Updated weekly PV MagazineDow Jones OPIS provides a brief overview of key pricing trends in the global solar PV industry.

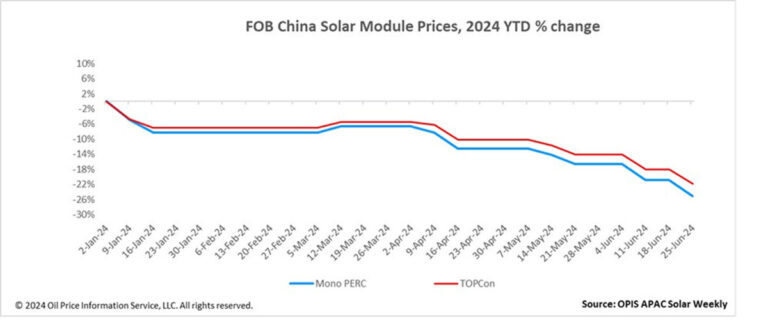

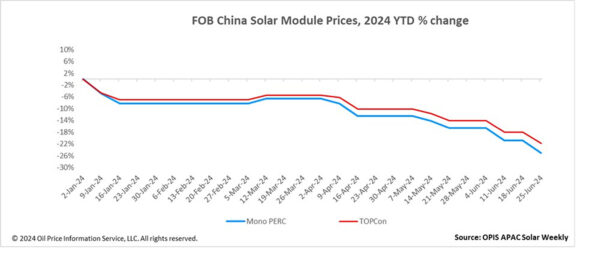

The OPIS benchmark rating of Chinese TOPCon modules, the CMM (Chinese Module Marker), was valued at $0.100/W, down $0.005/W from the previous week. Mono PERC module prices were valued at $0.090/W, down $0.005/W from the previous week. Both prices hit record lows as weak demand has led to slow market activity, according to OPIS data.

Module makers are lowering prices to secure new orders and maintain cash flow, with TOPCon modules trading at $0.10/W FOB China.

Solar modules exported to Europe continue to suffer from high freight rates due to the Red Sea issue. OPIS has heard freight rates from Shanghai to Rotterdam are around $0.0164-0.0175/W (around $6,000-7,000/FEU). This is impacting shipping, but it also provides an opportunity for module distributors to reduce inventory in Europe.

Market observers said prices remained stable during Intersolar, hovering around $0.10/W (+/- 0.3 cents) FOB China, and that European installation demand does not appear to be very strong this year, at least in the utility-scale sector, despite the installation season only just beginning.

Latin America continues to show weakness, with module distributors describing price competition in the market as “intense.” Prices in the Brazilian market are generally lower than other markets as buyers are price-sensitive. TOPCon prices for Brazil have fallen to the $0.08-0.09/W range FOB China, with Tier 2-3 module distributors offering lower prices, the module distributor added.

One buyer noted that current U.S. DDP (Delivered Duty Paid) TOPCon prices have risen to the low to mid $0.30s/W range. This price includes the Section 201 two-sided duties but does not include the new anti-dumping/countervailing duties. With this exemption set to expire mid-week, another market source told OPIS, “All new trade will be subject to the 14.25% Section 201 tariffs, which will likely push prices to the mid $0.30s/W range in 2024.”

Domestic demand in China remains weak amid growing inventory pressure. Further price cuts are expected in the coming weeks as module distributors liquidate stock to generate cash flow. The majority of market participants surveyed by OPIS expect TOPCon prices to fall below CNY0.8/W or $0.099/W ex-mainland China, which is the current production cost for integrated producers.

Popular Content

According to the China Nonferrous Metals Industry Association Silicon Industry, operating rates of integrated module distributors remain at 60-80 percent. The association said its module production capacity estimate for June was 50 GW, down from a previous forecast of 52 GW and down 5 GW from May.

According to the latest data from the Ministry of Industry and Information Technology, China exported 83.3GW of modules from January to April, up 20% year-on-year. Total module shipments from January to April reached $12.7 billion.

Looking ahead to the FOB China market, continued production cuts through July may ease some supply pressure, but the general bearish market will likely prevent module price increases in the short term.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, chemicals, renewable fuels and environmental commodities. The company acquired price data assets from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily represent PV Magazine.

This content is copyrighted and cannot be reused. If you would like to collaborate with us and reuse any part of our content, please contact us at editors@pv-magazine.com.