- S&P Global said tariffs on China could lead to inflation and slow U.S. GDP growth in the short term.

- Prices will take time to fall, which could delay the Fed’s rate cuts, they say.

- S&P said tariffs would boost domestic economic growth in the long run, but would also create market inefficiencies that would keep prices rising.

S&P Global Intelligence said U.S. efforts to offset Chinese imports could actually create uncertainty for China’s inflation efforts.

Indeed, if Washington accepts tariffs on foreign goods, it could force the Federal Reserve to keep interest rates high for a long time, risking delaying long-awaited rate cuts, the ratings agency said.

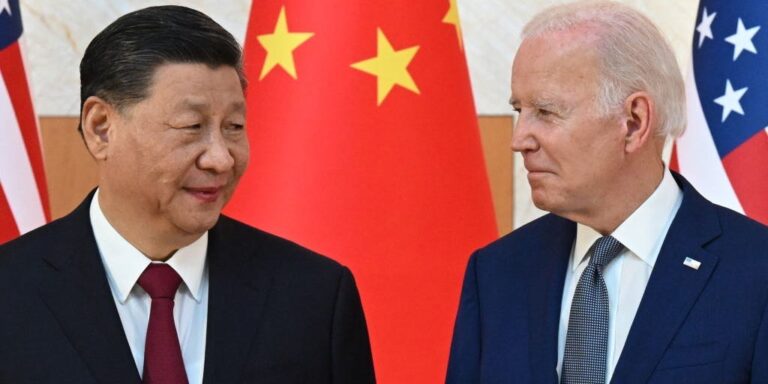

Tariff policy has received new attention in recent months, especially as the US presidential election draws closer. To protect domestic industries, both candidates have advocated protectionism, with former President Donald Trump even pledging to impose a 10% universal tariff on all US imports if elected. He plans to impose a 60% tariff on China.

While Biden’s policies are less sweeping, his administration has not shied away from protectionist tactics. Not only has Biden left in place most of the trade restrictions Trump previously imposed on China, but he recently announced new tariffs on Beijing’s technology exports, from electric vehicles to solar power products.

“But economists say the new tariffs, and tariffs more broadly, could have undesirable consequences: higher prices and a higher probability of higher interest rates for a longer period,” S&P wrote. “The Fed is expected to cut its benchmark interest rate slightly this year from its current multi-decade high level, but higher tariffs would likely lead to higher prices and complicate the central bank’s decisions.”

As of now, Biden’s proposed tariffs target a small portion of Chinese industry, taking effect between 2024 and 2026. Of the 14 sectors under review, the top five will account for just 3% of Chinese imports to the U.S. in 2022, S&P said.

But for domestic manufacturers, tariffs could ease downward pressure on prices as Chinese competitors lose their low-cost advantage. In this sense, protectionism may boost economic growth in the long run, but it also exacerbates market inefficiencies and compounds inflation.

“Global supply chains have evolved into their current form to exploit production efficiencies that have kept world and U.S. GDP higher and prices lower than would exist in the absence of globalization and trade,” Ben Harzon, senior U.S. economist at S&P, said in the report.

Moreover, the agency estimates that these tariffs could hurt growth in the U.S. GDP is currently expected to grow 2.49% this year, slightly below last year’s 2.54% increase.

Other analysts have expressed similar concerns, especially if Trump’s sweeping tariffs go into effect: One estimate is that his proposals could cost American consumers $500 billion a year.