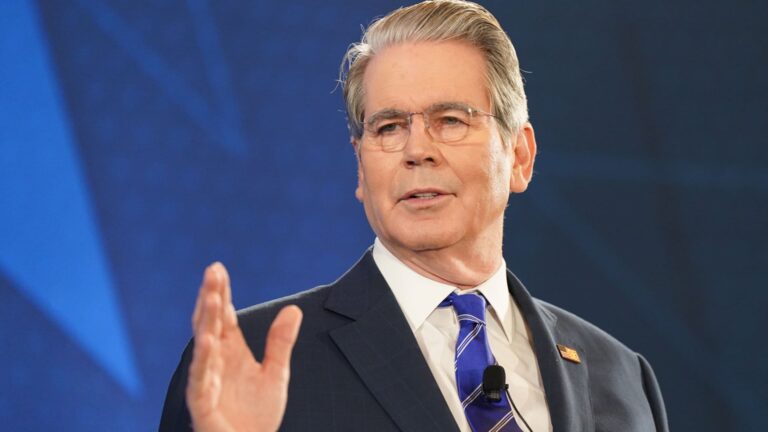

Treasury Secretary Scott Bessent speaking at the CNBC Invest In America Forum in Washington, D.C. on Oct. 15, 2025.

Aaron Clamage | CNBC

This is CNBC’s Morning Squawk newsletter. Subscribe here to receive future editions in your inbox.

Here are five key things investors need to know to start the trading day:

1. Tariff troubles

As the U.S.-China rare earth dispute reignites fears of a trade war, tariffs are back in the spotlight for both investors and policymakers. Stocks have oscillated in recent days as traders make bets on whether President Donald Trump will back off his threats — following the “TACO” playbook, as some have called it.

Here are the latest updates:

The Dow swung more than 650 points between its high and low yesterday, while the S&P 500 finished the day up just 0.4% after gaining as much as 1.2% earlier in the session. The Nasdaq similarly closed well off its highs.But Treasury Secretary Scott Bessent told CNBC that a stock market decline wouldn’t deter the U.S. from putting pressure on China. Watch Bessent’s full interview at CNBC’s Invest in America Forum.Federal Reserve Governor Stephen Miran meanwhile told CNBC that the trade dispute raises concerns around economic growth, and that it is another reason for the Fed to cut interest rates.The Fed’s Beige Book report released yesterday showed that tariffs are pushing inflation higher, and consumers are feeling the pinch. The report said overall economic growth “changed little” since its previous edition in early September.The Supreme Court is set to hear oral arguments next month in a case that could decide the fate of many of Trump’s steepest tariffs, and Trump said yesterday that he may be in attendance. He would be the first sitting president to ever attend arguments at the nation’s highest court, CNBC’s Kevin Breuninger reports.Follow live markets updates here.

2. Lay off the layoffs

People hold signs as they hold an “informational picket” over DOGE’s reductions to the federal workforce outside the Jacob K. Javits Federal Office Building on March 19, 2025 in New York City.

Michael M. Santiago | Getty Images

A federal judge yesterday blocked Trump from firing federal workers during the government shutdown — at least for now. San Francisco U.S. District Court Judge Susan Yvonne Illston’s temporary restraining order blocks the White House from taking any action to follow through with the layoffs and from firing other federal employees protected by the unions that filed the lawsuit.

The ruling comes days after the Trump administration began sending out reduction-in-force notifications to more than 4,000 federal employees. Russell Vought, the White House’s budget director, said yesterday that he expects more than 10,000 total cuts.

There’s still no end in sight for the shutdown, which is now on its 16th day. The Senate yesterday rejected stopgap funding bills for a ninth time.

3. On the move

A United Airlines airplane is towed from a gate at Newark Liberty International Airport on August 10, 2025, in Newark, New Jersey.

Gary Hershorn | Corbis News | Getty Images

4. Rollouts and rebuttals

Supercharged by the powerful M5 chip, the new 14-inch MacBook Pro delivers even more performance and takes the next big leap in AI for the Mac.

Courtesy: Apple Inc.

Apple unveiled new MacBook Pro, iPad Pro and Vision Pro models yesterday, the latest releases after it revealed its new iPhone 17 and watch models last month. The new products all feature Apple’s updated M5 chip, which the company says has four times the peak compute performance of its predecessor.

On the software front, artificial intelligence startup Anthropic launched a smaller and cheaper AI model for all users, named Claude Haiku 4.5. Its competitor OpenAI, meanwhile, is facing criticism for its decision to allow content such as erotica on ChatGPT. CEO Sam Altman defended the move, saying yesterday that OpenAI is “not the elected moral police of the world.”

5. The road ahead

A Tesla Model 3 at the company’s store in Vallejo, California, US, on Thursday, Oct. 9, 2025.

David Paul Morris | Bloomberg | Getty Images

Legacy automakers are sounding the alarm on the electric vehicle business, but Tesla is staying largely quiet.

While Tesla is the clear leader in the U.S. EV market, the company has given up market share amid rising competition and sliding brand value, CNBC’s Lora Kolodny reports. The broader EV industry is also no longer benefitting from now-expired $7,500 tax credits that helped rev up consumer interest.

With its quarterly earnings report due in next week, Wall Street is eager to see if Tesla — or its famously opinionated CEO Elon Musk — will report similar challenges as its competitors.

The Daily Dividend

With what feels like a new billion-dollar tech deal every day, it’s hard to keep track of who’s paying who for what. Here’s the $1 trillion web of artificial intelligence deals, visualized.

— CNBC’s Jeff Cox, Dan Mangan, Liz Napolitano Leslie Josephs, Kif Leswing, Ashley Capoot, Lora Kolodny, Jonathan Vanian, Magdalena Petrova, Jordan Novet, Kevin Breuninger and Lillian Rizzo contributed to this report. Josephine Rozzelle edited this edition.