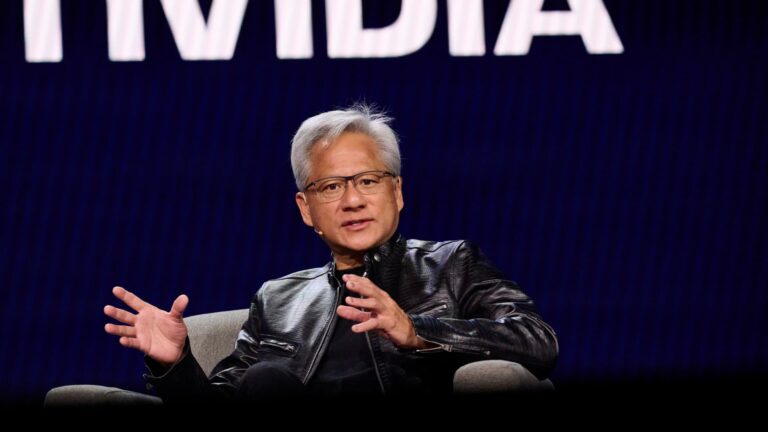

Nvidia on Monday revealed another $2 billion investment in neocloud poster child CoreWeave — the latest in a continuing effort by CEO Jensen Huang to support companies that are enabling what he calls the “five-layer cake” of the artificial intelligence buildout. Monday’s announcement is aimed at helping AI infrastructure company CoreWeave develop more than five gigawatts of data center capacity by 2030 using Nvidia technology inside. These mega data centers, or AI factories as Jensen likes to call them, have peak load equivalents to small cities. CoreWeave has used Nvidia GPUs — graphics processing units, which are the gold standard for AI — and networking products since its founding. As part of the expanded relationship, CoreWeave will implement Nvidia’s Vera CPU, or central processing unit, and its BlueField storage as well. CRWV ALL mountain CoreWeave performance since its IPO in March 2025 Under the deal, CoreWeave issued nearly 22.94 million shares and sold them in a private placement to Nvidia on Friday at $87.20 each. Shortly after Monday’s open, the stock jumped as much as 16.8% to a session-high above $108. The rally cooled a bit later in the day. Nvidia shares were modestly lower. As of September, according to FactSet, Nvidia had already owned 24.28 million CoreWeave shares. Critics may argue that Monday’s disclosure is another example of so-called circular investing, in which Nvidia invests in CoreWeave and CoreWeave turns around and buys Nvidia technology. While we understand that concern, we don’t see this as circular investing, which is a practice that should be shunned by investors. This is not a circular deal For starters, Nvidia has the money needed to invest without needing to tap capital markets to raise funds. While investing significant sums in CoreWeave — and many other AI companies, including OpenAI — Nvidia is not “propping up” these companies as critics would say. In a CNBC interview after Monday’s investment was announced, Jensen explained, “We’re investing a small percentage of the amount that ultimately has to go and be provided.” Yes, the investments are large, but nowhere near the amount of money needed to achieve the vision. So, these companies, including CoreWeave, are going to have to raise or generate a lot more money to get their projects done. As investors in Nvidia, we want the company to be making strategic investments that will see unused cash put to good use. Sure, Nvidia could go out and buy the stock of any company that it thinks will go higher, and generate a strong return on uninvested cash, which could then be used to fund growth or buybacks. However, by investing in its own customers, Nvidia is able further standardize the entire industry on its ecosystem. Not only does this help ensure strong demand in the future, as hardware is replaced and upgraded, and new software comes out to run on that hardware. It also means that the others, even those that Nvidia hasn’t invested in, will need to leverage Nvidia offerings if they are themselves going to attract customers. These investments in customers have the potential to both provide a strong direct financial return, which we were seeing given the move in CoreWeave’s stock on the news, as well as an even stronger indirect benefit via the strengthening of the Nvidia ecosystem as AI advancement accelerates and adoption goes mainstream. On CNBC, Jensen explained that the AI stack is like a five-layer cake, with energy at the lowest level; followed by chips, dominated by Nvidia; infrastructure provided by CoreWeave and other clouds; AI models such as OpenAI’s ChatGPT and Google’s Gemini; and then the top application layer – where we find the various applications now being developed for consumers and enterprises across industries. Nvidia may be at the heart of the chip layer, but it wants to be invested across all levels. As investors, why would we not want the same? Jensen spoke to the “incredible” demand for AI software and hardware, as companies race to work on the next generation of pre-training, post-training, and inferencing capabilities. Additionally, the CEO said that over the past year, he has seen companies investing in the “application” layer of AI — something we touched on briefly while covering Jensen’s chat last week with BlackRock CEO Larry Fink at the World Economic Forum in Davos, Switzerland. The application layer, in Jensen’s view, is the most important in the AI stack, as these applications will transform every industry. CoreWeave CEO Michael Intrator, who joined Jensen on CNBC, said that Monday’s announcement does three things — aligns “around the physical infrastructure,” provides CoreWeave a “wonderful alignment with Nvidia on the software side,” and third, validates that CoreWeave can deliver the best offerings to its customers and enables the company to now license its software to on-premise data center customers that may not want to put all their workloads in a third-party cloud. Restarting business in China Importantly, as we think about next month’s quarterly earnings release from Nvidia, Jensen once again reiterated that there is no China revenue or future potential business in China baked into management’s financial outlook. That said, he did note, “We’re looking forward to the H200 licenses being finalized, and we’re looking forward to the Chinese government contemplating how they would like to allow us back into this market.” He added that demand for H200 and the demand for the Nvidia stack remain “very significant” there. Jensen did the CNBC from China, where was set to celebrate the Chinese New Year with Nvidia workers. Many Chinese tech companies are said to be interested in the H200s after the U.S. government, late last year, cleared the way for the chips to be exported. The move reversed previous bans on allowing Nvidia and other major AI chip designers from selling in China due to U.S. national security concerns about the hardware ending up in the hands of the Chinese military. The U.S. government will take a 25% cut of the Chinese chip sales. Bottom line Shares of Nvidia have been flat to start 2026 following a nearly 39% gain last year. The stock, which closed at a record of $207 back in late October, finished Friday at nearly $188. That is just over a 9% drop. During Monday’s Morning Meeting for Club members, Jim Cramer said, “A new club member needs to sock in some Nvidia right here because we’ve had tremendous multiple compression ahead of what could be another earnings explosion.” NVDA 1Y mountain Nvidia 1 year (Jim Cramer’s Charitable Trust is long NVDA. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.