Jorge Casuso

May 30, 2024 – Rent growth in Santa Monica remains sluggish, with median prices falling -0.2% in May, the fourth consecutive monthly decline this year, according to a rent report released Thursday by Apartment List.

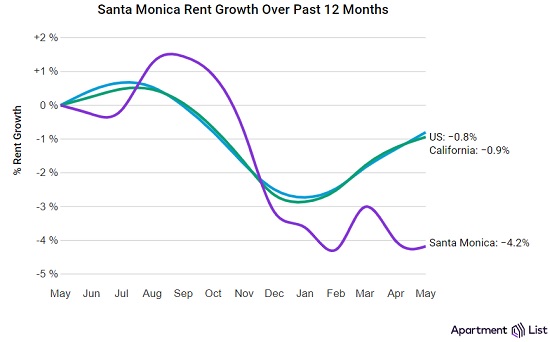

According to data based on the site’s property listings, Santa Monica’s rent decline over the past 12 months was -4.2%, compared with -0.9% statewide and -0.8% nationally.

|

Still, the downturn affecting Santa Monica’s rental market reflects a national trend that could continue into the summer, Apartment List researchers wrote.

“This time of year typically marks the height of moving season and a period of accelerated rent growth, but this month’s sluggish growth suggests the market is heading into another slowdown over the summer,” the researchers wrote.

“From the second half of 2022 onwards, seasonal declines have been sharper than usual and seasonal increases have been more moderate. As a result, apartments are, on average, slightly cheaper than a year ago.”

The monthly report found that the average rent across Santa Monica was $2,463, down slightly from $2,472 in April. The average rent for a one-bedroom apartment was $2,331 and for a two-bedroom apartment it was $2,795.

The average rent in Santa Monica is $271 higher than the $2,192 average rent for the 25 Los Angeles and Orange County cities in Apartment List’s database, and well above the national average rent of $1,404.

Calabasas currently has the highest rent among Los Angeles-area cities, with an average rent of $3,313, while Long Beach is the most affordable city in the Los Angeles area, with an average rent of $1,784.

The average rent across Los Angeles is $2,093, roughly the same as last month.

The report found that the metro area’s fastest annual rent growth was in Mission Viejo (3.3%), while the slowest was in West Hollywood (-7.1%).

The “trajectory” of rents this year mirrors a “notable shift to positive rent growth” in February and March of last year, “followed by growth leveling off and then beginning to decline,” the researchers wrote.

“In February and March of this year, the data again appeared to reflect the beginnings of a recovery, but the two subsequent months have been more reflective of the sluggishness that has characterised the rental market since the second half of 2022.”

While demand for apartments remains strong, the report predicts that “a steady supply of new builds will give renters ample choice and help prevent prices from skyrocketing.”

According to the website, data for the Apartment List Rental Report is collected monthly from millions of listings on the site.

The report calculates rents for one- and two-bedroom properties and “seeks to identify the actual transacted rent prices, rather than the listed rent prices.” Click here to view the full report.