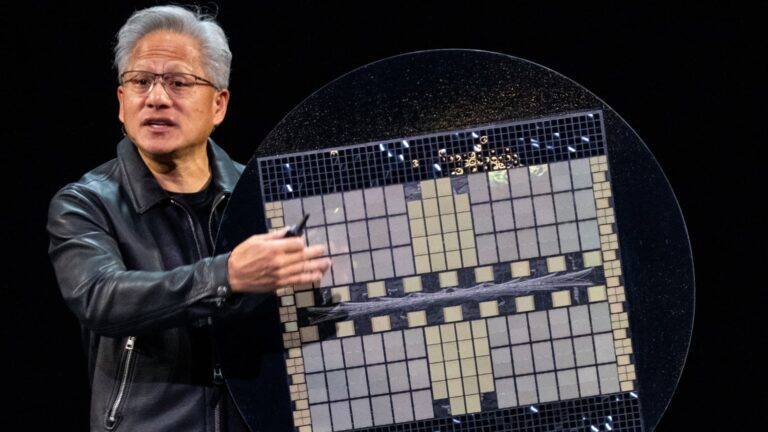

Nvidia earnings, the most important report of the quarter, will be out after Wednesday’s close, and AI rockstar CEO Jensen Huang will be on the hot seat to answer tough questions about the spiraling artificial intelligence spending promises and how these tech companies — big and not so big — are going to pay for them all. Club stock Nvidia has gained about 35% year to date, as of Tuesday’s close, trading around $181 each. That’s nearly double their lowest close of 2025 on April 4, just days after President Donald Trump first announced his so-called reciprocal tariffs. There have been a lot of twists and turns in U.S. trade policy since then, with Trump making tariff deals with several countries and still working to reach one with China. Shares of Nvidia, which have largely benefited from Trump’s trade pacts and its own blockbuster AI dealmaking, closed at a record high of $207 on Oct. 29 and marked their first close above a $5 trillion market cap. NVDA YTD mountain Nvidia YTD Along with the incredible rise in the stock price, Nvidia’s earnings have kept pace. As a result, the stock still trades at about 27 times fiscal 2027 earnings estimates, the lower end of the range over the past decade. The forward price-to-earnings multiple is that far out because Nvidia’s earnings calendar has the company releasing Wednesday evening its fiscal 2026 third quarter, which ended in October. Unlike other recent quarters, Nvidia stock is not red-hot going into the print, and expectations are more reasonable. That’s because the concerns about AI valuations that have hit the overall stock market have crept into the Nvidia trade. The stock has dropped 12% from its record close and trades around a $4.4 trillion market cap. What to expect — and why According to the consensus analyst estimates compiled by LSEG, Nvidia is expected to report a 53% year-over-year increase in fiscal Q3 earnings per share (EPS) to $1.25 on revenue of $54.92 billion, which would be a 56% increase over the year-ago period. Wall Street analysts, per FactSet data, are looking for a 59% October quarter rise in data center segment revenue to $49.04 billion. Looking to the current fiscal fourth quarter, which ends in January, analysts are looking for management to guide revenue to about $62.17 billion, with a roughly 74% gross margin. An additional indication that demand is strong came on Nov. 10, when we learned that Nvidia CEO Jensen Huang had reached out to key semiconductor manufacturer Taiwan Semiconductor , asking that it increase wafer production. We believe this action was a clear indication that Huang expects the strong demand for Nvidia’s AI chips to continue and align with his “$500 billion in order visibility” comment he made at the company’s GTC event a few weeks ago. While there is a lot riding on Nvidia’s report, we do have a good sense of what it might say as it relates to the outlook for 2026. After all, the three biggest hyperscale cloud players – Club names Amazon and Microsoft , and Alphabet ‘s Google, as well as Club holding Meta Platforms – all made it quite clear that the spending they’re doing on AI infrastructure not only won’t slow down in 2026 but will increase. They all raised their spending outlooks, citing the need for far more computing power than currently available. In addition to the public companies forecasting more spending on AI infrastructure ahead, OpenAI is going around making massive commitments for more power and compute. Last week, we also learned that Amazon -backed Anthropic committed to building out $50 billion in data center infrastructure nationwide. Then, on Tuesday, Microsoft announced new partnerships with Anthropic and Nvidia. Anthropic pledged to buy $30 billion in Azure cloud capacity from Microsoft and additional compute from Nvidia’s Grace Blackwell and Vera Rubin systems. In exchange, Microsoft will invest $5 billion into Anthropic, and Nvidia will put $10 billion into the startup. Sure, most, if not all, of these names are working internally on their own specialized chips. But we fully expect their spending with Nvidia to grow alongside their internal initiatives. There are still many benefits to working on a platform that is not only the industry standard for AI software development but also general-purpose in nature. It provides more flexibility and can support a wider range of applications, which is key to ensuring the capacity being built is able to be used no matter how customers’ needs and preferences may shift. That Nvidia flexibility can be seen when we look at what’s taking place with the neocloud players, like CoreWeave . In previewing CoreWeave’s quarter, analysts at Loop Capital noted that their checks before the release found “up to 8-year neocloud contracts being signed for Ampere,” in some cases at up to 90% of the original cost. That’s pretty shocking given that Nvidia’s Ampere is the predecessor to Hopper, which is the predecessor to Blackwell. In other words, the neocloud cohort is seeing so much demand against such a tight graphics processing unit (GPU) supply environment that they’re even willing to take chips originally released in mid-2020. That should ease any concerns over obsolescence, as it is clear that even two-generation-old chips have a place in today’s compute-starved world. In some cases, the older chips may even make more sense. According to Loop analysts, “While it’s true that Blackwell is more power efficient … it’s also true that Blackwell requires greater gross-power and that Ampere data centers are built in lower-power areas … and are constructed for air cooling. As such, it is more efficient to extend Ampere as is as opposed to taking the six months to retrofit the data centers for liquid cooling [needed for Blackwell] and lose the productivity while still being in a lower power area.” When reporting its quarter last Wednesday, CoreWeave reported a 134% increase in revenue and 271% increase in the revenue backlog, with CEO Michael Intrator calling out an operating environment that was “highly supply-constrained” due to “insatiable customer demand.” On the post-earnings call, Intrator backed Loop’s findings that older generation chips are still in high demand. “In Q3, we saw our first 10,000-plus H100 contract approaching expiration. Two quarters in advance, the customer proactively re-contracted for the infrastructure at a price within 5% of the original agreement. This is a powerful indicator of customer satisfaction as well as the long-term utility and differentiated value of the GPUs run on CoreWeave’s platform,” he said. CoreWeave CFO Nitin Agrawal added, “Demand remains robust for not just the Blackwell platform, but across our GPU portfolio. In the third quarter, we signed a number of deals for older generations of GPUs, adding new customers and re-contracting existing capacity.” To be sure, CoreWeave did have problems with some new data centers from a subcontractor that slammed the stock 16% on Nov. 11. Including that post-earnings slide, Tuesday was the sixth straight session of declines for CoreWeave. Intrator defended the quarter on CNBC, telling Jim Cramer that “every single part of this quarter went exactly as we planned, except for one delay at a singular data center.” Last Wednesday, we also heard from Advanced Micro Devices CEO Lisa Su after she addressed at an analyst day event earlier that week and forecasted companywide revenue would grow at a roughly 35% annual rate over the next three to five years. Su said on CNBC, “In the last 12 months, we’ve seen every one of our largest customers say, ‘We can see the inflection point now Lisa, like we can see that demand is accelerating because people are now starting to get real productivity out of the AI use cases,’ and you know we have all of the largest hyperscales in the world saying they’re investing more in capex because they can see the return on the other side of it.” 5 questions for Nvidia With the hyperscaler capex commentary, along with Huang’s request from Taiwan Semi, neocloud contracts indicating that Nvidia’s older offerings still have immense value, and Nvidia’s closest competitor, AMD, calling for significant growth in the years ahead, here are the five questions we have as we head into Nvidia’s quarterly release. 1. Can the market sustain 40% capex growth through the end of the decade? This is really going to depend on end market demand – which will itself depend on use cases – and Nvidia’s customers’ (like the cloud providers) ability to monetize that demand. While currently in a situation where the cloud players need to invest ahead of monetization to build out initial infrastructure, whether these levels of capex continue should be tied to the monetization trends. The last thing we want is for names like Meta to forget just how brutal Wall Street can be when spending to the high heavens without a clear path toward a positive return on investment. Meta learned that the hard way when the stock tanked 11% post-earnings and has generally moved lower since. 2. What did Huang mean about China winning the AI race, which was later softened? The answer here may be tied to the CEO’s style of “running scared,” meaning that despite all his success, Huang still seeks to innovate as fast as possible, lest anyone catch up or surpass Nvidia’s chip platforms. Is that what he was getting at? Trying to get the U.S. government to increase its sense of urgency as it relates to the AI arms race with China? We suspect so, but will look for him to clarify on the call. 3. What are the plans for free cash flow – capital returns to shareholders, more deals? Nvidia is a cash printing machine at the moment. Free cash flow is expected to increase by about 67% its fiscal 2026 third quarter. On a full fiscal year 2026 basis, the Street expects Nvidia’s cash flow to grow by about 60% and another 48% in fiscal 2027. With net debt estimated to be negative – meaning Nvidia is sitting on more in cash and equivalents than it owes to the tune of about $70 billion – investors are curious as to how management plans to deploy that cash. Share buybacks are always an option, but so are acquisitions or investments in other companies, which Nvidia has been doing at a furious pace. Any thoughts on that from management would be key. 4. How can we get clarity on the $500 billion of orders for Blackwell and Rubin? While we believe that number to include networking revenue related to these platforms, we will be listening for clues as to the timing of when this revenue will be realized, as well as management’s confidence in the financial standing of the customers placing these orders. 5. What about margins? Margins are always of interest since they tell us how much the top line we should expect to show up in earnings. That’s especially true when a new product is ramping, as that initial phase of production can often crunch profit margins. That said, we don’t think there will be the same margin hit going from Blackwell to Vera Rubin as we saw in transitioning from Hopper to the latest Blackwell platform. That’s because those two used different rack architectures. In contrast, the new Vera Rubin platform will use the same rack architecture as the Blackwell. Still, any commentary on margin dynamics is sure to be scrutinized by investors. AI spending concerns We would be remiss not to highlight some concerns we have as it relates to Nvidia. The major one is funding – not the funding of Nvidia’s needs, but rather the needs of its customers. While the hyperscaler customers plus Meta have previously funded their data center ambitions with free cash flow, we have started to see even these monstrously large players tap the debt markets. We must watch this new wrinkle to ensure that management teams haven’t forgotten about the value investors place on operating efficiency and disciplined spending, and that the borrowing doesn’t start to balloon. The Club also has concerns about the sheer dollar size of the commitments being made by names like Oracle, OpenAI, and SoftBank, the latter of which recently divested its stake in Nvidia to fund its commitment to OpenAI. We don’t view the SoftBank sale as a negative for Nvidia, as Nvidia needs OpenAI to make good on its spending commitments more than it needs the investment from SoftBank. However, the move does signal just how large the investment commitments are getting. The final, perhaps greatest, concern relating to funding in the AI space is that the major players are becoming increasingly interconnected with every new deal. That’s even more concerning when you consider that one of the biggest spenders, OpenAI, isn’t even pubic, which means we don’t have a clear picture of its financial standing and ability to make good on its commitments. Tuesday’s big news from another growing non-public player, Anthropic, raises the stakes. As noted earlier, Nvidia and Microsoft intend to invest in Anthropic, which itself has committed to spending on Microsoft’s Azure cloud and Nvidia’s GPUs. So, let’s sketch this out: A and B (Microsoft and Nvidia) invest in C (Anthropic), while C agrees to buy from A and B. One can see how this all starts to feel risky in the sense that if one domino falls, it’s going to have potentially massive ripple effects throughout the AI cohort. We expect the nature of the deals to come up during Nvidia’s post-earnings Q & A session, and we want to hear management explain why they think the concerns are overblown. Bottom line Ultimately, these concerns do keep us cautious in terms of putting new money to work in the data center theme. At the same time, signs of accelerating demand – which serve to support the committed increase in spending, much of that coming Nvidia’s way – keep us in the stock. We believe that while there may be hiccups along the way, long-term investors would do well to maintain a core position in Nvidia, the company at the heart of the entire AI investment cycle, and Jim’s mantra through the years on Nvidia: “Own it, don’t trade it.” (Jim Cramer’s Charitable Trust is long NVDA, AMZN, MSFT, META. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.