Finding a business with the potential to grow significantly isn’t easy, but it can be done by looking at some key financial indicators. Usually, you need to notice a growth trend. return Return on Invested Capital (ROCE) and associated expansion base This is the ratio of invested capital to total capital. Essentially, this means that a company can continually reinvest in profitable endeavors. This is the hallmark of a compound interest machine. Opera We’ve taken a look at (NASDAQ:OPRA) and its ROCE trend and really like it.

What is Return on Invested Capital (ROCE)?

For those unfamiliar, ROCE is a metric that assesses how much pre-tax profit (as a percentage) a company earns on the capital invested in its business. The formula for calculating this at Opera is:

Return on Invested Capital = Earnings Before Interest and Taxes (EBIT) ÷ (Total Assets – Current Liabilities)

0.076 = US$69 million ÷ (US$998 million – US$83 million) (Based on the trailing 12 months ending March 2024).

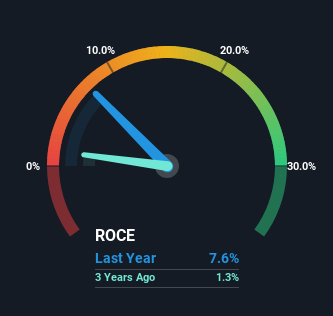

So, Opera’s ROCE is 7.6%. While that’s a low return in absolute terms, it’s on par with the software industry average of 7.2%.

View our latest analysis for Opera

Above you can see how Opera’s current ROCE compares to its prior returns on capital, but the history can only tell you so much – if you want to see what analysts are predicting going forward you can check out this free analyst report on Opera.

What can Opera’s ROCE trends tell us?

Opera’s ROCE is on an upward trend, which gives it some promise. Looking at the data, we can see that while capital invested in the business has remained relatively flat, the ROCE generated has increased by 51% over the past five years. Essentially, the business is generating higher returns from the same amount of capital, which is evidence that the company is becoming more efficient. However, it’s worth looking into this further, because while a more efficient business is great, it could also mean that there are not enough areas to invest internally for organic growth going forward.

Key Takeaways

In summary, it’s good to see Opera has become more efficient and achieved a higher rate of return on the same amount of capital. And with a respectable 43% dividend paid out to those who have held shares in the past five years, it’s fair to say these developments are starting to get the attention they deserve. As the stock is proving to be on a promising trend, it’s worth investigating the company further to see if this trend will continue.

Like many other companies, Opera faces risks. Two Warning Signs Something you should know.

Opera isn’t the highest grossing company, but check this out. free A list of companies with healthy balance sheets and high return on equity.

Valuation is complicated, but we can help make it simple.

investigate Opera By checking our comprehensive analysis, you can see whether it may be overvalued or undervalued. Fair value estimates, risks and warnings, dividends, insider trading, financial strength.

View free analysis

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.