Latin America Embedded Finance Business and Investment Opportunities Market

Dublin, May 28, 2024 (GLOBE NEWSWIRE) — The “Latin America Embedded Finance Business and Investment Opportunity Databook – 75+ KPIs for Embedded Lending, Insurance, Payments and Affluent Segments – Updated Q1 2024” report has been added. ResearchAndMarkets.com Recruitment.

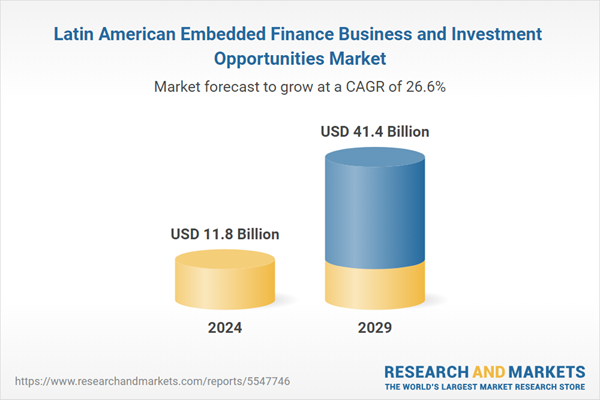

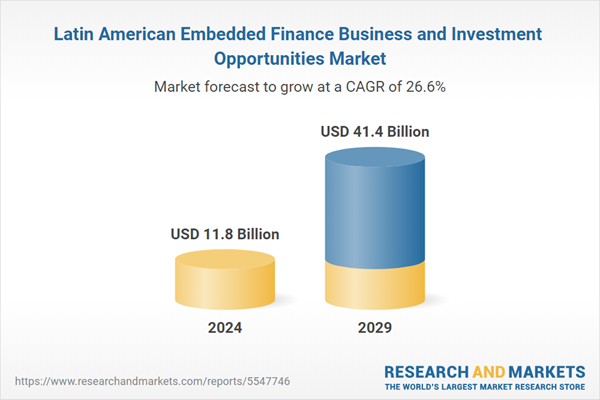

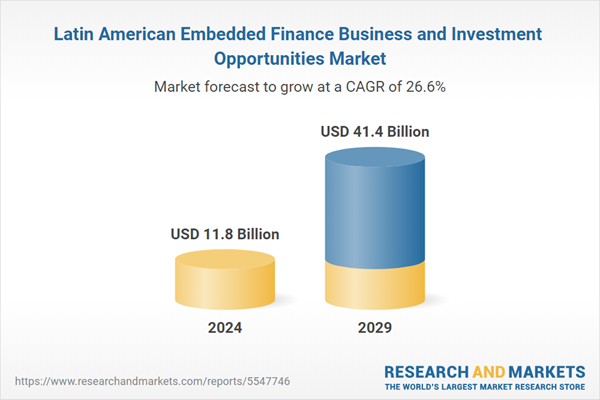

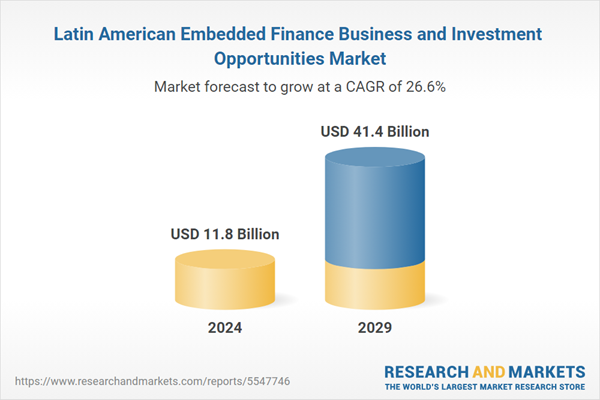

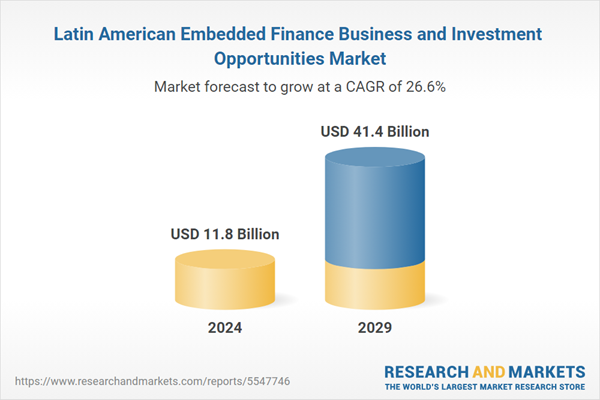

The embedded finance industry in this region is expected to grow by 37.6% on an annual basis to reach USD 11.77 billion in 2023. The embedded finance industry is expected to grow steadily during the forecast period, registering a CAGR of 28.6% between 2024 and 2029. Embedded finance revenues in the region will increase from USD 11.77 billion in 2024 to USD 41.4 billion by 2029.

The report covers market opportunities and risks for lending, insurance, payments, wealth and asset-based finance sectors across various verticals and provides an in-depth data-centric analysis of the embedded finance industry. With 75+ KPIs at country level, the report provides a comprehensive understanding of embedded finance market dynamics, market size and forecast.

Latin America’s embedded finance market is experiencing a period of significant growth, fuelled by a young, tech-savvy population, high mobile phone penetration and a growing unbanked and underbanked population.

Key Growth Drivers of the Latin American Embedded Finance Market: Rapid expansion is driven by several factors.

High Mobile Penetration: Latin America has one of the highest mobile phone penetration rates in the world, making it fertile ground for mobile-based embedded financial services. For example, Latin America is famously a mobile-first region, with mobile penetration predicted to reach 74% by 2025. For many people, their smartphone is their primary, and often only, device for accessing the Internet.

Large unbanked population: A significant portion of Latin America’s population is unbanked or underbanked. Embedded finance provides a convenient and accessible way for these people to access financial products and services. According to the World Bank, 122 million people in Latin America were thought to be unbanked in 2021. Payment solutions, such as those offered by e-commerce company MercadoLibre, can help these people access digital marketplaces.

Increased demand for digital solutions: The COVID-19 pandemic has accelerated the adoption of digital solutions across industries. Consumers are becoming increasingly accustomed to using digital platforms for financial transactions. The publisher estimates that in Argentina, the number of consumers paying more than half of their monthly spending with cash fell by 26% between 2021 and 2023. In the same period, that figure fell by 22% in Brazil and Mexico.

Open banking regulations: Several Latin American countries have introduced open banking regulations, encouraging collaboration between traditional financial institutions and fintech companies and stimulating innovation in embedded finance.

Government support is key to accelerating the growth of digital payments in Latin America, with governments and incumbents fueling the boom along with consumer demand. Several countries in the region are getting directly into the game, such as Brazil’s Pix system, an instant payments platform controlled by the country’s central bank. A recent survey found that 43 percent of consumers use Pix daily, while only 29 percent rely on credit cards and 21 percent use cash.

Key deals and innovations in the Latin American embedded finance market:

-

In October 2024, Itau Unibanco and Inswitch will introduce “Pix no mundo”, an innovative solution for cross-border payments in Latin America. “Pix no mundo” translates to “Pix around the world” and allows Brazilians abroad to use the Pix payment system for purchases and transactions throughout Latin America as if they were in Brazil.

-

Fintech deal volume in Latin America will remain relatively stable in 2023. The share of early-stage deals shows strong growth, indicating a focus on nurturing and supporting emerging fintech startups.

-

In June 2023, Accenture, a global professional services firm, announced a strategic investment in Palfin, a leading provider of responsible and compliant Web3 infrastructure services to financial institutions in Latin America. While the amount of the investment was not disclosed, it is clear that Accenture views the move as significant, as it marks Accenture Ventures’ first “Project Spotlight” investment in Latin America.

Challenges and Risks of the Latin American Embedded Finance Market: Despite its promising future, the Latin American embedded finance market faces several challenges.

-

Regulatory uncertainty: The regulatory framework for embedded finance is still developing in some countries, creating uncertainty for businesses.

-

Data security concerns: Integrating financial services within non-financial platforms requires strong data security measures to ensure consumer trust.

-

Financial literacy: A significant portion of the Latin American population lacks financial literacy, which can hinder the adoption of embedded financial services.

Competitive Landscape: The Latin American embedded finance market is a dynamic market with a mix of established players and emerging startups. Key participants include:

-

Traditional banks: Large banks such as Itau Unibanco (Brazil) and Bancolombia (Colombia) are actively exploring embedded finance opportunities.

-

Fintech startups: Several fintech startups, such as Clip (Mexico) and Nubank (Brazil), offer innovative embedded financial solutions.

-

Technology companies: Tech giants like MercadoLibre are leveraging their existing user base to offer embedded financial services.

Other Latin American giants looking to capitalize on growing demand for agile digital payments include Argentine e-commerce giant Mercado Libre, whose digital wallet, Mercado Pago, had 14 million users in the country as of 2022 and can be used to make payments, take out loans and even buy life insurance.

Strategic Opportunities: The embedded finance market in Latin America offers several strategic opportunities for players.

-

Focus on mobile-first solutions: Developing mobile-centric embedded financial solutions is essential to cater to the region’s mobile-savvy population.

-

Partnerships: Collaboration between traditional financial institutions, fintech startups and technology companies can accelerate innovation and market penetration.

-

Financial Inclusion Solutions: The development of embedded financial products tailored to the needs of the unbanked and underbanked is a key growth area.

-

Invest in Data Security: Building a strong reputation around data security is essential to gaining consumer trust and adoption.

Key attributes:

|

Report Attributes |

detail |

|

number of pages |

750 |

|

Forecast Period |

2024 – 2029 |

|

Estimated market value in 2024 (USD) |

$11.8 billion |

|

Market value forecast to 2029 (USD) |

$41.4 billion |

|

Compound Annual Growth Rate |

26.6% |

|

Target area |

latin america |

This title is a bundled product that combines the following five reports, each containing over 500 tables and 600 figures:

-

Embedded Finance Business and Investment Opportunities in Latin America

-

Embedded Finance Business and Investment Opportunities in Argentina

-

Embedded Finance Business and Investment Opportunities in Brazil

-

Embedded Finance Business and Investment Opportunities in Colombia

-

Embedded Finance Business and Investment Opportunities in Mexico

For more information on this report, please visit: https://www.researchandmarkets.com/r/vy03tw

About ResearchAndMarkets.com

ResearchAndMarkets.com is a leading global source of international market research reports and market data providing the latest information on international markets, regional markets, key industries, top companies, new products and latest trends.

Attachments

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900