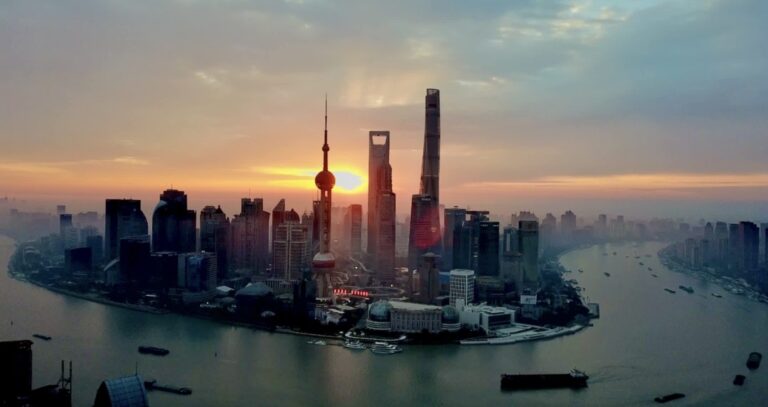

SHANGHAI, CHINA – JANUARY 1: The sun rises over the Oriental Pearl Tower in Shanghai, China on New Year’s Day, January 1, 2023. (Photo by VCG/VCG via Getty Images)

Vcg | Visual China Group | Getty Images

Asia-Pacific markets got off to a mixed start to the second half of the year as investors assessed China’s official business activity data for June and Japan’s business confidence index.

China released its official PMI over the weekend, with the manufacturing PMI coming in at 49.5, unchanged from May and marking a second consecutive month of contraction.

Business confidence among Japan’s biggest manufacturers improved in the second quarter to its highest level in two months. The Bank of Japan’s Tankan survey showed business confidence improved to +13 from +11 in the first quarter. Economists polled by Reuters had expected +12.

Non-manufacturing business confidence was +33, in line with market expectations and down from +34 in the previous quarter. This is the first deterioration in non-manufacturing business confidence in four years.

Separately, S&P Global Purchasing Managers’ Indexes for several Asian countries, including China, Japan and South Korea, will also be released.

| Ticker | company | name | price | change | %change |

|---|---|---|---|---|---|

| .N225 | Nikkei Stock Average | Nikkei | 39,751.65 | +168.57 | +0.43% |

| .HSI | Hang Seng Index | HSI | 17,718.61 | +2.14 | +0.01% |

| .AXJO | S&P/ASX 200 | ASX 200 | 7,726.60 | -40.90 | -0.53% |

| .SSEC | Shanghai | Shanghai | 2,967.29 | -0.12 | 0.00% |

| .KS11 | KOSPI Index | Korea Composite Stock Price Index | 2,790.37 | -7.45 | -0.27% |

| .FTFCNBCA | CNBC 100 Asia IDX | CNBC 100 | 9,882.13 | +8.76 | +0.09% |

Japan’s Nikkei Stock Average rose 0.8%, while the Tokyo Stock Price Index rose 0.94%. At current levels, the Nikkei is at its highest since April 1.

South Korea’s KOSPI fell 0.16%, while the small-cap KOSDAQ rose 0.55%.

Australia’s S&P/ASX 200 fell 0.65%.

Hong Kong markets will be closed on Monday due to a public holiday.

Overnight in the United States, all three major indexes fell as traders focused on “near-perfect” inflation data, according to industry experts.

Inflation slowed to the lowest level in more than three years in May, with the core personal consumption expenditures price index rising 0.1% from the previous month and 2.6% from a year earlier, in line with Dow Jones forecasts.

The core PCE index, which excludes food and energy prices, is the Fed’s preferred inflation measure. Headline PCE, which includes food and energy, was flat month-over-month and up 2.6% year-over-year, also in line with expectations.

“From a market perspective, today’s PCE report was near perfect,” said David Donabedian, chief investment officer at CIBC Private Wealth US. “This was undoubtedly a positive report.”

The S&P 500 lost 0.41%, and the Nasdaq Composite lost 0.71%. Both averages hit new intraday highs early in the session before trailing. The Dow Jones Industrial Average lost 0.12%.

—CNBC’s Hakyung Kim and Alex Harring contributed to this report.