The technology industry is booming, fueled by advancements in areas such as artificial intelligence (AI), cloud computing, chip design, virtual/augmented reality (VR/AR), etc. Technology has repeatedly proven to be one of the best markets to invest in for the long term due to its ever-expanding nature.

Many of the industry’s leading companies have a reputation for making big profits over the years. Nasdaq 100 The technology sector has risen 390% over the past decade. Berkshire HathawayThe firm, led by investment mogul Warren Buffett, has more than 40% of its portfolio invested in tech stocks.

It’s not too late to invest in technology. Now is the perfect time to start. Here are two of the top tech stocks to buy in June.

1. Intel

You might be surprised Intel (Nasdaq: INTC) The company has made it onto this list after a tough few years. It’s no secret that the chipmaker’s business has faced some challenges recently. Intel was once king of the chip market, with over 80% market share for central processing units (CPUs) in 2017, and is now the largest chip maker in the world. apple (Nasdaq: AAPL) As the main chip supplier.

But things have changed dramatically for the company. Increased competition has caused its position in the CPU market to fall to 64%, and its contract with Apple expired in 2020. Meanwhile, changes in the chip industry have led to a decline in demand for CPUs while sales of graphics processing units (GPUs) have soared. This downfall has caused Intel’s stock price to fall 47% over the past three years.

But sometimes the best time to invest in a company is when a stock price hits bottom and appears to be starting to recover. That’s certainly the case with Intel, making it one of the most valuable tech stocks to buy now and hold for the long term.

Intel is moving to a foundry model that prioritizes chip manufacturing over design, a move that will see the company open chip factories across the U.S. and differentiate itself from competitors such as: NVIDIA and AmThe company outsources its manufacturing, and as markets like AI continue to drive chip demand, Intel is perfectly positioned to meet that need, which could lead to strong revenue growth over the next few years.

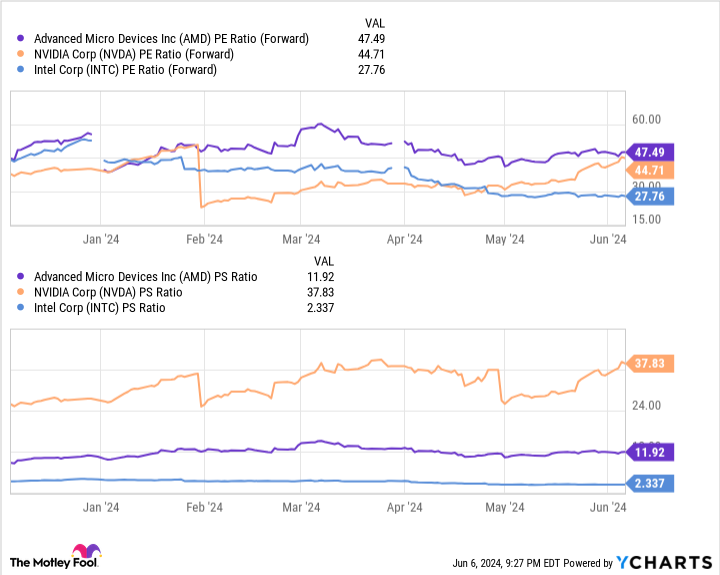

The chart above shows that Intel may be the most highly valued semiconductor stock this month, with the lowest forward price-to-earnings (P/E) and price-to-sales ratios among the big three semiconductor companies. In addition to a promising shift in its business model, Intel is a stock to buy this June and a tech stock not to be overlooked.

2. Apple

Apple has a reputation for reliability: The company’s shares have risen 343% over the past five years, despite declining product sales due to the COVID-19 pandemic and economic downturn in 2022.

Recent setbacks have led some analysts to question whether we’re witnessing Apple’s downfall, but the company’s $102 billion in free cash flow, fast-growing services business, and continued dominance in consumer technology make it unlikely the iPhone maker will prevail in the long term.

For example, Apple’s declining iPhone sales in China, its third-largest market, have attracted a lot of attention since last year as local consumers turned to domestic competitors. However, the issue appears to be resolving and tilting in Apple’s favor. On May 28, Bloomberg reported that iPhone sales in China surged 52% last month after a series of price cuts by Apple.

While discounts are often a short-term solution to a problem, the connectivity and services of Apple’s products suggest that recent buyers will stick with the company. Apple has strategically built an interconnected ecosystem of its products, encouraging users to branch out to many other devices after buying one.

Meanwhile, services like iCloud, Apple TV+, Music, and even the App Store allow the company to continue making profits even if consumers decide not to upgrade their devices. As a result, Apple’s surging sales in China could keep it a threat there for years to come.

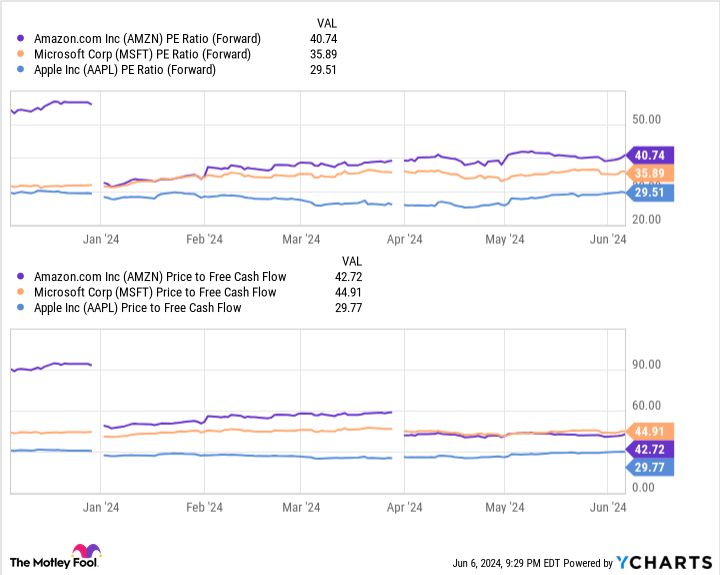

Like Intel, Apple’s stock is trading at a much better valuation than its peers, with a lower forward P/E and price-to-free cash flow ratio. Microsoft and AmazonAdd to this the company’s expansion into high-growth markets such as AI and VR/AR, and it goes without saying that Apple is the tech stock to buy this month.

Should I invest $1,000 in Apple right now?

Before you buy Apple stock, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now… and Apple wasn’t among them. The 10 stocks selected have the potential to generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That comes to $740,688.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of June 3, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a director of The Motley Fool. Dani Cook has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Advanced Micro Devices, Amazon, Apple, Berkshire Hathaway, Microsoft, and NVIDIA. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The post 2 Tech Stocks to Buy in June was originally published by The Motley Fool.