(Bloomberg) — Ivy Chan thought she created it.

Most Read Articles on Bloomberg

Fresh out of school with a degree in chemistry, she joined one of China’s largest real estate companies in 2016, when China’s real estate market was growing. She worked until 11pm every day, and after she was named a “sales champion,” she was transferred to a larger city. She used her limited vacation time to regularly pamper herself by purchasing her $550 spa package. Her money was so plentiful that she didn’t have to think much about it. “Bank accounts were just a series of numbers,” Chan says.

Everyone wanted what Zhang and his colleagues were selling. Owning property was very important and was often a prerequisite for marriage. Since prices were never going to fall, condominiums served the combined function of wealth storage, insurance, and retirement savings. At one point, real estate accounted for about a quarter of gross domestic product, according to Bloomberg Economics. Some estimates were even higher.

However, those busy days did not last long. By 2021, developers will be selling homes faster than building them and racking up debt to expand, despite President Xi Jinping’s warning that “housing is for living, not speculation.” It became so. Everything came crashing down when the government suddenly started cracking down on debt. Many homebuyers were forced to wait while construction progressed, sparking angry protests across the United States. Development companies such as Country Garden Holdings and the bankrupt giant China Evergrande Group have defaulted on their bonds. Government revenues have plummeted. Images of vacant buildings and unfinished public works projects have become a global symbol of declining public confidence and dissatisfaction with Xi Jinping’s handling of the world’s second-largest economy.

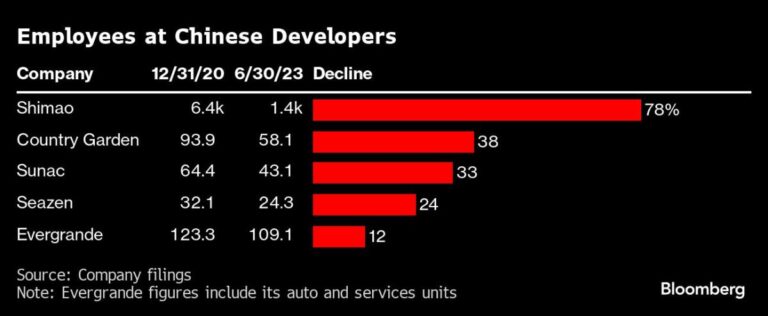

And a group of young professionals who thought they had found an escalator to China’s wealthy middle class had their lives turned upside down. What was supposed to be a lifelong career turned out to be just a blip in the bubble. According to Ke Yan Zhijiu of the Real Estate Research Group, about 500,000 people lost their jobs in the real estate sector in the three years to 2023 due to the recession. This does not include employees in related industries such as construction and marketing. Alex Capri, a senior research fellow at the National University of Singapore, said they all faced setbacks at some point in their careers, forcing them to adjust their skills on an “epic scale”. “The real estate meltdown is causing a dark reflection on the wider public.”

The days when some real estate companies handed out Mercedes-Benz cars as year-end bonuses are a distant memory, but many analysts say the situation is far from rock bottom yet. According to Bloomberg Economics, the economic influence of the housing sector could shrink to about 16% of China’s GDP by 2026. That possibility could put around 5 million people, the size of Ireland’s population, at risk of job loss or loss of income, analysts wrote. Even young workers in their prime are struggling to find work, with youth unemployment reaching 15.3% after China revised its data methodology. “People are very depressed and scared. The situation is very tough,” said Anne Stevenson Yang, co-founder of J Capital Research Ltd.

Zhang, 30, said he helped sell an apartment in Country Garden worth about 1 billion yuan ($139 million) and relied on selling health supplements on social media to pay for it. Ta. So far, her income is not enough, and she sells three products a month. It’s a far cry from the days when she was making the equivalent of $83,000 a year. She and her husband have put off having a baby, searching online for discount offers, cooking at home to avoid takeout, and minimizing socializing to keep expenses down. “If you want to live like before, you’re basically dreaming,” Chan says. “Before, she spent 3,000 yuan, but now she is considering whether she can cut it down to 2,000 yuan. Then I’ll see if I can cut it down to 1,000. As long as I can survive.”

The suffering is not limited to salespeople. Ivan Lee, 28, has twice lost his job as an investor relations manager in Hong Kong. Most developers have stopped issuing dollar bonds in the $203 billion market, which was one of the world’s largest high-yield bond markets when times were good. Investors stopped buying the asset class as prices plummeted and communication between debtors and companies became weaker. “As the crisis grew, we could sense that engagement with overseas investors and analysts was no longer the most important concern for management,” Lee said.

Charlie Zeng, who worked at development companies such as China Vanke, earned more than $250,000 in a good year, but spent a year looking for work. In the most desperate moment, he volunteered and accepted a 90% cut in his salary. After 70 interviews, he received several offers, but all were cancelled. Although he eventually found a job, he remains pessimistic about real estate. “There is no future in this industry,” Zeng said. “This sector has been abandoned.”

Apartment and commercial real estate sales are expected to be 45% lower this year compared to 2021, according to data compiled by Bloomberg and estimates from Fitch Ratings. New home sales for the 100 largest real estate companies fell by about 45% in April. From a year ago. China Vanke, once seen as a surefire way to survive with state support, is also under pressure, with its credit rating downgraded to junk status.

Meanwhile, consumers are taking extreme steps to voice their dissatisfaction. According to Freedom House’s China Opposition Monitor project, of the 952 protests that took place in China in the fourth quarter of 2023, 17% were related to housing issues. Many of the demands centered on wages for construction workers and delays in completing the project. The country’s intense surveillance and often harsh penalties mean the risk of people taking to the streets is much higher than in Western countries.

Another way to measure a tough market is to look at rental yield, or the annual profit you make when you rent out your investment property. According to a report by ANZ Group Holdings, the rate is just 1.5% in China’s largest cities, about half the rate in Hong Kong and significantly lower than New York’s almost 5%. These low interest rates provide little incentive for investors to buy financial products. apartment.

There are some optimistic views. Some local governments have loosened speculation-cooling measures and lifted purchasing restrictions in some large cities, including Hangzhou, home to Alibaba Group. Another hope may lie with government-backed companies such as Poly Property Group. The Communist Party claims control over all aspects of the economy. Nine of the top 10 land buyers in the first two months of this year were state-owned developers, with the largest buyer being China Resources, according to a research note by Andrew Chan and Daniel Huang of Bloomberg Intelligence. It was the Rand Corporation.

The Chinese government has identified two pillars of its new housing policy: building affordable housing and renovating blighted city centres. The central bank is providing cheap funding for these efforts through the so-called Pledged Additional Loan Program, with about 3.4 trillion yuan available as of the end of January. If these renovation plans go well, downward pressure on house prices could ease as early as next year, said UBS Group AG analyst John Lamb. Lam, who was initially a big bear on Wall Street, is now one of the few analysts with a positive view on the Chinese real. Estate.

Shares of Chinese developers soared on May 16 on news that China is considering a plan to buy unsold homes from local governments. “Changes in the real estate sector’s growth model could help accelerate the sector’s recovery and alleviate the severity of job losses,” said Maggie Hu, an assistant professor at the Chinese University of Hong Kong. But “the situation could worsen in the short term.”

The possibility of recovery is little consolation for workers like Li, who are still looking for work. “In the good old days, success was much easier to achieve,” he says. “During the winter, you have to work harder and be more careful with every step and decision.” — With Emma Don

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP