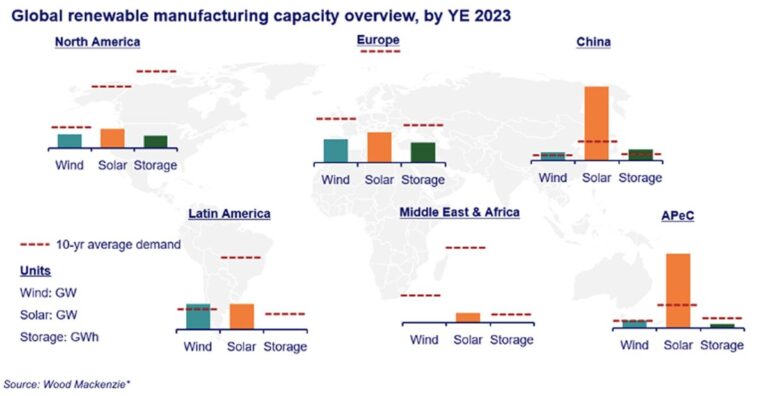

Low prices and integrated supply chains could enable Chinese manufacturers to supply more than 65% of global demand for renewable energy equipment, leading to a 35% increase in exports between 2019 and 2023, Wood Mackenzie said in its latest report.

Manufacturing Cost ChinaRenewable energy manufacturers are paying up to 200% less than their Western counterparts in key competing markets, a new report has found. Wood Mackenzie.

The consultancy said rapidly falling prices, integrated supply chains and “high performance standards” have enabled China-based renewable energy manufacturers to supply more than 65% of total global demand, and said there was evidence that non-Chinese products were twice the price of equivalent Chinese-made equipment.

“Benefiting from strong domestic Chinese supply chains, equipment produced overseas by Chinese manufacturers remains price competitive despite rising prices due to inflation uncertainty and rising production costs,” said Xiaoyang Li, Wood Mackenzie’s director of power and renewables research, Asia Pacific.

The consultancy said Chinese manufacturers are targeting overseas markets with local content requirements to become regional manufacturing hubs. Between 2019 and 2023, China’s renewable exports are expected to grow by 35%, which Wood Mackenzie attributes to “competitive pricing and capacity advantages.”

During the same period, investment in wind and solar power projects increased by 23%, and energy batteries overtook solar modules to become China’s leading renewable energy commodity export.

According to the report, there is growing interest from Chinese companies in investing in overseas renewable energy projects, but progress has been slow due to high development risks and uncertain revenue streams. Wood Mackenzie said Chinese renewable energy companies tend to invest in markets with high electricity demand, stable operating environments and predictable revenue streams.

“Backed by a strong equipment supply chain from Chinese manufacturers, Chinese solar and storage investors prefer greenfield investments when exploring opportunities overseas,” Li said.

In November, Wood Mackenzie released a report stating that China’s significant increase in solar module production capacity and solar power generation facilities has helped it maintain relatively low and stable electricity prices compared to Europe and the United States.

China’s cumulative solar power capacity surpassed 670GW in April, with around 60.5GW of new solar power capacity installed since the start of the year.

This content is copyrighted and cannot be reused. If you would like to collaborate with us and reuse any part of our content, please contact us at editors@pv-magazine.com.