KARACHI:

Pakistan recorded a current account surplus of $100 million in November 2025, reversing a deficit of $291 million in October, but the modest improvement came despite a sharp decline in goods exports and was driven almost entirely by remittances sent by overseas Pakistani labourers who continue to receive little to no institutional support from the state.

Rather than reflecting a strengthening of export competitiveness or productive capacity, the surplus underscores Pakistan’s growing dependence on remittance inflows generated by migrant workers, many of whom face systemic hurdles, harassment, and mistreatment at the hands of immigration, labour, and enforcement authorities, including the Federal Investigation Agency (FIA).

The surplus comes despite clear stress on the trade front. Goods exports declined on a year-on-year basis, reflecting price pressures, lack of interest of corporations, and competitiveness challenges faced by Pakistan’s export sectors. SBP data shows exports of goods during November stood at $2.27 billion, while imports amounted to $4.73 billion, resulting in a trade deficit of $2.45 billion for the month. The deterioration in merchandise trade highlights the fragile nature of Pakistan’s recovery, with export momentum failing to keep pace with import growth.

Yet, the external account remained in surplus largely due to robust secondary income inflows, dominated by workers’ remittances. Remittances reached $3.19 billion in November, lifting total secondary income inflows to $3.46 billion for the month, more than offsetting deficits in goods, services, and primary income accounts.

Pakistan’s substantial remittance inflows, reaching around $38 billion annually and constituting about 10% of GDP, have paradoxically acted as an economic trap rather than a lifeline, as highlighted by economist Atif Mian in his recent blog. These large inflows from overseas workers fuel rapid consumption growth that outpaces the expansion of productive capacity. This imbalance triggers real appreciation of the Pakistani rupee, resulting in an overvalued exchange rate that undermines the competitiveness of export sectors. As a consequence, traditional export industries weaken, while the economy becomes increasingly dependent on continuous remittance flows to sustain foreign exchange reserves and household spending.

This phenomenon closely resembles “Dutch disease”, where resource windfalls crowd out tradable sectors and perpetuate structural vulnerabilities. Mian highlights persistently low investment-to-GDP ratios as a direct outcome, as overvaluation discourages productive investments in manufacturing and exports. Instead, the economy remains stuck in a cycle of reliance on remittances, fostering stagnation and reduced long-term growth potential, as elites in rent-seeking sectors benefit from the status quo without incentives for broader reforms.

On a cumulative basis, the July-November FY26 period recorded a current account surplus of $578 million, compared to a deficit of $1.88 billion in the same period last year, underscoring the decisive role played by overseas Pakistanis in stabilising the balance of payments.

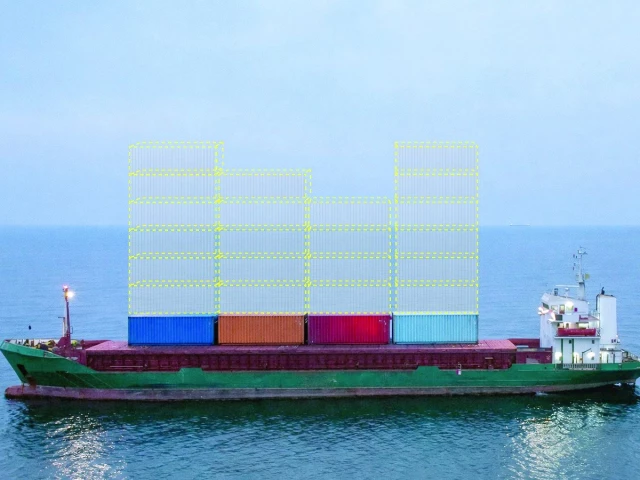

The export slowdown reflects persistent structural bottlenecks, including high energy costs, limited value addition, and subdued demand in key markets. SBP data shows negative export growth in November, with goods exports contracting 18.5% month-on-month, while imports expanded by 15%, intensifying pressure on the trade balance.

Economists note that Pakistan’s reliance on a narrow export base, dominated by textiles, has made it particularly vulnerable to global slowdowns and pricing shocks. Despite a modest recovery in services exports, including IT-related receipts, the overall goods and services deficit widened to $2.59 billion in November.

Behind the headline surplus lies a more sobering reality: Pakistan’s external resilience is increasingly being financed by low-paid migrant labour, much of it employed in the Gulf and other regions under challenging conditions. Analysts point out that the surge in remittances is not necessarily a reflection of improved migrant welfare, but rather greater financial strain on overseas workers, who are sending a larger share of their earnings home to support families grappling with inflation and stagnant incomes.

Many of these workers face job insecurity, delayed wages, longer working hours, and limited legal protections, particularly in construction, domestic work, and low-skilled services. Despite these headwinds, remittance flows have remained resilient, effectively acting as Pakistan’s first line of defence against external shocks.

SBP figures show that workers’ remittances accounted for over 93% of total secondary income inflows in November, highlighting the economy’s deep dependence on migrant earnings rather than export-led growth or foreign investment.

The November surplus provided marginal relief to Pakistan’s foreign exchange position. SBP gross reserves rose to $15.86 billion by the end of November, while reserves excluding CRR and SCRR stood at $14.68 billion.

Primary income outflows, mainly interest payments on external debt, remained heavy at $817 million in November, keeping pressure on the income account and reinforcing concerns about debt sustainability.