(Bloomberg) — China’s carbon dioxide emissions into the atmosphere have fallen for the first time since the pandemic ended, suggesting the world’s top polluter may have peaked more than five years ahead of its own deadline, according to a new study from Carbon Brief.

Most read articles on Bloomberg

Emissions in March fell 3% from a year earlier, the first annual decline since January 2023, Lauri Myrvirta, a senior research fellow at the Asia Society Policy Institute, said in a report released on Tuesday.

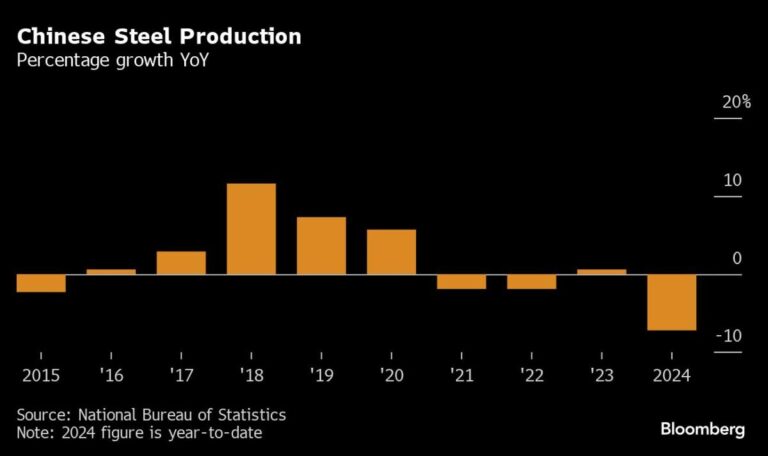

Mirlivirta said record wind and solar installations met almost all of China’s growing electricity demand and a slowdown in the real estate sector helped reduce carbon emissions from the highly polluting steel and cement sectors. Meanwhile, growth in oil consumption has “stood still.”

Carbon Brief’s analysis is in line with other studies, including from BloombergNEF, which say global emissions could fall by up to 2.5% this year, mainly due to cuts in coal-fired power generation in China.

The drop in China’s emissions reversed 14 months of rising pollution that followed rapid manufacturing growth and investment after the government turned to the factory sector to help the economy recover from the pandemic. Mirlivirta said the decline was expected to continue in April, supporting the view that emissions may have peaked last year, well ahead of China’s 2030 deadline.

“If the expansion of clean energy sources maintains last year’s record level, China’s carbon dioxide emissions could peak as soon as 2023,” he said.

The turnaround has been driven by impressive developments in clean technology: China will install more solar power in 2023 than the United States has ever built. And rapid advances in electrification mean that one in 10 cars on the road no longer burns petroleum products, Mirlivirta said.

Peaking emissions is a key milestone on China’s journey to net zero, which it has committed to achieving by 2060.

Still, there are growing signs of friction in the country’s decarbonization efforts. The national power grid is struggling to keep up with tons of solar power that peaks during the day and fades at night. Solar installations fell for the second straight month in April compared with a year earlier, but are still higher than the previous year.

Moreover, it is questionable whether China can achieve its net-zero goal as long as it continues to rely on coal, the most polluting fossil fuel, as its primary source of energy. Last month, World Energy Monitor reported that the number of coal-fired power plants worldwide grew 2% last year, with China accounting for about two-thirds of that growth.

On the Wire

Market excitement over China’s property bailout is quickly cooling as doubts about the policy’s effectiveness are rising again.

Weaker credit appetite and slowing M2 growth could darken China’s oil demand and economic outlook, according to Bloomberg Intelligence.

China has hit back at G7 critics of its international trade practices, accusing member states of exaggerating the threat of excess capacity posed by the world’s second-largest economy.

This week’s diary

(All times are in Beijing unless otherwise stated.)

Tuesday, May 28:

Wednesday, May 29:

-

CCTD’s weekly online briefing on China Coal, 15:00

-

SHPGX hosts China Gas Power Forum, Day 2

Thursday, May 30:

Friday, May 24:

-

China’s official May PMI, 09:30

-

China’s weekly iron ore port stockpiles

-

Shanghai Stock Exchange Weekly Stock, ~15:30

–With assistance from Kanupriya Kapoor.

(Updated the publication items in the second section)

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP