When you buy a stock, there is always the possibility that it will fall by 100%. But, on a more optimistic note, the stock prices of good companies can rise by more than 100% in the long run. OnMobile Global Limited (NSE:ONMOBILE) shareholders will be well aware of this, given that the share price is up 141% in five years. Also pleasing for shareholders is the 21% increase in the last three months, although this could be linked to a strong market which is up 9.5% in the last three months.

The past week has proven to be a favorable one for OnMobile Global investors, so let’s take a look at whether fundamentals have driven the company’s five-year performance.

View our latest analysis for OnMobile Global

While markets are a powerful pricing mechanism, share price reflects investor sentiment as well as underlying business performance. One imperfect but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, OnMobile Global’s EPS actually fell 4.3% per year.

Therefore, it is difficult to argue that earnings per share is the best metric to judge a company, as earnings may not be optimal at the moment, so it is worth looking at other metrics to understand share price trends.

A 2.8% annual decline in earnings is not a good thing, and while it’s certainly surprising to see the share price rise, a closer look at the data might provide some answers.

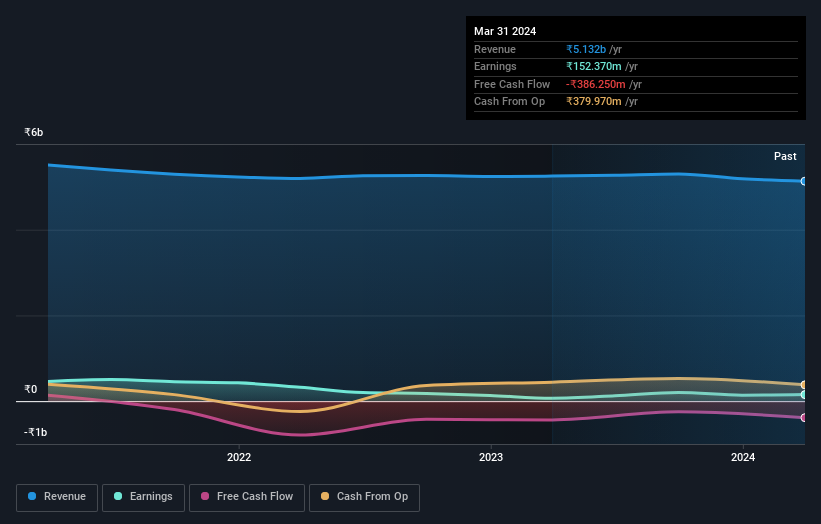

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

A closer look at OnMobile Global’s financials free Report the balance sheet.

What about the total shareholder return (TSR)?

Investors should note that there’s a difference between OnMobile Global’s total shareholder return (TSR) and its share price change, which we’ve covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. OnMobile Global’s five-year TSR was 168%, which is higher than the share price yield because it paid a dividend.

A different perspective

OnMobile Global delivered a TSR of 2.3% in the trailing 12 months. Unfortunately, this falls short of the market return. If we look back over five years, the return is even better, at 22% per year over that period. It’s entirely possible that this business continues to outperform despite the share price appreciation slowing. It’s very interesting to look at share price over the long term as a proxy for business performance. But to gain true insight, we need to consider other information as well. For example, consider the ever-present threat of investment risk. We’ve identified 3 warning signs There is at least one company in OnMobile Global that cannot be ignored, and understanding them should be part of your investment process.

of course, You may find a great investment by looking elsewhere. Take a look at this free A list of companies that are expected to see revenue growth.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complicated, but we can help make it simple.

investigate OnMobile Global By checking our comprehensive analysis, you can see whether it may be overvalued or undervalued. Fair value estimates, risks and warnings, dividends, insider trading, financial strength.

View free analysis

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.