Ah, election year…

Billboards plastered everywhere, a never-ending news cycle desperate to catch your eye, and a constant stream of calls and text messages from random campaigns (how did you get my number?).

We all love these years, don’t we?!

The first presidential debate, scheduled for next Thursday, will see the first look at a second-round showdown between President Joe Biden and former President Donald Trump.

Will they argue about the economy and inflation? Probably will…

With conflicts continuing around the world, will they reveal their foreign policy plans? Maybe…

Will their conversation be laced with subtle (and not so subtle) quips about age and mental strength? Most likely…

As an investor, I’ll save the highlights for later.

A Biden or Trump victory could provide some insight into potential opportunities, but I expect there will be some fierce accusations from both sides. (Of course, Adam O’Dell sees an opportunity in one segment; we’ll have more information next week.)

So, instead, let’s look at a trend that’s still garnering a lot of attention, and rivaling political advertising…

The AI stock megatrend continues

AI offers incredible benefits to investors willing to be early adopters of this megatrend, which is expected to grow into a multi-trillion dollar megatrend with many profit opportunities along the way.

And I expect this to continue no matter who is in the White House in January.

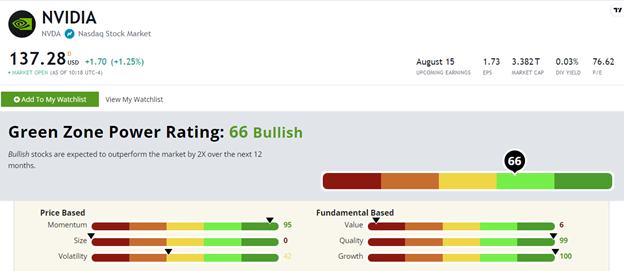

if you, NVIDIA Corporation (Nasdaq: NVDA) With an astounding 216% increase over the past year, our Green Zone Power Rating system remains “bullish.”

NVDA Green Zone Power Rating June 2024.

Together Rating: 66 out of 100NVDA should outperform the market by 2x over the next 12 months.

This may be a conservative estimate, given that NVDA has performed more than eight times the S&P 500’s 25% gain since last June, but we intend to go with the system’s predictions.

NVDA teeth You lose out on value and size factors.

You’ll pay a premium for that significant growth.

NVIDIA is the most valuable stock on the New York Stock Exchange. $3.34 trillion Market capitalization, i.e. Size factor is 0 out of 100 It makes sense.

But when we look at AI megatrends, NVDA still reigns supreme.

What about AAPL?

Matt Clark is Apple Inc. (Nasdaq: AAPL) last week in Money & Markets DailySo, I’ll explain it briefly.

Apple stock is rated 37 out of 100, a “bearish” score Current Green Zone Power Ratings:

AAPL’s June 2024 Green Zone Power Rating.

This may come as a bit of a shock considering we’re talking about one of the largest technology companies in the world, but Apple has also been reluctant when it comes to AI.

Investors are starting to take notice, too, as CEO Tim Cook outlined the company’s Apple Intelligence capabilities and announced a new partnership with OpenAI.

Since Apple’s announcement at WWDC on June 10, AAPL stock has risen more than 9% and its Momentum Rating has risen to 48.

The Green Zone Power Rating is still expected to underperform expectations, so I will continue to follow that guidance, but I will be keeping a close eye on AAPL’s ratings from here on out…

AI is clearly here to stay, and both presidential candidates will likely have some say in the pandemic in their debates next week, so perhaps they can find some common ground amid the smear campaign.

Adam expects that to happen and believes it will be a big boost for investors in a volatile election year. He will have more details on that starting Monday…

Have a nice weekend!

Until next time,

Chad Stone

Editor-in-chief, Money & Markets Daily