While the S&P 500 has posted several all-time highs since mid-May, the Nasdaq has not posted a new all-time high since April 2024. One reason for the Nasdaq’s lag is the sell-off across the enterprise software industry.

The enterprise software industry provides software that automates business processes such as payroll, supply chain, compliance, accounting, and even customer management. Enterprise companies are constantly expanding the scope of their clients’ businesses, programming new features within existing software and creating new lines of business.

Some of the biggest enterprise software companies took big hits in earnings, revenue and guidance released in March, April and May. The sell-off in enterprise software stocks may have stunted the Nasdaq’s gains.

Sales fall short of expectations, guidance lowered

Salesforce (CRM) earnings released last week sparked a broad sell-off in the enterprise software space. The company reported better-than-expected earnings but lower-than-expected revenue and provided lower-than-expected second-quarter guidance. The company’s shares fell 20% in trading after the earnings release, to $212 per share.

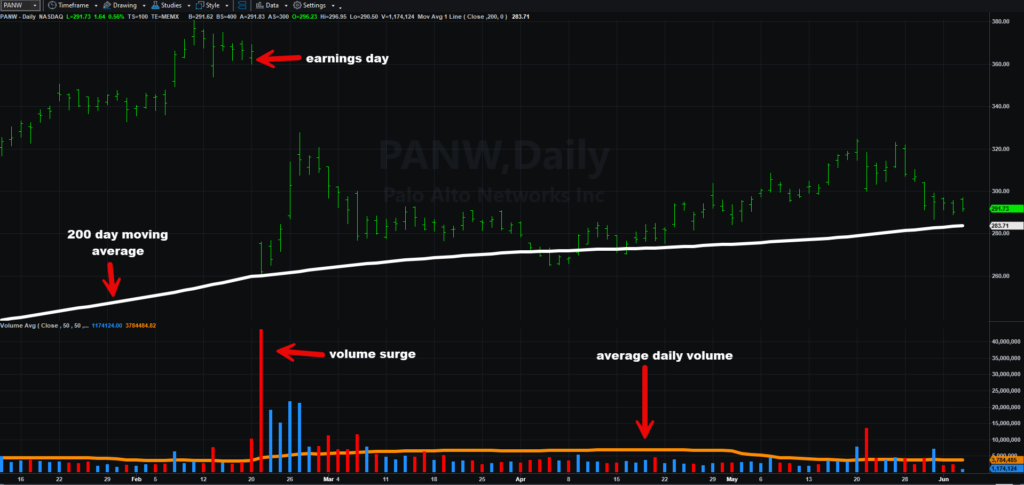

Palo Alto Networks (PANW) is under pressure in the post-earnings environment, after the company lowered its revenue outlook for the next quarter and the full year.

Adobe (ADBE) opened trading about $71 lower on March 15 after beating profit and revenue targets in its earnings report on March 14. The enterprise software company also expects revenue to decline in the second quarter. ADBE is scheduled to release its next earnings report on June 13.

Intuit (INTU), a corporate finance software company, was sold off after reporting better-than-expected earnings on May 23 but lowering its profit guidance. Volume surged on the downside, and the stock slid below its 200-day moving average.

The table below shows some of the largest enterprise software companies along with their current price-to-earnings multiples, year-to-date stock performance, and average daily options trades.

| symbol | P/E Ratio | Year-to-date performance | Option Volume |

| Orks | 36 | Four% | 51,760 |

| now | 78 | -2% | 13.585 |

| Payk | twenty five | -twenty one% | 2,146 |

| Wednesday | 34 | -twenty two% | 18,389 |

| Customer Relationship Management | 44 | -6% | 110,963 |

| Pan W | 45 | 1% | 69,562 |

| Adobe | 37 | -26% | 32,127 |

| Into | 67 | 0% | 8,333 |

Credit spreads are created by selling an at-the-money put or call option and buying an out-of-the-money put or call option and are typically used in range-bound markets. Directional vanilla trading is when you buy a call option if you think the stock price will go up, or buy a put option if you think the stock price will fall. Learn more about options here.

Options trading is not suitable for all investors. Applications for TradeStation Securities accounts to trade options will be considered and approved or disapproved based on all relevant factors, including trading experience. See www.TradeStations.com/DisclosureOptions. For more information about costs and fees associated with options, visit www.TradeStation.com/Pricing.

Margin trading involves risks, and it is important that you fully understand the risks before trading on margin. The Margin Disclosure Statement outlines many of the risks, including that you may lose more funds than you have deposited in your margin account, that your broker may force you to sell securities in your account, that your broker may sell securities without contacting you, and that you will not be entitled to margin call extensions. To review the Margin Disclosure Statement, go to www.TradeStation.com/DisclosureMargin.