Image Source/DigitalVision via Getty Images

Liberty All-Star Equity Fund (NYSE:US) is truly an “all-star” investment. As one of the oldest closed-end funds trading today, USA has an exceptional track record for investors. USA is the focus of our coverage. We have covered this fund for several years. In our first article, we outlined the fund’s structure, asset allocation and investment approach. This article led us to cover the US with a broader overview, including its distribution history and total return profile.

Recently, we took a different approach and discussed why buying US stocks is not the most efficient approach to equity investing. In that article, we discussed a US portfolio strategy: diversifying growth and value stocks across market cap. We noted that the US distribution structure is one in which you capture long-term gains from a broadly allocated basket of stocks. As an alternative, Vanguard Total Stock Market Index Fund (VTI) and sell a similar portion of the position accordingly. The theory is that VTI’s long-term performance stems from its low fees.

Today, we will take the discussion further by revisiting performance since our last interview and following up from a different perspective. We will explore USA and discuss who is a good fit for USA’s value proposition and who is not. USA is a solid fund, but its structure may suit some investors but not others.

Fund Overview

USA is an equity closed-end fund that loosely replicates index funds with a diversified portfolio of large-cap stocks. As the ticker indicates, USA invests in companies domiciled in the United States. The fund focuses on large-cap stocks, with an overall portfolio similar to many market-cap weighted indexes such as the S&P 500 (SPX). USA is large in size, with $1.9 billion in assets under management or AUM. USA is unleveraged, which gives it a lower risk profile but may inhibit long-term performance. The fund charges a management fee of 0.91% of assets under management. The fee structure is inexpensive compared to other closed-end funds and mutual funds. However, the fees are higher than most index funds.

United States Fact Sheet

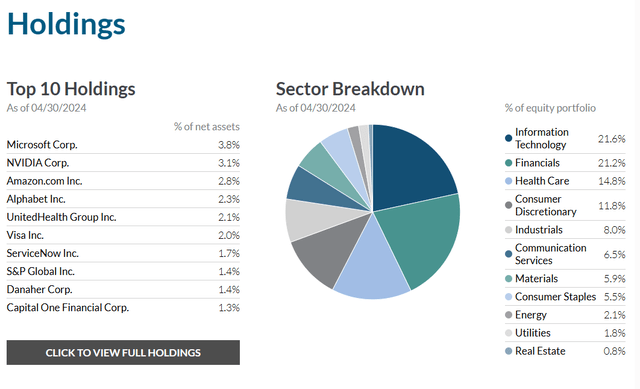

The US portfolio is well diversified, with the largest sector allocation being Information Technology at 21.6%. Importantly, the US portfolio is less weighted to top stocks than the competing indexes; the top 10 stocks account for 23% of the US portfolio, compared to 28% for the VTI portfolio.

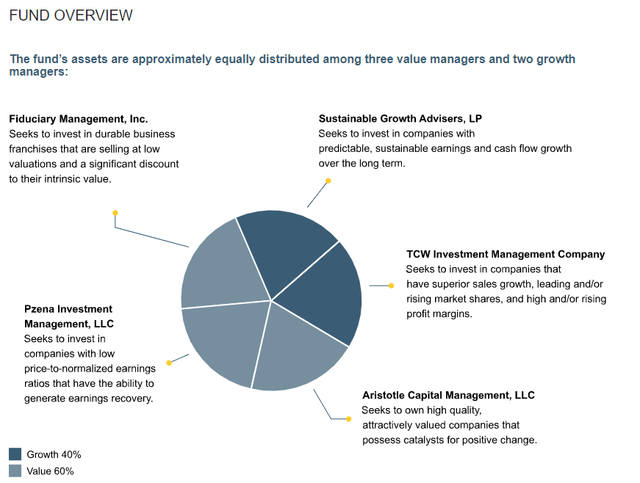

The fund’s portfolio management is split across five different managers: Fiduciary Management, Sustainable Growth Advisers, Pzena Investment Management, TCW Investment Management, and Aristotle Capital Management. Each advisor focuses on either growth or value, depending on their area of expertise. The fund splits its portfolio equally between each management team. It’s worth noting that each advisor has been with USA for quite some time.

United States Fact Sheet

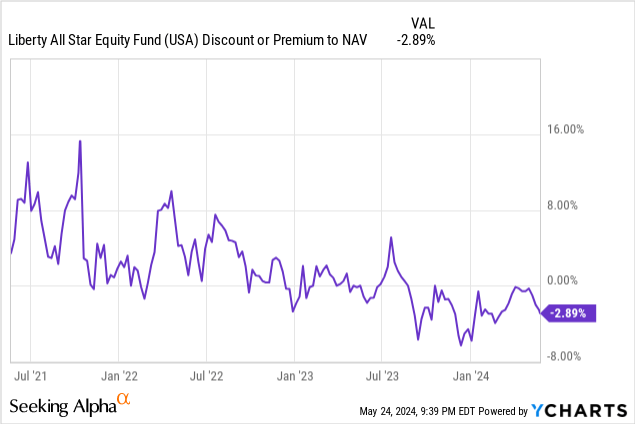

USA is currently trading at about a 2% discount to its net asset value. Since our last coverage, USA has traded at a smaller discount to its net asset value, narrowing the gap from 5%. Historically, USA has traded close to its net asset value with a portfolio of unleveraged, highly liquid securities. There is little question about the intrinsic value of USA’s holdings. In contrast to USA, some closed-end funds hold complex and/or illiquid securities. Compared to a portfolio of publicly traded stocks, these complex portfolios are difficult to value and may experience large price fluctuations compared to NAV. Additionally, USA is unleveraged, which removes another layer of complexity from the equation. As a result, USA may trade close to its NAV.

Personnel evaluation

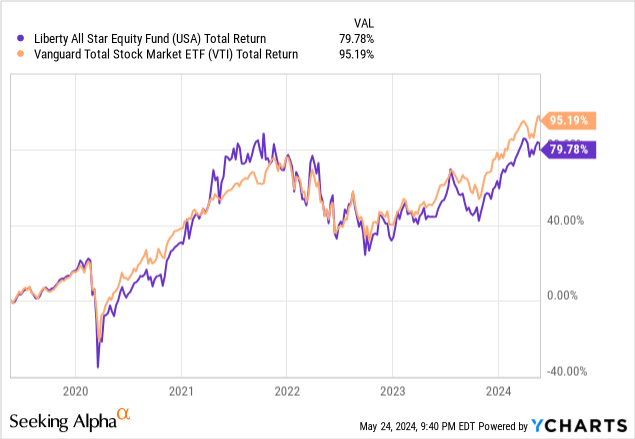

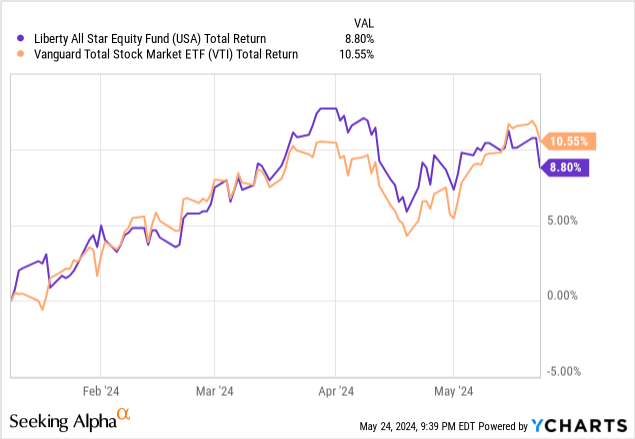

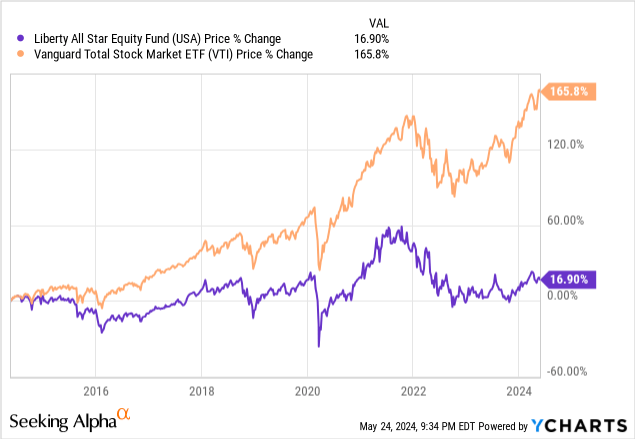

Since our last coverage, USA has performed in line with the market, underperforming VTI by about 100 basis points, assuming dividends are reinvested. In a similar portfolio, USA’s performance is unlikely to diverge significantly from VTI’s overall equity market approach. However, USA’s higher fee structure may undermine its long-term performance.

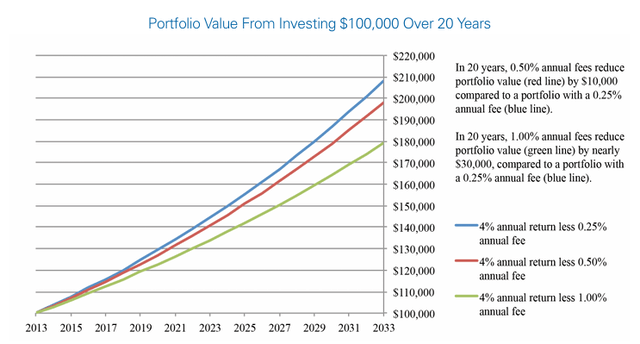

Over the long term, the impact of fees becomes more pronounced. The SEC provides a chart that shows the impact of various fee structures over time. This scenario assumes you invest $100,000 over 20 years. A 75 bps increase in annual fees over the 20 years would wipe out almost $30,000 in value, assuming a 4% annual return.

SEC

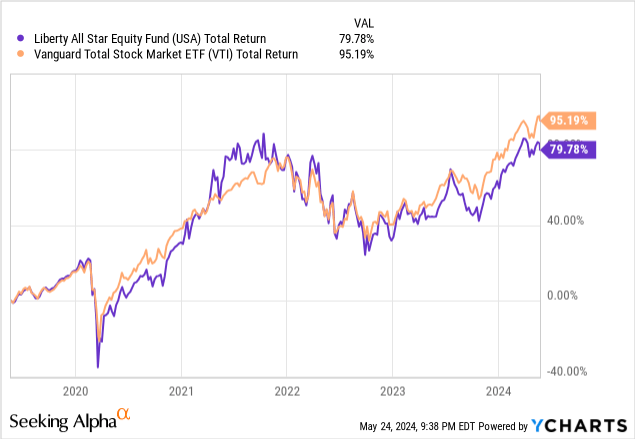

In the US, values have similarly declined due to inflated fee structures. If we evaluate the past 5 years, it becomes clear that the US performance is starting to decline. Compare VTI’s total return of 95% to the US’s total return of 80%.

Keep in mind that both scenarios assume that all distributions are reinvested back into the fund. gross Taxes. This is an important piece of the puzzle because the tax implications of each investment will be radically different for any given investor.

VTI continues to outperform in both the short and long term, which supports our previous assertion.

A saving grace

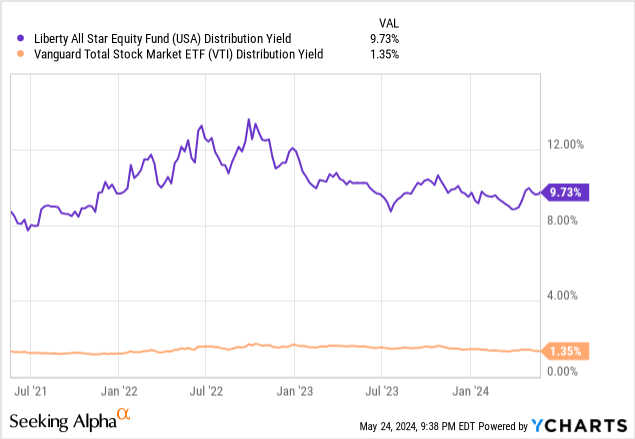

With total returns lagging, USA’s true value proposition falls into a different realm: USA’s distribution is much more generous than VTI’s yield.

Investors are attracted to the yield that comes from USA’s unusual dividend policy. While most closed-end funds distribute fixed dividends monthly, USA distributes dividends quarterly based on net asset value. This policy is unusual but not unheard of; it is also used by other funds such as Royce Value Trust (RVT) and BlackRock Science and Technology Term Trust (BSTZ). The fund’s fact sheet provides an overview of the dividend policy.

The current policy is to provide annual equity distributions of approximately 10 percent of net assets, payable in four quarterly installments of 2.5 percent of the Fund’s net assets at the close of trading on the New York Stock Exchange on the Friday prior to each quarterly declaration date.

USA’s policy is to distribute 10% of the fund’s net asset value as dividends. For shareholders, this equates to a high and growing dividend yield, assuming long-term appreciation of large cap stocks. This assumption is critical to USA’s long-term performance. USA’s long-term sustainability depends on the portfolio earning at least 10% per year in excess of the dividend rate. If not, the NAV will begin to decline and the dividend will disappear accordingly.

The likelihood of US maintaining its distribution is based on the key factors supporting economic growth. The economy appears to stay on track, with inflation remaining high and the economy moving towards a soft landing. The fund’s history shows that the distribution model is indeed sustainable. Variable distributions are beneficial in stressful situations where fixed dividends may be detrimental to the long-term health of the fund. Still, we can identify instances where US’s income generating power begins to wane.

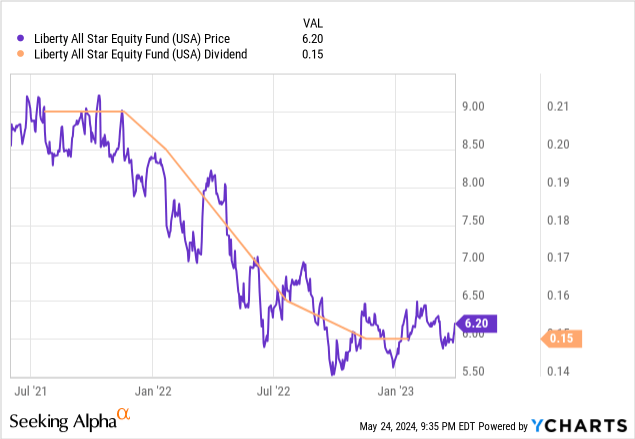

For example, between September 2021 and September 2022, stock markets fell sharply, impacting prices and dividends in the U.S. A rapid recovery subsequently stabilized the fund, but a prolonged decline could have devastating consequences.

While the tide is strong, the US continues to provide high returns to shareholders. Those who do not want to replicate the strategy benefit from having a trusted management team selectively harvest and distribute capital gains on their behalf.

Who should buy America and who shouldn’t?

US is a great option for investors looking for a closed-end fund that delivers high returns from the domestic stock market. The fund distributes the majority of its earnings as quarterly dividends. Shareholders may consider the tax impact of these dividends as another factor affecting performance.

Those holding US stocks in taxable accounts are responsible for paying taxes on dividend distributions. US dividends are allocated between income, capital gains and return of capital, each with their own unique tax implications. For investors holding in taxable accounts, this means that a portion of the dividends goes to tax and cannot be reinvested. Tax burden is another large long-term performance dampener that varies depending on an individual’s tax burden.

Investors who hold VTI or similar index funds in taxable accounts will incur a lower ongoing tax burden because the majority of earnings are kept within the fund rather than distributed as dividends.

Again, the majority of USA’s distributions come from realizing gains in the portfolio. The ETF structure allows for more tax-efficient compounding of gains. The total returns shown above are independent of any taxes levied on USA’s distributions.

A tax-advantaged account means that the compounding effect of USA’s dividend distributions is more efficient. As a result, an individual retirement account or similar vehicle may be a better holding place for USA shares than a taxable brokerage account. Additionally, retired investors may find the fund attractive as a way to generate capital to meet required minimum dividends. Given that 10% of the net asset value is liquidated annually, USA generates a sufficient yield to meet dividend requirements without the need to sell additional shares.

Conclusion

USA is a unique fund that has delivered good performance to shareholders for decades. The fund’s management team and diversified approach to portfolio allocation provide an additional layer of security for investors who want protection from certain types of risk. USA is a solid fund, but there are factors that buyers should beware of, and we reiterate our Hold rating. An inefficient distribution structure for tax-sensitive investors is a major drag on long-term performance. Given USA’s high fees, investors may choose lower-cost exchange-traded funds like VTI.

USA’s portfolio has important strengths and weaknesses to consider. For example, USA’s management has a strong track record of selecting assets that will appreciate in value to support the fund’s distributions. The five managers bring their expertise to bear on the fund’s mission of providing risk-adjusted returns to investors. However, when the portfolio is constructed with the expertise of all the managers, USA is more similar to an index fund or actively managed large-cap stock fund that does not have a differentiated portfolio.

However, USA may be attractive to certain investors, such as those looking to generate capital for RMDs. The fund’s long-term performance has been in line with the market after fees. Investors who can accept lower performance for convenience should consider USA as a yield-generating equity investment.