Embedded Finance Business and Investment Opportunities Market in India

DUBLIN, May 17, 2024 (GLOBE NEWSWIRE) — The “India Embedded Finance Business and Investment Opportunities Data Book – 75+ KPIs for Embedded Finance, Insurance, Payments and Assets Sectors – Updated Q1 2024” report is now available. Added. ResearchAndMarkets.com Recruitment.

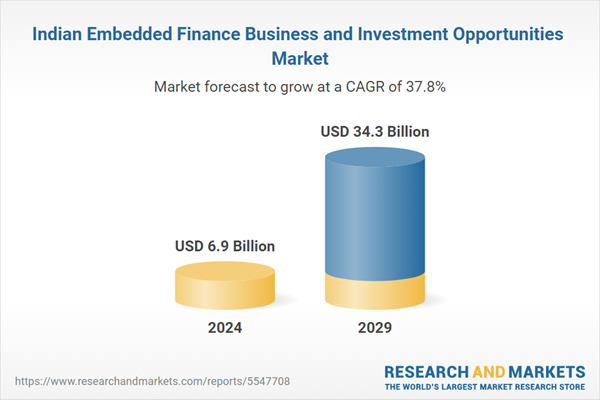

India’s embedded finance industry is expected to grow by 43.1% on an annual basis to reach USD 6.9 billion by 2024.

The embedded finance industry is expected to grow steadily during the forecast period, registering a CAGR of 37.8% from 2024 to 2029. The country’s embedded finance revenue is expected to reach US$34.32 billion by 2029, up from US$6.9 billion in 2024.

The report provides an in-depth data-centric analysis of the embedded finance industry, covering market opportunities and risks across various sectors in lending, insurance, payments, and asset-based finance sectors. The report includes 75+ KPIs at country level to provide a comprehensive understanding of Embedded Finance market dynamics, market size, and forecast.

Embedded finance is one of the fastest growing sectors in the fintech industry, with huge growth potential in developing countries like India thanks to young people increasingly adopting new-age technologies. there is. Embedded Finance has the potential to revolutionize the delivery of financial services in India.

This innovation increases accessibility, affordability, and convenience for consumers while fostering business growth and innovation. Embedded finance represents not only a technological advance but also a socio-economic transformation. By streamlining financial services, it is expected to integrate millions of individuals into the formal financial sector. With India’s population exceeding 1.3 billion and a rapidly expanding digital economy, the country presents a huge opportunity for fintech companies looking to introduce breakthrough financial services to consumers. I am.

India growth drivers: Embedded finance is expanding the availability of financial services in India. Embedded finance allows individuals who have been previously underserved or excluded from traditional banking services to gain access to financial products and services. Embedded finance is also improving financial inclusion in India by providing individuals with greater access to financial services.

Unbanked population: A large unbanked population creates a large demand for credit. Fintech companies are addressing this gap with innovative financing solutions such as short-term loans and his BNPL (Buy Now, Pay Later) services. Demand for embedded credits is expected to increase in smaller cities. Providers like KreditBee and Pine Labs are developing expansion strategies into these areas, forging partnerships with stores to expand their reach. Paytm, a leading mobile wallet player, leverages its platform to offer BNPL, personal loans, and merchant loans. This trend is expected to continue and PhonePe may soon enter the consumer finance space.

Digitalization triggered by the pandemic: The COVID-19 pandemic has accelerated the adoption of online shopping and digital financial services. This has created fertile ground for embedded financial solutions as consumers have grown accustomed to managing their finances online. E-commerce giants like Flipkart and Myntra are incorporating financing at checkout through their partnerships with NBFCs. This allows shoppers to split their cart amount into multiple interest-free EMIs, increasing sales.

In the mobility space, Ola Money includes micro-insurance for taxi rides that covers theft and damage. This quickly became popular because it removed friction by bundling insurance directly into the taxi booking experience. Healthcare platforms like Practo also allow patients to fund medical costs and insurance premiums through built-in financing. Such embedded finance improves access to critical services for people with irregular incomes.

The dominance of UPI in the Indian payments landscape: One of the most striking examples of the impact of embedded finance can be seen in the rise of the Unified Payments Interface (UPI) in India. With billions of transactions worth trillions of rupees recorded every month, UPI has become the dominant force in the country’s payments ecosystem, replacing cash and driving the digitization of the economy. Acceptance of his UPI among retailers has also increased, enhancing credit eligibility for small businesses and consumers. According to UPI statistics for 2024, in India more than 260 million people use UPI and 360 million UPI transactions are recorded per day.

Embedded finance aims to streamline financial processes in both consumer and business commerce by reducing entry barriers for different products and services and facilitating payments at different touchpoints. .

Reasons to buy

-

Deep understanding of embedded financial market dynamics: Understand market opportunities and key trends with forecasts (2019-2028).

-

Insights into opportunities by end-use sectors – Gain market dynamics by end-use sectors and assess emerging opportunities across various end-use sectors.

-

Develop market-specific strategies: Identify growth segments and target specific opportunities to develop embedded finance strategies. Assess key market-specific trends, drivers, and industry risks.

-

Gain sector insights: Based on proprietary research, this report identifies opportunities across the embedded lending, embedded insurance, embedded finance, and embedded assets sectors.

Key attributes:

|

report attributes |

detail |

|

number of pages |

130 |

|

Forecast period |

2024-2029 |

|

Estimated market value in 2024 (USD) |

$6.9 billion |

|

Projected market value to 2029 (USD) |

$34.3 billion |

|

compound annual growth rate |

37.8% |

|

Target area |

India |

range

India embedded finance market size and forecast

Embedded finance by major sectors

-

retail

-

logistics

-

Telecommunications

-

manufacturing industry

-

consumer health

-

others

Embedded finance by business model

-

platform

-

patron

-

Regulatory body

Embedded finance with a decentralized model

-

unique platform

-

Third party platform

India embedded insurance market size and forecast

Built-in insurance by industry

-

Insurance built into consumer products

-

Built-in insurance in travel and hospitality

-

insurance built into the car

-

Insurance integrated into medical care

-

Insurance built into real estate

-

Built-in insurance in transportation and logistics

-

insurance embedded in someone else

Built-in insurance by consumer segment

Built-in insurance by offer type

Built-in insurance by business model

-

platform

-

patron

-

Regulatory body

Built-in insurance by distribution model

-

unique platform

-

Third party platform

Embedded insurance by sales channel

-

embedded sales

-

Bank sales

-

Broker/IFA

-

tied agent

Built-in insurance by insurance type

Embedded insurance in the non-life insurance field

India embedded loan market size and forecast

Embedded lending by consumer segment

-

business loan

-

personal loans

Embedded financing by the B2B sector

-

Embedded financing in retail and consumer goods

-

Embedded financing in IT and software services

-

Embedded financing in media, entertainment and leisure

-

Embedded financing in manufacturing and distribution

-

Loans embedded in real estate

-

Other embedded financing

Embedded financing with the B2C sector

-

Embedded financing in retail shopping

-

Loans integrated into home renovations

-

Embedded financing in leisure and entertainment

-

Embedded financing in healthcare and wellness

-

Other embedded financing

Embedded Loans by Type

-

BNPL financing

-

POS rental

-

personal loan

Embedded financing by business model

-

platform

-

patron

-

Regulatory body

Embedded financing with distribution model

-

unique platform

-

Third party platform

India embedded payment market size and forecast

Embedded payments by consumer segment

Built-in payment by end-use department

-

Embedded payments in retail and consumer goods

-

Payments embedded in digital products and services

-

Payments embedded in utility bill payments

-

Embedded payments in travel and hospitality

-

Embedded payments in leisure and entertainment

-

Embedded payments in health and wellness

-

Payments built into office supplies and equipment

-

Other embedded payments

Built-in payments by business model

-

platform

-

patron

-

Regulatory body

Incorporating a decentralized payment model

-

unique platform

-

Third party platform

India embedded wealth management market size and forecast

Market size and forecast for the Indian asset-based financial management industry

Asset-based finance by asset type

Asset-based finance by end users

For more information on this report, please visit https://www.researchandmarkets.com/r/so0uch.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. We provide the latest data on international markets, regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900