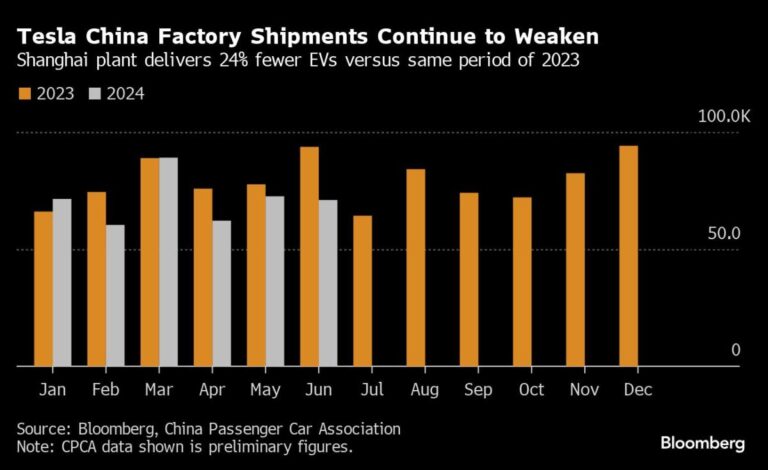

(Bloomberg) — Shipments from Tesla Inc.’s Shanghai factory fell 24.2% from a year ago, marking the electric car maker’s fourth output decline this year amid a price war in China.

Most read articles on Bloomberg

Tesla Inc.’s Model 3 and Model Y deliveries fell to 71,007 units in June, according to Bloomberg calculations based on preliminary data released Tuesday by the China Passenger Car Association. Shipments were down 2.2% from May.

The decline comes ahead of Tesla’s closely watched second-quarter production and delivery numbers due later Tuesday in the U.S. The production drop in China, the world’s largest EV market, will add to the strain Elon Musk’s company is under around the world amid slowing EV sales growth.

Analysts expect Tesla to deliver 439,302 EVs in the second quarter, down 5.8% from a year ago and marking the second consecutive quarterly decline.

More broadly, sales of new energy vehicles in China are expected to rise 28% in 2023 from June last month as subsidies for trade-ins announced in April are gradually implemented, according to provisional data from PCA.

Total shipments of new energy vehicles are expected to reach 970,000 units in June, up 8 percent from the previous month.

Shenzhen-based BYD (BYDDY) led the growth with a record number of passenger vehicle sales of 340,211 units. Li Auto delivered 47,774 vehicles, led by strong sales of its recently launched L6 model, a long-range, five-seater electric vehicle.

Nio and Geely Automobile Holdings’ Zeekr brand also recorded record monthly sales of over 20,000 units each.

China said in April it would offer one-time payments of up to 10,000 yuan ($1,400) to consumers who trade in their old cars for new ones that meet certain emissions standards, and additional incentives have been offered by various local governments, encouraging consumers to buy new cars and helping to temporarily stabilize auto prices, according to the PCA.

PCA did not break down Tesla’s domestic sales and exports in its preliminary data, but the U.S. automaker typically focuses on domestic deliveries in the final month of each quarter.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP