Millions of Americans have already been barred from buying homes, and the costs of buying a home continue to rise.

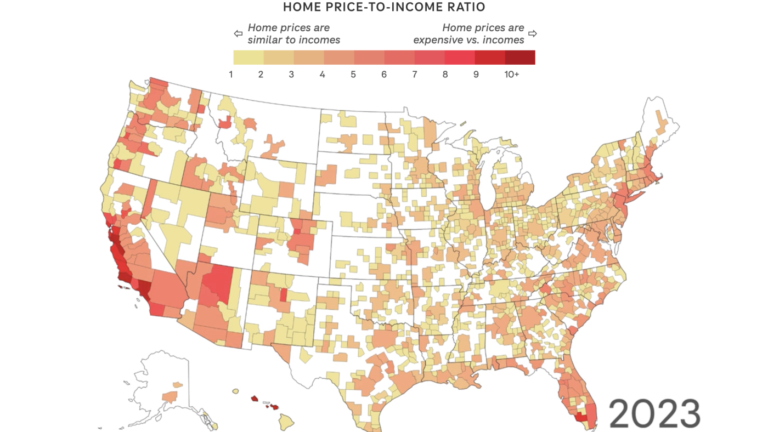

For decades, it was common for home prices to be roughly three times a buyer’s annual income, but that ratio has shifted sharply since the COVID-19 pandemic, with home prices up 47% since the beginning of 2020. The median home sale price last year was roughly five times the median household income, according to figures compiled in a new report by the Joint Center for Housing Studies at Harvard University, and there are signs that things might get worse.

The twin blows of rising house prices and high mortgage rates “have put homeownership out of reach for all but the most advantaged families,” said Daniel McCue, a senior fellow at the center.

Nearly half of metro areas require buyers to earn more than $100,000 to purchase a median-priced home, but in 2021, that was true in just 11% of markets, according to the report.

Enter your city name below to see how income and home price gaps have changed where you live.

For prospective buyers and current homeowners, rising property taxes and insurance costs are also adding to the financial burden. Harvard University estimates that “the monthly cost of a median-priced home in the United States is [when adjusted for inflation] This is the highest level since data was first collected more than 30 years ago.”

This makes it even harder to close the racial gap in homeownership: By the first quarter of 2024, only 8% of Black renters and 13% of Hispanic renters will have enough income to cover the monthly payment on a median-priced home, according to the report.

Meanwhile, home sales are plummeting as many homeowners are hesitant to sell and unwilling to give up low-interest mortgages. Existing home sales last year fell to the lowest level in nearly 30 years and were even lower than after the 2008 housing crisis. The U.S. homeownership rate rose just 0.1 percentage point last year, the slowest increase since 2016.

The housing shortage is also driving up rental prices

Rising home prices have forced millions into renting, making the market more competitive and more expensive. A Harvard University study found that housing is out of reach for a record half of U.S. renters. Since 2001, inflation-adjusted rents have risen 10 times faster than renter incomes.

Housing experts say the underlying problem for buyers and renters alike is a massive housing shortage that has been building for decades and will take years to resolve. Construction of single-family homes is on the rise, and some developers are building smaller, lower-cost units. A boom in multifamily construction is also helping to ease rent prices, especially in areas such as Austin, Texas, which has seen some of the biggest price hikes in recent years.

But the authors of the Harvard report say this grace period is unlikely to last long.

First, apartment construction is slowing again due to high interest rates and rising other costs, such as land, labor and insurance. And because all of this is so expensive, most of what is being built is at the top of the market. Over the past decade, the United States has lost more than 6 million homes with rents under $1,000. For every 100 extremely low-income renters, the National Low Income Housing Coalition calculates that there are only 34 homes they can afford.

At the same time, demand for rentals remains strong, especially as more people from Gen Z are living alone. The number of renter households increased by more than 500,000 last year, the biggest increase since 2016.

If construction continues to slow while demand continues to rise, “we risk another period of rapid rent growth similar to the recent spike that contributed to some of the worst renter conditions on record,” the Harvard report warned.