(Bloomberg) — The European Commission has expressed concern that European chipmakers risk losing significant market share in China as Beijing boosts investment in the industry and seeks self-sufficiency in key technologies.

Most read articles on Bloomberg

NXP Semiconductors of the Netherlands, Infineon Technologies of Germany and Japanese chipmaker Renesas Electronics AG all could be affected by China’s efforts to foster domestic rivals, according to people familiar with the matter and a European Commission report seen by Bloomberg.The companies don’t make industry-leading semiconductors like the processors used in Apple Inc.’s iPhones, but they do make microcontrollers and other chips that are essential to key sectors of the economy, including cars, industrial applications and consumer electronics.

“Discriminatory standards, local content requirements and other non-tariff barriers could be used (and are already being used) to encourage the growth of domestic MCU companies that can take advantage of China’s huge EV market, to the detriment of European and Japanese chip suppliers,” European officials wrote in a report prepared for a meeting between them and their U.S., Japanese and South Korean counterparts earlier this week.

Microcontrollers (MCUs) are essentially tiny computers on a chip that typically control a single function in an electronic device, such as deploying airbags in a car or controlling the water temperature in a washing machine. China already accounts for 30% of global MCU demand, according to the report.

Bloomberg News reported earlier this year that the Chinese government has quietly asked electric-car makers from BYD Ltd. to Geely Automobile Holdings Ltd. to dramatically increase purchases from domestic makers of auto chips as part of a campaign to reduce reliance on Western imports and revitalize China’s domestic semiconductor industry.

European semiconductor manufacturers may also be affected by heavy Chinese investment in production capacity for components such as analog, discrete, mixed-signal and power semiconductors, according to the analysis.

China plans to spend more than $100 billion to build new chip factories to make semiconductors needed for everything from consumer electronics to smartphones. Beijing has significantly increased spending on domestic manufacturing capacity after the United States imposed restrictions on Chinese companies’ purchases and manufacturing facilities of high-performance chips. China has focused on older chips that are less advanced and not subject to U.S. regulations, but demand is still rising due to the growth of electric vehicles and renewable energy markets.

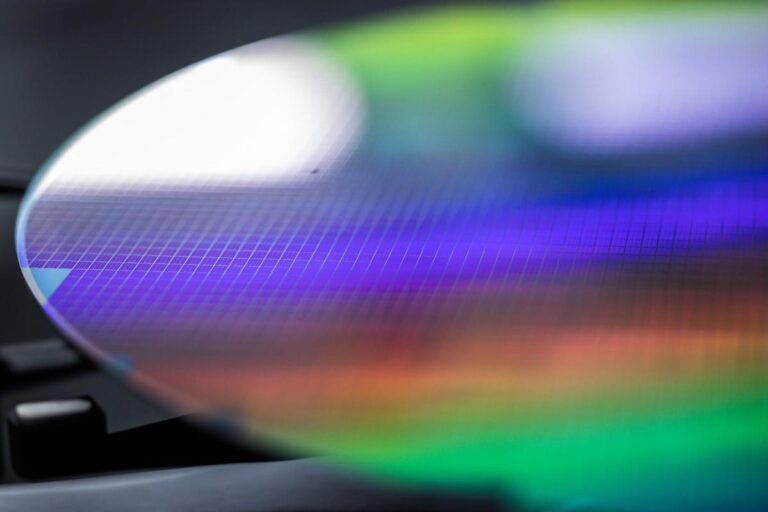

The SEMI trade group predicts that 41 semiconductor fabs will open in China between 2023 and 2027, more than any other region in the world, including 34 fabs using 300-millimeter wafers and seven using 200-millimeter wafers — larger wafers that allow companies to produce more chips.

Earlier this week, Chinese President Xi Jinping called for China to step up innovation because other countries have monopolies over certain key technologies, including semiconductors, underscoring the escalating technology conflict with the United States.

Washington fears that Chinese chipmakers will gradually flood global markets with their products, as China has done in the solar and steel markets, and U.S. officials have expressed those concerns to their European counterparts.

The European Union’s executive body is examining the extent to which EU companies are using mature or lower-quality chips from China, but its latest analysis has found that fears of a systematic flood of global markets with Chinese chips are “unlikely” to come to fruition.

The report, citing data from Dutch equipment maker ASML Holdings, said demand in China is so high that any additional capacity will be absorbed by the domestic market until at least 2030. Chinese foundries typically make chips exclusively for companies headquartered in China.

European officials wrote that the oversupply could also force Chinese chipmakers into price wars with domestic rivals and lead to capacity cuts.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP