When you want to find potential multi-baggers, there are often underlying trends that can give you clues. Ideally, a business will exhibit two trends. First, it is growing. return Return on Invested Capital (ROCE) and, secondly, amount It has invested over 100% of its invested capital. This shows that the company is a compounding machine and can continually reinvest earnings back into the business to generate higher returns. Fisher & Paykel Healthcare (NZSE:FPH) The return trend isn’t surprising, but let’s look a little more closely.

What is Return on Invested Capital (ROCE)?

For those unfamiliar, ROCE is the ratio of a company’s annual pre-tax profit (revenue) to the capital employed in the business. For Fisher & Paykel Healthcare, the formula for calculating this metric is:

Return on Invested Capital = Earnings Before Interest and Taxes (EBIT) ÷ (Total Assets – Current Liabilities)

0.19 = NZ$353 million ÷ (NZ$2.3 billion – NZ$385 million) (Based on the trailing 12 months ending March 2024).

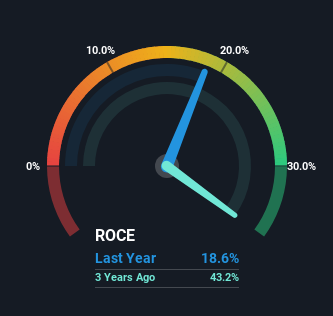

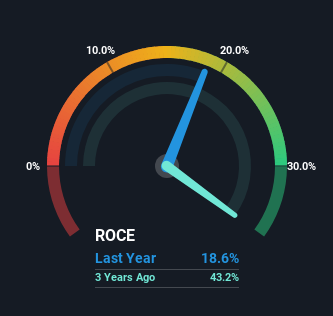

therefore, Fisher & Paykel Healthcare has an ROCE of 19%. In absolute terms, this is a satisfactory return, but compared to the medical device industry average of 10%, it is far better.

View our latest analysis for Fisher & Paykel Healthcare

In the chart above we compare Fisher & Paykel Healthcare’s historical ROCE with its past performance, but the future is arguably more important. If you’d like, you can see forecasts made by the analysts covering Fisher & Paykel Healthcare. free.

What does Fisher & Paykel Healthcare’s ROCE trend indicate?

Looking at the trend in Fisher & Paykel Healthcare’s ROCE doesn’t give us much confidence. Specifically, ROCE has been declining from 31% over the past five years. However, given that both revenue and the amount of assets deployed in the business are increasing, this could suggest that the company is investing in growth, leading to a short-term decline in ROCE as a result of the additional capital. And if the increased capital generates additional revenue, then in the long term the company, and therefore shareholders, will benefit.

Key Takeaways

Despite the decline in return on capital in the short term, we think it’s encouraging that Fisher & Paykel Healthcare’s revenue and invested capital are both growing. The stock has also performed phenomenally, delivering a 101% return over the past five years, so long-term investors would no doubt be ecstatic about the results. Therefore, while investors may have already factored in the underlying trends, we believe this stock is worth continuing to look into.

For more information about Fisher & Paykel Healthcare, Two Warning Signs was found by our analysis.

While Fisher & Paykel Healthcare isn’t currently the most profitable company, we’ve compiled a list of companies that are currently earning a return on equity of over 25%. Check it out here free I’ll list them here.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com