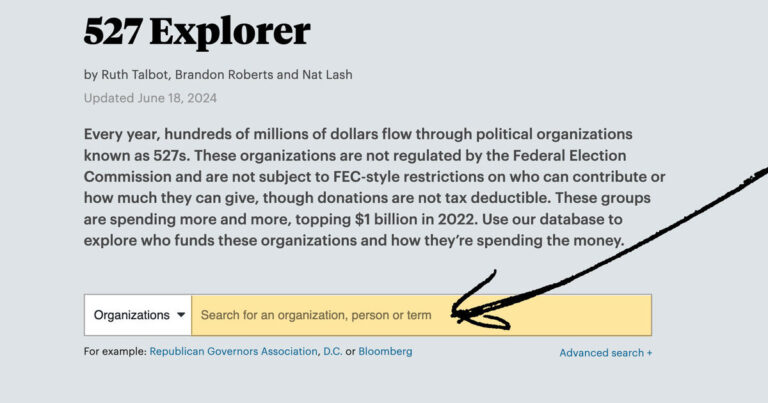

Every year, individuals and corporations donate hundreds of millions of dollars to tax-exempt political groups to influence elections across the country. These groups, commonly known as 527s after a provision in the tax code, can raise unlimited amounts of money for political contributions. Today, ProPublica is releasing a database that will make it easier for journalists, researchers and others to search 527 finances and find patterns.

It’s a treasure trove of data that includes a wide variety of groups, including well-known groups such as the Democratic Governors Association, which influences key elections across the country, as well as many lesser known groups such as Citizens for Choice Trash Pickers, a Minnesota-based group that advocates for local freedom of choice in waste collection.

While organizations listed in the database have the potential to influence election outcomes, they often have limited direct support for political candidates, meaning much of their activity is not regulated by the Federal Election Commission or state equivalents and therefore is not available on the FEC’s easily searchable website.

The 527s in our database file reports with the IRS just like charities, but their filings don’t appear in the same place as most nonprofits. Instead, they’re published in an entirely separate part of the IRS website, with outdated and hard-to-use search tools. But buried behind that clunky interface is important and useful information, from the names of organization leaders to itemized expenses and donations.

We experienced the usefulness of this data firsthand last year when former ProPublica contributor Ilya Maritz used it to report on companies that resumed donations to the Republican State Attorneys General Association after January 6, 2021.

RAGA, one of the largest and most influential 527s, robocalled supporters of then-President Donald Trump to march on the Capitol that day. After the attack, many of RAGA’s trusted donors publicly condemned the action, but an analysis of the data revealed that many of them paused their donations, then quietly resumed them months later. We were only able to understand this after downloading and analyzing a hard-to-use dataset.

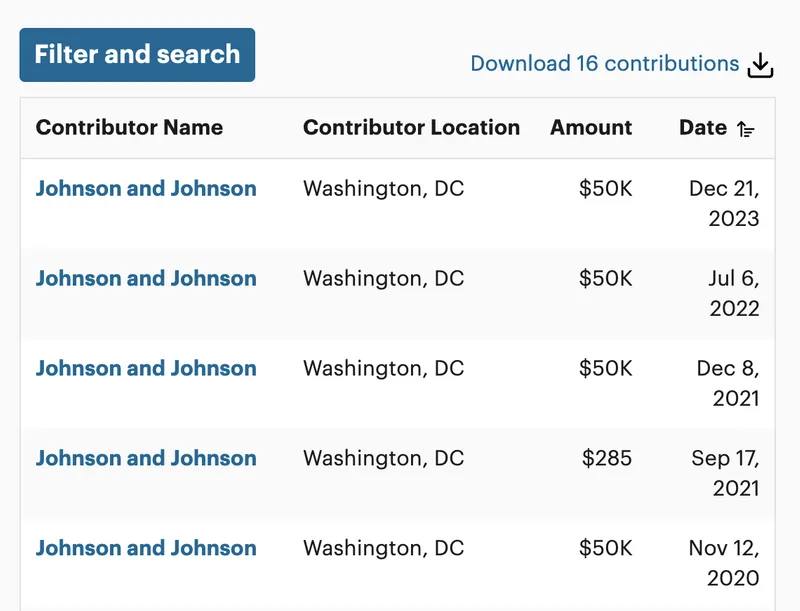

Our new database makes it easy to search all donations to RAGA, showing that not only did companies like Microsoft stop donating to Republican groups, they also stopped donating to the Democratic State Attorneys General Association. We also uncovered that Johnson & Johnson wrote a large check to a Republican group later that year.

Despite their influence, 527s are rarely scrutinized and almost never audited, experts say. Lloyd Mayer, a law professor at the University of Notre Dame, said these organizations’ filings aren’t posted in the same places as most other nonprofits and political groups, so they aren’t viewed as frequently. “Federal Election Commission filings are easier to search and therefore much more visible, making it easier for reporters to write stories on them and for opponents and law enforcement investigators to find out,” Mayer said.

In this environment, questionable spending often goes unnoticed. ProPublica found 527 networks that purport to help police, veterans, cancer patients and firefighters, but the bulk of the donations appear to go to a small number of fundraisers and management companies that help raise more money. They collect millions of dollars from Americans but don’t seem to spend much of it on their purported causes.

Last year, The New York Times found a similar collection of 527 groups that appeared to put almost all of the money they raised into fundraisers and organizations with ties to their founders. ProPublica identified the networks we reported on by looking at donations and spending to groups similar to those found by the Times. In our new database, we’ve created a feature that shows 527s that appear to have similar donors and spending, and researchers and the public can do the same.

The database can help you find interesting things that are worth looking into further. You can easily see that some organizations withhold the names of their major donors, pay the majority of donations to a single company, or appear to return most donations to their largest donors. Experts say that whether these practices are legal often depends on the circumstances.

The American Dental PAC Educational Fund, for example, spent a huge amount on suites and tickets to see artists like Taylor Swift and Celine Dion, about $1.5 million between 2005 and 2020, and the company that owns Washington, D.C.’s Capital One Arena, accounted for about 12% of the PAC’s reported spending. Experts say that if the tickets further the organization’s causes, such as being used as a prize at a fundraiser, it’s a legitimate expenditure. If it has nothing to do with promoting a political cause in any way, it’s not a legitimate expenditure. Emails and phone inquiries to the group went unanswered.

Now that we’ve made this data easier to explore, we can’t wait to see what you discover! You can dig into the state-level data to find the biggest players and largest organizations in your state, take advantage of powerful search features to look at notable figures, and sort and filter to see the biggest donations made in a year or to a specific organization.

In addition to the Similar Organizations feature, we’ve added another way to help you discover connections between organizations: Each donation and expense has its own page, and we use machine learning to surface similar donations and expenses so you can do things like find other donations that are likely to be from Walmart, even if they have slight differences in name or address.

If you use this new information to write your own stories, encounter any bugs or issues, or have ideas for improvements, please let us know!