharmaceutical manufacturing facility following a strategic review. The 17,000-square-meter factory had begun production just three years ago in the Sino-Singapore Guangzhou Knowledge City, a high-tech business park jointly backed by the Guangzhou municipal government and Temasek Holdings-owned CapitaLand. Lonza still has manufacturing facilities in Suzhou and Nansha, and maintains a commercial sales organization in China.

A China Real Estate Investment Trust that owns the industrial property recently reported that occupancy at buildings in the Shanghai Technology Park had nearly halved after a subsidiary of smartphone maker Oppo vacated 19,314 square meters (207,890 square feet) of space before its lease expired. The mobile phone maker decided last year to close its chip development unit, Zec.

Rental pressure

Corporations now have the upper hand in lease renewal negotiations for warehouses and other real estate.

“The competition for tenants is pretty fierce right now,” Luke Li, managing director of ESR Group, said during an online logistics industry conference in mid-June. The Hong Kong-based real estate asset manager owns e-commerce distribution centers, cold-chain warehouses and manufacturing industrial parks in China and other countries. To maintain warehouse occupancy rates, landlords are offering tenants flexible rental terms, better amenities and other attractive terms, Li added.

ESR’s latest financial report showed that its revenue in Greater China fell 20% year-on-year in 2023, with the company citing weaker consumer sentiment and reduced rental demand.

Another Singapore-listed REIT, Mapletree Logistics Trust, has also struggled in China. Rents at its 43 properties in the country fell 10% in the first three months of 2024, and some tenants have fallen behind on rent payments. The trust maintains occupancy rates for its China logistics assets at about 93%.

Mapletree Reit CEO Ng Kiat said on an earnings call in April that the environment in China will remain volatile and uncertain over the next 12 months. The trust is focused on retaining tenants and is considering selling some of its worst-performing China assets, he added. “We’re trying to get more clarity on whether we’re seeing a bottom, but I don’t think we’re seeing a bottom right now. We’ll have to wait and see,” Ng said. Mapletree declined to comment.

“Everybody is cutting costs,” said Humbert Pan, China head of Gaw Capital Partners, an alternative investment firm that holds real estate assets. Pan, who spoke at the same conference as Li, said logistics rents aren’t rising even though the buildings are occupied. “I think most logistics owners are struggling to negotiate with existing or new tenants,” he added.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP