Daniel Riffet/Photo Nonstop via Getty Images

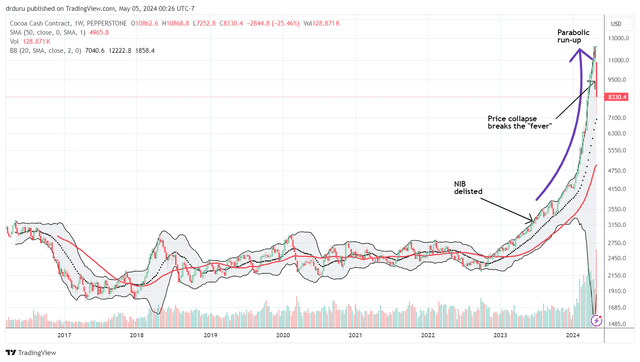

For many years, cocoa prices remained within a relatively well-defined range. Towards the end of 2020, I wrote about various trades from my perspective as a cocoa permable.Unfortunately, iPath® Bloomberg Cocoa’s liquidity is The sub-index Total Return (SM) ETN (NIB) depleted over time, and NIB was eventually delisted in June 2023. The loss of retail investors’ best means of participating in cocoa trading coincided with cocoa’s strong rally. The very next month, the price of cocoa skyrocketed, quadrupling in price in an astonishing increase. The weekly chart of the CocoaCash contract below shows the magnitude of the move. The price accelerated in a parabolic manner, ending only after the price quadrupled.

Cocoa prices have risen parabolically this year. (TradingView.com)

Cocoa demonstrated the dangers inherent in parabolic movement. At some point, troops arrive to counter the breakneck pace of acquisition. Resources are ultimately finite, leading to buyer exhaustion. The underlying market can also react to prices through destruction of demand, increased supply to take advantage of high prices, changes in market rules, and/or the appearance of even the slightest reversal in the flow of news. there is. Any of these triggers can cause sudden and violent price movements that go against the general trend. Last week saw just such a reversal, looking like the (for now?) high point of an epic price rally. At a recent financial results conference, Hershey (HSY) Chairman and CEO Michel Bach offered the following speculation about the apparent bursting of the bubble (from Seeking Alpha Transcript):

“…that decline is just further evidence of the tremendous volatility we’re seeing in the market. It’s hard to pinpoint how much of that has declined. Any meaningful new signals about supply and demand are Not yet. So there are some early signs that maybe it’s mid-season, so a lot of the decline is being driven by some of the non-supply, demand economics, but so far. Some of the other factors that we’ve been discussing relatively may also be at play, such as speculators’ views on regulation.

In this article, we discuss the factors that brought cocoa to such volatile levels, the outlook for future prices, and how retail traders can (partially) participate in cocoa trading through the Invesco DB Agriculture Fund ETF. I will outline (NYSEARCA:DBA).

(Short term) No demand destruction

Despite soaring prices, global demand appears to remain strong. Although Europe and Asia saw slight growth compared to the previous year, grinding operations increased in all regions compared to the previous year.

- North America (National Confectionery Association): North American cocoa milling data for the first quarter of 2024 was 113,683 tons, an increase of 3.7% year-on-year. The 9.3% quarter-over-quarter increase reflects an immediate surge in demand and suggests that manufacturers expect consumption to increase in coming quarters.

- Europe (European Cocoa Association): Cocoa crushing volumes in Europe increased by 4.7% quarter-on-quarter to 367,287 tonnes. However, the region saw a decline of 2.2% year-on-year, indicating that demand may stabilize in the long term.

- Asia (Asia Cocoa Association): Cocoa crushing volumes in Asia increased by 5.1% quarter-on-quarter to 221,530 tonnes. However, it was still down 0.2% compared to the previous year.

The milling data is color-coded by the difficulty of accessing the raw cocoa. African Bank paints a dire picture of future production prospects once the disaster is over. Harmful weather such as last year’s heavy rains and this year’s high heat, fires, and drought have damaged crops. Diseased trees reduce yield. Years of low prices to farmers have discouraged investment in farms. The International Cocoa Organization (ICCO) has reportedly predicted a cocoa shortage of 374,000 tonnes this season, a significant increase from last year’s deficit of 74,000 tonnes. Unable to benefit from today’s high prices, despite rising input costs and reduced purchasing power due to currency devaluation, farmers are abandoning farming and pursuing more productive endeavours. I did.

modest supply response

According to the Financial Times, cocoa producers in Latin America enjoy a freer market for their production, with Ecuadorian producers, for example, securing 80% of the selling price. This value gain is particularly impressive considering the African Export-Import Bank estimates that West Africa captures only $10 billion of the $200 billion in value (not just price) from the global cocoa industry. The Financial Times also quoted Ecuador’s Exporters Association as saying that acreage will increase by 20% to 600,000 hectares. According to Reuters, Ghana, the world’s second largest producer, produces 1.38 million hectares. However, Ghana’s cocoa production will fall to 580,000 tonnes (a 22-year low according to the Ghana Cocoa Board) in the 2023/2024 season, compared to Ecuador’s 430,000 tonnes. This large gap in productivity could favor Latin American producers in the long run.

Ivory Coast, the world’s largest producer, has also suffered a significant drop in production. Ivory Coast is expected to see a 30% drop in shipments between October 1 and April 28, and production for the entire 2023/24 season is expected to be the lowest on record, down 21.5% year-on-year, according to government and association data. ing.

In other words, the rush to increase production in Latin America, while promising, is far from enough to fill West Africa’s supply gap in the near term. Still, cocoa prices could fall quickly as soon as supply expectations change.

Changes in market structure

Parabolic prices forced commodity exchanges to increase margins on futures contracts. This liquidity squeeze forces speculators and traders to close out positions they can no longer afford, thereby reducing market liquidity. According to Reuters, open interest in futures fell from 400,000 lots in November to 243,000 lots in the latest tally. Reduced liquidity may cause prices to rise or fall excessively.

The April 29 selloff, which marked the first explosion in cocoa fever, included a 17% price plunge in New York’s most actively traded contract, the biggest drop since 1960, according to Reuters. This was the intraday decline for cacao. The number of outstanding contracts has fallen to its lowest level in 12 years. “The market is currently caught between extreme crop shortages and dangerously low liquidity.”

Hints of better news to come

The outlook for cocoa is so bleak that even the slightest hint or suggestion of relief could lead to a significant drop in price. Morningstar notes that last week’s record weekly price decline (dating back to 1959) was driven not only by concerns about weaker demand (which is likely not short-term given the shattered numbers above) but also by speculation about improved crop yields. It was also suggested that this was the cause.

unstable price conditions

When you connect all the dots, the trading situation becomes incredibly volatile. The pressure to secure supply and maintain futures contracts is coupled with the fear that news of improved cocoa harvests and production could emerge at any time. Still, there are some strong price bulls in the market. Bloomberg cited Citigroup’s prediction that cocoa prices will hit $12,500 within “a few months.” One hedge fund expects the price to reach at least $20,000 by the end of the year. The low liquidity of the market means that the opinions of just a few traders or speculators can actually move the market in extreme directions one way or the other.

West African farmers left behind

West African farmers are at a loss amid price fluctuations. In Ghana, farmers are only allowed to sell their produce to a government agency, the Ghana Cocoa Board or COCOBOD. Good faith controls for price certainty on the former worked well when cocoa prices fluctuated within a predictable range. But now, with prices cut a year ago, farmers are no longer able to benefit from higher prices. They desperately need these high prices to invest in their farms to increase supply, rather than abandoning them to other companies (or adding to the environmental pollution caused by illegal gold mining in Ghana). I need it.

COCOBOD recently responded by increasing ‘Farm Gate’ prices by 58% for the remainder of the 2023/24 season. This belated action will provide some help. According to COCOBOD, “In line with the vision of the NPP government and in response to the increase in cocoa prices in the international market, an increase in the cocoa producer price has become necessary to increase the income of cocoa farmers. ” COCOBOD has also increased the allowable profit amount for Licensed Buying Companies (LBCs) to accommodate the increase in farmgate prices.

Ivory Coast also increased farm prices for intermediate crops by 50%. Ivorian farmers tend to get better prices than Ghanaian farmers in good times because they can sell directly to industry associations and private purchasing companies (so smuggling from Ghana to Ivory Coast can be a problem) ).

While these increases are good for farmers, exporters could be hit hard. Some beleaguered exporters may be forced out of business as they settle for significantly cheaper contracts negotiated last year. Ivory Coast’s Price Stabilization Fund is supposed to deal with such situations, but understandably it has not been tested under these kinds of harsh conditions. Cocoa supply problems could worsen if exporters and shippers shut down.

The poor finances of cocoa farmers are in stark contrast to the fortunes of chocolate industry giants. Fast Company recently reported on an Oxfam analysis that claims the Ferrero and Maas families are worth more than the combined GDPs of Ivory Coast and Ghana. Organizations like Africa Cocoa Marketplace are working to build a more just chocolate economy. The entire industry, both public and private, needs to identify and maintain a portfolio of alternatives to foster investment and opportunities in cocoa farms to avoid further worsening price crises in the future.

Invesco DB Agriculture Fund ETF (DBA)

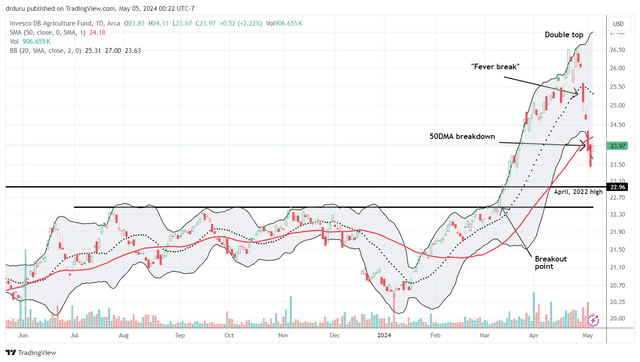

Individual investors in the United States cannot invest directly in cocoa stocks. The Invesco DB Agriculture Fund ETF (DBA) provides exposure to cocoa. As of this writing, his 10.5% of DBA’s holdings are included in his July 2024 Cocoa contract. During cocoa’s peak, DBA held a greater concentration of cocoa futures through earlier dated futures contracts. Still, cacao remains the largest commodity held by DBA. The top two holdings are financial instruments used to track commodity prices and facilitate the operation of the ETF. Cocoa is currently in backwardation (where the forward futures price is higher than the long-term futures price), so if prices continue to fall, cocoa could be an additional drag on DBA performance. For now, there is a close correlation between DBA and Cocoa Cash contracts. According to the graph below, DBA reached its last major high on April 19th, just like Cocoa, and first collapsed on April 29th, just like Cocoa.

The Invesco DB Agriculture Fund ETF (DBA) has triggered multiple technical signals and outlooks. (TradingView.com)

From a technical perspective, DBA’s uptrend ended below its 50-day moving average (DMA). From here, DBA will need to maintain support at the all-time highs reached in March 2022, when corn prices skyrocketed due to Russia’s invasion of Ukraine (corn futures for September 2024 are just 5.2 of DBA’s holdings). (only %). Further support may come from the March 2024 breakout point. (See points drawn above). A new 50DMA breakout would re-establish a bullish setup for DBA, but a bounce from lower support would only set up a short-term trade.

DBA is an incomplete trade in cocoa. However, as long as cocoa maintains strong price movements, DBA is likely to remain correlated. Once this correlation ends, cocoa trading will also end. We will regularly check the distribution of DBA holdings.

And yes, I’m still crazy about cocoa…

Please be careful!