- dogwifhat has been retesting key support levels as resistance in recent weeks, highlighting a strong downtrend.

- This trend has not yet stopped, and buying pressure on shorter time frames alone may not be enough to reverse the trend.

Dog Whiff Hat [WIF] Other major meme coins have also suffered significant losses over the past few weeks. Since hitting a high of $4.08 on May 29, WIF has fallen 54% and is trading at $1.86 at the time of writing.

It is ranked 50th on CoinMarketCap, down significantly from a month ago. A $10 price prediction failed to materialize due to a shift in market sentiment. Is dogwifhat headed for further losses or should traders expect a recovery?

A southward Fibonacci extension is the next price target

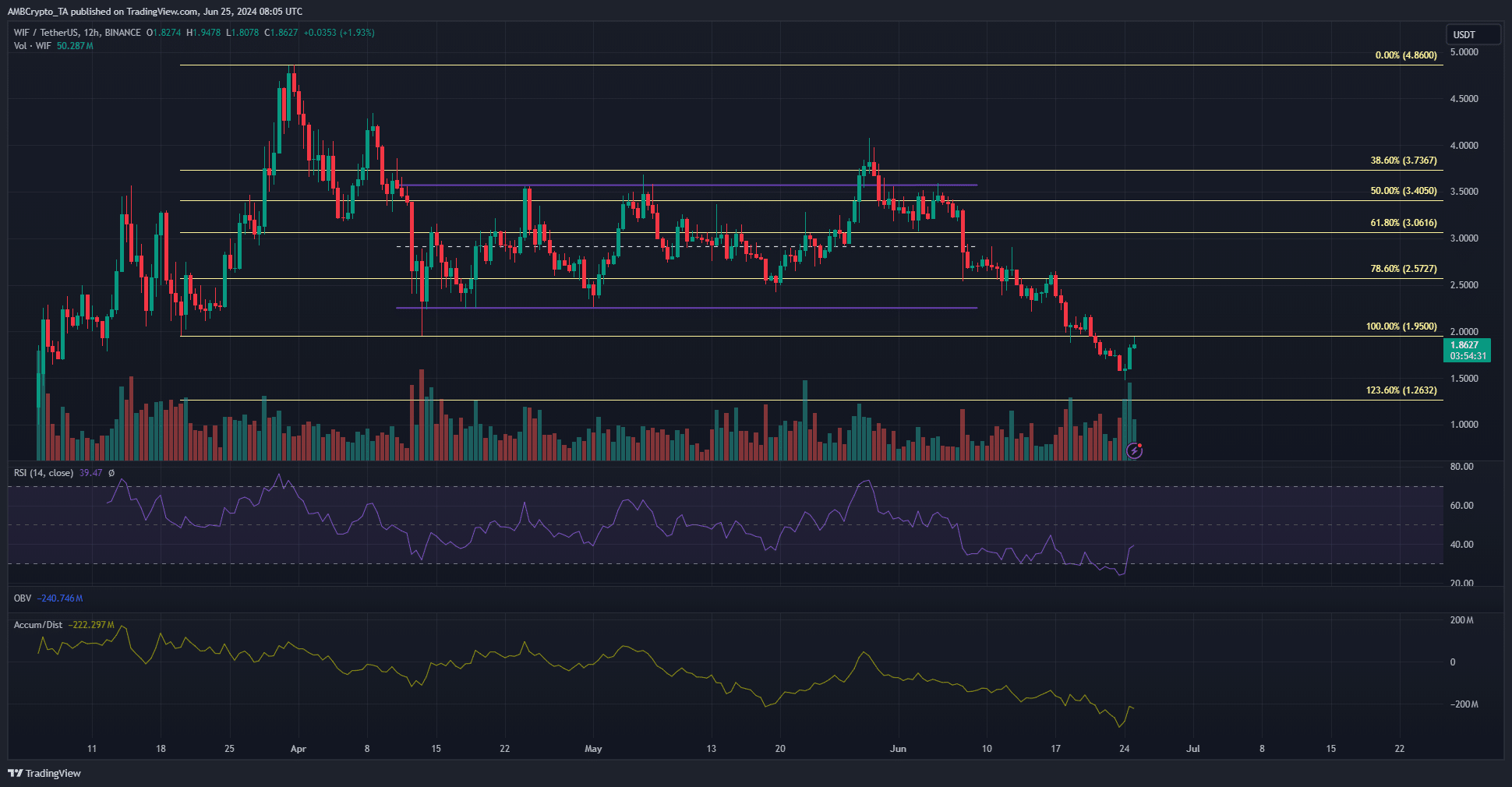

WIF/USDT chart. Source: TradingView

The market structure for WIF was very bearish. On June 15, the price bounced back from the low of the range, as happened many times in April, but the bulls were unable to force an uptrend this time.

Instead, the bounce lost momentum just above the $2.57 level and turned lower. The retest of the 78.6% Fib retracement level as resistance is evidence that the 100% level and a potential southern extension could be the next support level.

At the time of writing, the $1.95 level has been retested as resistance, with the bears maintaining the upper hand.

Over the past month, the accumulation/distribution chart has shown a solid downtrend. The daily RSI is also below the neutral 50 level, indicating a solid downtrend is underway.

Therefore, a move towards the $1.26 support level is likely to commence soon.

Short-term sentiment was bearish and buyers were lackluster.

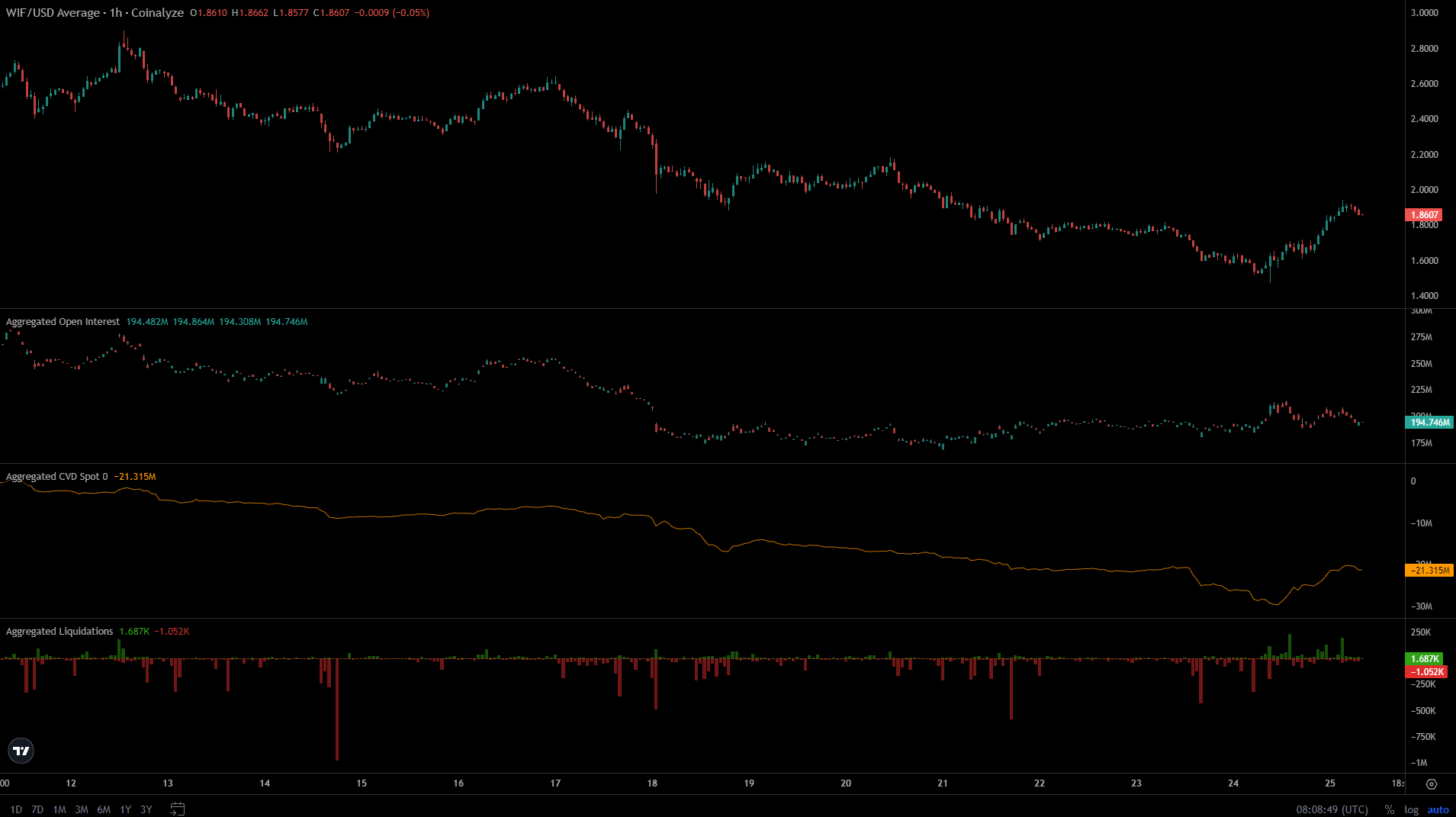

Source: Coinalyze

Both the higher and lower timeframe charts showed a bearish trend. Coinalyze’s hourly chart shows that the open balance tried and failed to rise in the past 24 hours. At this point, WIF jumped from $1.47 to $1.95.

Is Your Portfolio Green? Check out the WIF Profit Calculator

The failure of OI meant that futures traders did not believe in a recovery and were reluctant to bid in. Spot CVD rebounded, which was an encouraging sign.

The price surge has sparked a flurry of short selling over the past 24 hours, and short sellers could potentially profit in the coming days, but they should keep a close eye on spot CVD movements.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and consists solely of the opinions of the authors.