A major semiconductor industry event in China saw a drop in the number of exhibitors this year, reflecting challenges in the local market and a desire to stay out of the spotlight amid tightening U.S. export controls.

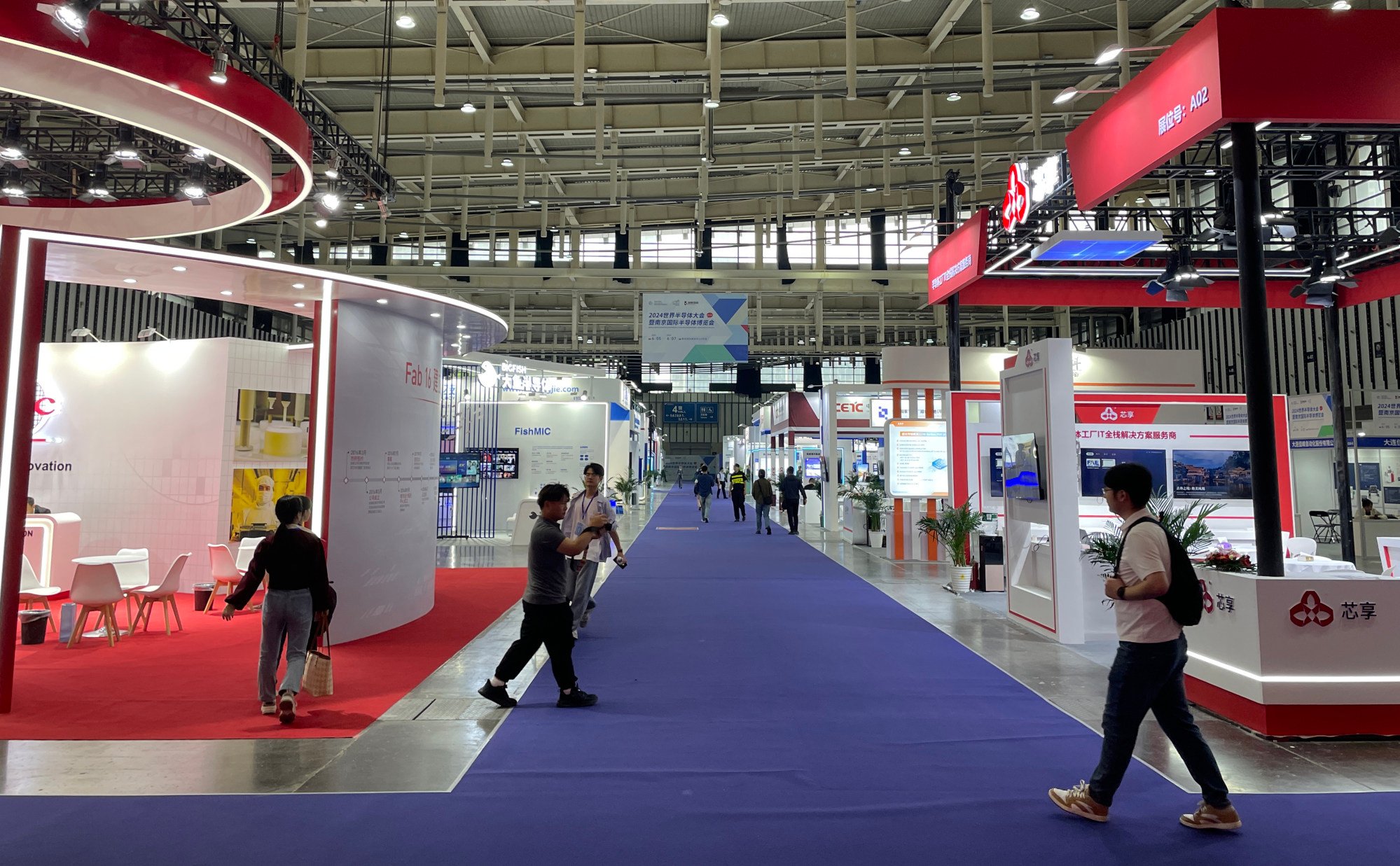

The sixth World Semiconductor Congress (WSC), which opened on Wednesday in Nanjing, capital of east China’s Jiangsu Province, attracted more than 200 exhibitors from a wide range of chip-related applications, including artificial intelligence (AI), automotive and electronic design automation (EDA) software, as well as global foundry leaders Taiwan Semiconductor Manufacturing Co. (TSMC), Huawei Technologies and Tencent Cloud.

Last year, the show attracted 300 exhibitors. Chen Gen, one of the organizers, blamed the decline in exhibitor numbers on “market-driven” practices, although previously many exhibitors had been “invited” by local governments.

Attendance this year also appears to be declining, reflecting a weakening domestic market. According to the Semiconductor Industry Association (SIA), China’s semiconductor sales will fall 14% year-on-year in 2023, the steepest decline among global markets. Current market conditions remain uncertain and the industry still faces challenges, according to speakers at a forum on high-quality growth in the semiconductor sector.

TSMC has been operating a foundry capable of making 16-nanometer logic chips in Nanjing since 2016, but declined to attend the forum or comment on the sidelines of the event amid geopolitical tensions across the Taiwan Strait. Last year, TSMC’s China manager, Chen Fan, gave a presentation on the company’s roadmap to 2-nanometer advanced technology by 2026.

Only a few foreign companies are exhibiting at this year’s show, including Samsung Electronics, British chip IP provider Arm, US engineering simulation software company Ansys, STMicroelectronics and Ericsson China.

Other local exhibitors included graphics processing unit startup Biren Technologies and YMTC, China’s largest flash memory chip maker.

Automotive semiconductor companies are feeling the effects as price wars continue in China’s auto manufacturing sector. Xiao Zuonan, general manager of China Core, a Suzhou-based maker of automotive microcontroller units, said at a forum session on Wednesday that profit margins last year came under downward pressure from pricing trends in the auto market.

Xiao highlighted the predicament most of China’s smaller auto chip makers face in substituting foreign products: “Even if their sales reach billions of yuan, their profits are negative.” [so] “How can we compete with foreign auto chip companies that cover every segment and have much deeper pockets than we do?”

Bloomberg reported earlier this year that Beijing has told domestic automakers to prioritize the use of domestically-made chips in their procurement, as most applications for auto electronics don’t require advanced chip-making techniques and can be achieved with the mature 28nm node.

Semiconductors and generative AI applications were another focus of the WSC amid rising AI activity in China, where Arm touted its semiconductor IP solutions that help streamline chip designers’ workflows and speed up product launches.

Liu Daolong, a semiconductor solutions expert at Tencent Cloud, said the company’s cloud-based EDA platform offers free solutions to help chip designers work with local foundries such as Semiconductor Manufacturing International Corp as part of a strategy to build a customer base.

Teng Ran, head of semiconductor research at CCDI Group, a market analysis firm backed by China’s Ministry of Industry and Information Technology, was bullish on the outlook for generative AI-enhanced smartphones and PCs in 2024.

“AI [generated content] “Following last year’s decline, we will see a significant increase in demand for chips such as CPUs, GPUs and memory, as well as hardware based on these chips,” he said.