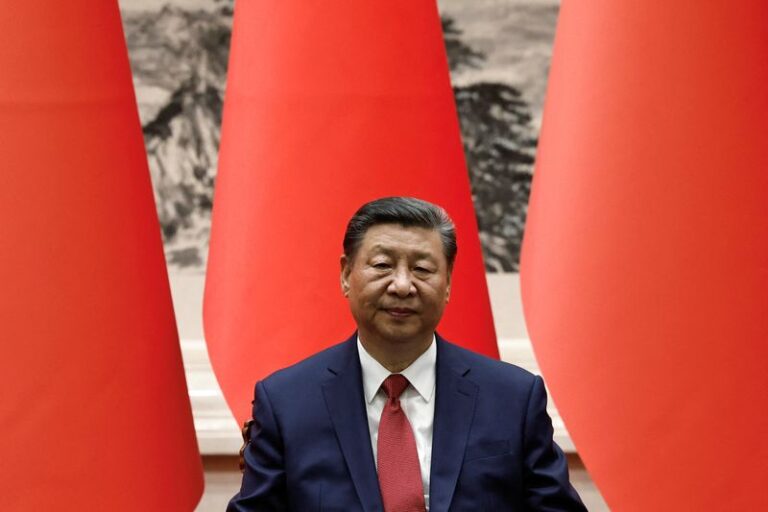

BEIJING (Reuters) – China’s President Xi Jinping Chinese state media said a spokesman for the country’s foreign ministry met with Pakistani Prime Minister Sharif in Beijing on Friday, days before Pakistan is due to submit its annual budget and apply for a new loan from the International Monetary Fund.

Pakistan is of strategic importance to China because of its location in the Arabian Sea, providing a land route to the Gulf of Aden and the Suez Canal, allowing Chinese ships to avoid potential chokepoints in the Straits of Malacca.

Sharif’s government is expected to seek at least $6 billion in aid under a new IMF program after the presentation of its annual budget, scheduled for June 10. And Pakistan’s roughly $27 billion in debt to China, according to World Bank data, will be at the center of upcoming talks with the IMF.

The IMF began talks on a new loan in May after Islamabad completed a $3 billion short-term loan program that helped it avoid a sovereign debt default last summer.

Pakistan owes about 13 percent of its total debt to China, which has been used to pay for infrastructure projects and other expenditures over the years.

China has lent Islamabad almost twice as much as Pakistan’s second and third largest multilateral lenders, the World Bank and the Asian Development Bank, to which Pakistan owes $16.2 billion and $13.7 billion, respectively.

Chinese companies have invested an additional $14 billion in Pakistan since a new economic corridor linking the two countries was announced in the summer of 2013 as part of Chinese President Xi Jinping’s flagship “Belt and Road” initiative, according to data from the American Enterprise Institute, a think tank.

Much of this investment has been made by Chinese state-owned energy companies, which are financing fossil-fuel and nuclear power plants as well as a logistics route under construction linking the Arabian Sea port of Gwadar with China’s northwestern Xinjiang region.

(Reporting by Joe Cash and Kevin Liffey Editing)