(Bloomberg) — Oil prices edged higher as traders weighed China’s economic outlook and geopolitical risks in Europe and the Middle East.

Most read articles on Bloomberg

Brent crude futures rose nearly 6 percent last month to trade above $85, while West Texas Intermediate crude futures were around $82. A private gauge of Chinese manufacturing activity showed it expanded to its highest level in three years in June, diverging from official data that showed a contraction, clouding the outlook.

In France, Marine Le Pen’s National Rally party won a landslide victory in the first round of parliamentary elections, raising political risks in the region, while Israeli Prime Minister Benjamin Netanyahu has vowed to fight Hamas until it is eliminated.

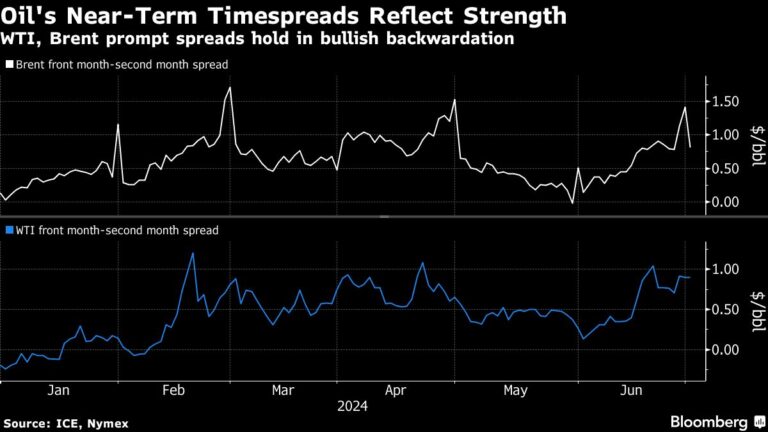

The rally in oil prices since hitting rock bottom early last month has stalled in recent days, with U.S. crude futures trading in a range of around $3 per barrel for the past two weeks. OPEC+ has supported prices by saying plans to add more oil back to the market depend on market conditions. Asset managers have pumped money back into U.S. crude futures last week, but key spreads are in a bullish backwardation structure, signaling tight supplies.

“With backwardation rising and hedge funds building up long positions for a third consecutive week, this looks set to carry some momentum into the third quarter,” said Ole Hansen, head of commodity strategy at Saxo Bank AS. “Whether OPEC+ supply increases, as well as geopolitics, China and the U.S. presidential election are likely to be key focuses in the coming months.”

Click here to get Bloomberg’s Energy Daily newsletter delivered to your inbox.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP