(Bloomberg) — European stocks edged up and U.S. stock futures were little changed as investors assessed political uncertainty in countries such as France and traders awaited policy decisions from major central banks due to be announced this week.

Most read articles on Bloomberg

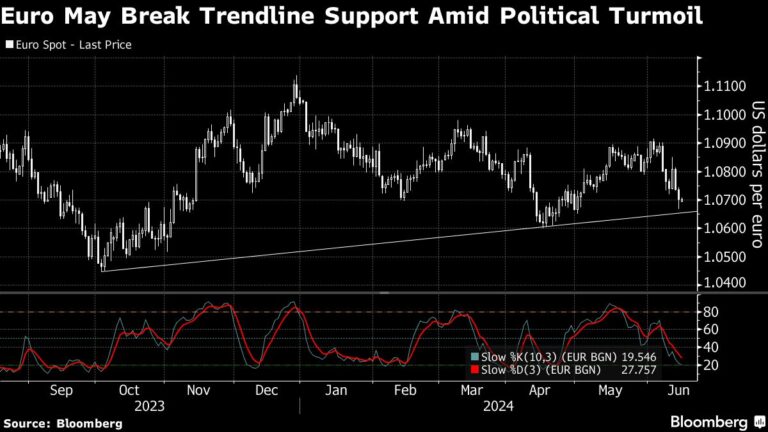

The Stoxx 600 index rose 0.3% at the open after falling last week. The euro was little changed against the dollar. Benchmark 10-year Treasury yields rose 2 basis points while the U.S. dollar was little changed. The MSCI Asia Pacific index fell the most in two weeks, with Japanese stocks leading the decline.

Growing concerns about political instability in France fueled a flight to safe assets over the weekend, sending global stock indexes down their biggest drop in two weeks on Friday and widening the gap between French and German bond yields.The possibility of a far-right majority in France is one factor increasing risks to European stocks, according to Citigroup strategists, who downgraded the region to neutral from overweight.

“Investor uncertainty around the ballot box is on full display again, and the past two weeks have highlighted the risks of volatility,” said Bob Savage, head of market strategy and insights at BNY Mellon.

France’s left-wing coalition party released a manifesto that criticized most of President Emmanuel Macron’s seven years of economic reforms and put it on a collision course with the EU over fiscal policy. Far-right leader Marine Le Pen appealed to moderates and investors and said she would not try to oust Macron if he wins France’s general election.

ECB officials see no need to worry about French market turmoil

Interest rate policy will remain a focus this week after Minneapolis Federal Reserve President Neel Kashkari said over the weekend that the central bank will take its time to look at upcoming data before starting to cut rates.

Policymakers from Britain to Australia are likely to signal they’re not yet convinced enough about deflation to cut borrowing costs. Federal Reserve officials including Dallas Fed President Lori Logan, Chicago Fed President Austen Goolsby and Fed President Adriana Kugler are scheduled to speak.

For bond traders, data matters more than Fed rhetoric

Traders will also be keeping a close eye on European and UK inflation rates to probe bets on the outlook for global monetary policy.

In China, the People’s Bank of China kept the one-year MLF rate unchanged. A range of key economic data was mixed. Retail spending beat expectations in May, but industrial expansion slowed in May, suggesting serious imbalances in the economic recovery are easing at least a little. Shares of Chinese property developers fell after home prices tumbled in May as the country’s most aggressive efforts to support the property market proved slow to revive demand.

In commodities markets, crude oil fell after its biggest weekly gain since early April.

Major events this week:

-

Italian CPI, Monday

-

US Imperial Manufacturing, Monday

-

ECB Chief Economist Philip Lane to speak on Monday

-

Philadelphia Fed President Patrick Harker speaks Monday

-

Australian interest rate decision, Tuesday

-

Chile interest rate decision on Tuesday

-

Eurozone CPI, Tuesday

-

Singapore trade, Tuesday

-

U.S. retail sales, business inventories, industrial production and cross-border investment on Tuesday

-

Richmond Fed President Thomas Barkin, Dallas Fed President Rory Logan, Fed President Adriana Kugler, St. Louis Fed President Alberto Mussallem and Chicago Fed President Austen Goolsbee on Tuesday.

-

Japan Trade, Wednesday

-

The Bank of Japan released the minutes of its April policy meeting on Wednesday.

-

UK Consumer Price Index, Wednesday

-

Bank of Canada to release summary of deliberations on Wednesday

-

Brazil interest rate decision Wednesday

-

New Zealand GDP on Thursday

-

China loan prime rate Thursday

-

Indonesia interest rate decision Thursday

-

Eurozone consumer confidence on Thursday

-

Norway interest rate decision Thursday

-

Swiss interest rate decision on Thursday

-

Eurozone finance ministers meet on Thursday

-

Bank of England interest rate decision on Thursday

-

U.S. housing starts, initial jobless claims Thursday

-

Japan Consumer Price Index, Friday

-

Hong Kong Consumer Price Index, Friday

-

India S&P Global Manufacturing PMI, Friday

-

Eurozone S&P Global Manufacturing PMI, S&P Global Services PMI, Friday

-

UK S&P Global/CIPS Manufacturing PMI, Friday

-

U.S. Existing Home Sales, Conference Board Leading Index, Friday

-

Canadian retail sales Friday

-

Richmond Fed President Thomas Barkin to speak Friday

Some of the key market developments:

stock

-

The Stoxx Europe 600 index was up 0.3% as of 8:04 a.m. London time.

-

S&P 500 futures little changed

-

Nasdaq 100 futures rose 0.1%

-

Dow Jones Industrial Average futures were little changed

-

MSCI Asia Pacific Index fell 0.7%

-

The MSCI Emerging Markets Index fell 0.2%.

currency

-

The Bloomberg Dollar Spot Index was little changed.

-

The euro was little changed at 1.0697 to the dollar

-

The Japanese yen was almost unchanged at 157.32 yen to the dollar.

-

The offshore yuan was little changed at 7.2721 per dollar.

-

The British pound fell 0.1% to $1.2672.

Cryptocurrency

-

Bitcoin fell 0.5% to $66,103.93.

-

Ether fell 1.3% to $3,551.35.

Bonds

-

The yield on the 10-year Treasury note rose 1 basis point to 4.23%.

-

German 10-year government bond yields were little changed at 2.36%.

-

UK 10-year government bond yields were little changed at 4.05%

merchandise

-

Brent crude fell 0.6% to $82.11 a barrel.

-

Spot gold fell 0.6% to $2,318.55 an ounce.

This story was produced with assistance from Bloomberg Automation.

–With assistance from Michael G. Wilson, Masaki Kondo, and Matthew Burgess.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP