(Bloomberg) — Asian stocks and bonds fell on Wednesday as traders assessed the impact of an overnight rise in U.S. Treasury yields and comments from the Federal Reserve chairman dented expectations of a Fed interest rate cut.

Most read articles on Bloomberg

The MSCI Asia Pacific Index fell for a second straight day as stocks slumped from Hong Kong to Japan and Australia. A higher-than-expected inflation reading deepened the sell-off in Australian government bonds and pushed Japan’s benchmark yield to its highest since 2011.

“The initial reaction is to rising US interest rates, with the US consumer confidence data being strong, reinforcing the risk that interest rates will remain high for a prolonged period,” said Xinyao Ng, investment director at Abrudo. “This is broadly negative for Asia as it supports a stronger dollar against Asian currencies.”

In Asia, U.S. Treasuries steadied after two weak sell-offs and a slide ahead of the Fed’s key inflation reading later this week. China’s yuan slid to its lowest since November amid signs that policymakers are weakening the currency against a strong dollar. Emerging Asian currencies such as the South Korean won and Malaysian ringgit also fell.

Oil prices continued to rise as fresh attacks in the Red Sea escalated geopolitical tensions in the Middle East ahead of the weekend OPEC+ meeting, with West Texas Intermediate climbing above $80 a barrel and Brent futures up 0.4%.

“Higher oil prices and rising U.S. and Japanese bond yields are likely to lead to a soft start to today’s Asian trading session,” said Tony Sycamore, market analyst at IG Australia in Sydney.

In corporate news, Lenovo Group Inc. said it plans to sell $2 billion worth of zero-coupon convertible bonds to a Saudi Arabian sovereign wealth fund, becoming the latest Chinese company to raise capital through such a bond offering in recent days.

Federal Reserve Rate

As Wall Street returned from the holiday weekend, the “T+1” rule went into effect, allowing U.S. stocks to settle in one day instead of two.

Investors also focused on comments from Fed Chairman Kashkari, who said the central bank’s policy stance was cautious but that officials had not completely ruled out further rate hikes.

Bond traders waiting to hear about the Federal Reserve’s interest rate policy may soon get some welcome help.

Starting on Wednesday, the Treasury will begin its first round of buybacks since the early 2000s targeting older, harder-to-tradable bonds, after the U.S. central bank in June is set to begin slowing the pace of its balance sheet reduction, known as quantitative tightening.

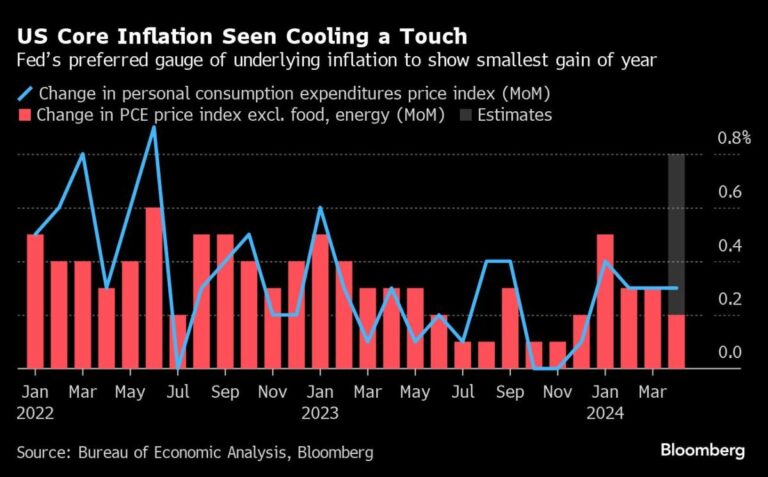

The Federal Reserve’s frontline inflation gauge is trying to point to some easing from stubborn upward price pressures, underscoring the central bank’s caution about the timing of interest rate cuts.

Economists expect the personal consumption expenditures price index excluding food and energy, due to be released on Friday, to rise 0.2% in April, the smallest increase so far this year for the measure that gives a better snapshot of underlying inflation.

Swap contracts currently price in roughly 30 basis points of Fed rate cuts for all of 2024, the equivalent of one cut as Fed moves have historically been in 25 basis point increments.

“We currently expect the first Fed rate cuts to come in November or December,” said Chris Law of FHN Financial. “The FOMC is looking for some good inflation reports, and by good, I mean that they should be generally better than April, let alone any month in the first quarter, as people like Governor Christopher Waller have suggested.”

Major events this week:

-

German Consumer Price Index, Wednesday

-

Fed Beige Book, Wednesday

-

Fed President John Williams to speak Wednesday

-

Eurozone economic confidence, unemployment rate, consumer confidence on Thursday

-

US initial jobless claims, GDP, wholesale inventories Thursday

-

Fed’s John Williams and Laurie Logan to speak Thursday

-

Japan unemployment rate, Tokyo consumer price index, industrial production, retail sales, Friday

-

China manufacturing and non-manufacturing PMI, Friday

-

Eurozone Consumer Price Index, Friday

-

U.S. Consumer Income, Expenditures and PCE Deflator Friday

-

Federal Reserve President Raphael Bostic to speak on Friday

Some of the key market developments:

stock

-

S&P 500 futures were down 0.2% as of 10:36 a.m. Tokyo time.

-

Nikkei 225 futures (OSE) fell 0.3%

-

Japan’s TOPIX falls 0.4%

-

Australia’s S&P/ASX 200 fell 0.9%

-

Hong Kong’s Hang Seng Index fell 1.2%

-

The Shanghai Composite Index rose 0.2%

-

Euro Stoxx 50 futures little changed

-

Nasdaq 100 futures fell 0.2%

currency

-

The Bloomberg Dollar Spot Index was little changed.

-

The euro was little changed at $1.0850

-

The Japanese yen weakened 0.1% to 157.34 yen to the dollar.

-

The offshore yuan was little changed at 7.2659 per dollar.

-

The Australian dollar was little changed at 0.6653.

Cryptocurrency

-

Bitcoin rose 0.2% to $68,358.01.

-

Ether little changed at $3,831.92

Bonds

-

The yield on the 10-year Treasury note was little changed at 4.55%.

-

Japan’s 10-year government bond yield rose 3 basis points to 1.065%.

-

Australia’s 10-year government bond yield rose 13 basis points to 4.39%.

merchandise

-

West Texas Intermediate crude rose 0.3% to $80.08 a barrel.

-

Spot gold fell 0.2% to $2,357.24 an ounce.

This story was produced with assistance from Bloomberg Automation.

–With assistance from Rob Verdonck.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP