(Bloomberg) — The People’s Bank of China tightened control over interest rates, introducing new mechanisms to influence short-term borrowing costs as policymakers expand their tools to guide markets.

Most read articles on Bloomberg

Any move by the central bank to conduct fresh bond buybacks or reverse repo operations would effectively narrow the range for short-term interest rates, strengthening market expectations that the seven-day repo rate will become the new benchmark.

Pan Gongsheng, governor of the central bank, has been controlling market liquidity and borrowing costs more tightly across the yield curve this year. Policymakers have signaled their preference for a single short-term rate as well as warning that the central bank is preparing to sell longer-term debt to quell a bond rally as investors rush to safe havens and fear a bubble.

“This gives the PBOC more control over short-term interest rates and gives it more flexibility to manage liquidity fluctuations,” said Duncan Wrigley, chief China economist at Pantheon Macroeconomics. “If bond sales lead to too much short-term liquidity pressure, the PBOC now has another tool to manage this to prevent a liquidity crisis.”

The People’s Bank of China’s latest policy measures pushed benchmark 10-year bond yields to their highest level since May on Monday.

President Xi Jinping’s economic officials are trying to balance promoting growth with keeping the yuan stable amid rising interest rates abroad and a real estate crisis that is squeezing domestic demand. Trade tensions with the United States and Europe are also clouding the outlook for manufacturing, which has been generally strong this year.

According to a statement on Monday, the central bank will conduct bond buyback operations between 4 pm and 4:20 pm on weekdays as necessary, in addition to the usual morning operations. The ad hoc and reverse repos will have an overnight maturity and the interest rates will be set at 20 basis points below and 50 basis points above the seven-day reverse repo rate, respectively.

The People’s Bank of China said the measures were aimed at “ensuring rational and sufficient liquidity in the banking system and improving the precision and effectiveness of open market operations”, but did not specify when the operations would begin or how frequently they would occur.

The central bank did not announce any further market operations on Monday afternoon.

Becky Liu, head of China macro strategy at Standard Chartered Bank, said the measures would narrow China’s interest rate band to the current 70 basis points from about 230 basis points previously.

“This will reduce the volatility of interbank interest rates,” Liu said. With reduced volatility, the seven-day reverse repo rate “will be more widely used as the benchmark reference rate for pricing most assets and liabilities, such as deposit rates and lending rates.”

Moves to improve the technical tools available to the People’s Bank of China may give banks more flexibility, but they don’t necessarily help answer some of the big questions now facing Chinese policymakers, such as whether credit can support the economy at a time when households and businesses are reluctant to take on more debt, or how to ease borrowing costs without depreciating the yuan.

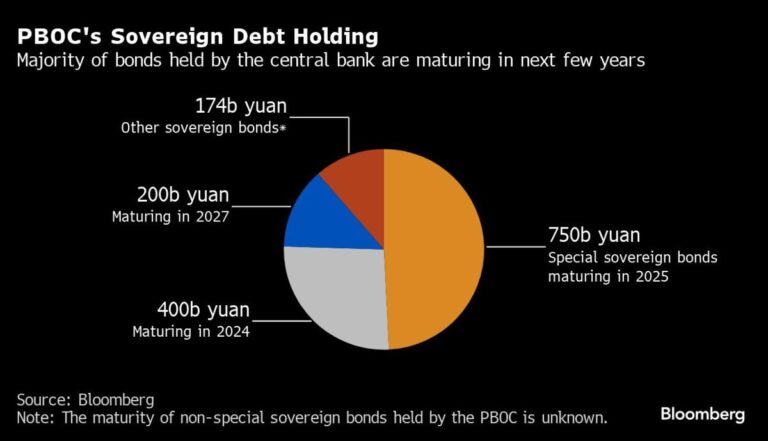

The latest announcement came days after the central bank said it was preparing to borrow “several hundred billion yuan” of medium- and long-term bonds, in a clear sign that authorities were considering selling securities to stem a slide in long-term bond yields.

China’s government bonds have surged this year on the country’s gloomy economic outlook and hopes of interest rate cuts. A lack of attractive alternatives and a shift from savings to financial investments have spurred demand, prompting a series of warnings from the central bank about the risks of a bond bubble, especially in longer-term bonds.

The new moves around the seven-day reverse repurchase rate could signal tighter regulation on the other side of the yield curve, according to Bloomberg Intelligence.

“With the People’s Bank of China also seeking to control the long-term interest rate curve through government bond transactions, China may effectively be employing yield curve control,” BI analysts Steven Chiu and Jason Li wrote in a note. “Future rate cuts may initially be delivered via seven-day reverse repos.”

That could also signal a move away from one of the central bank’s main tools, a one-year policy loan known as the Medium Term Lending Facility (MLF). Since its introduction a decade ago, the MLF has been the central bank’s main tool for injecting money into the economy and guiding market interest rates.

But demand from banks for such funds has been sluggish in recent months as the cost of borrowing from one another has fallen. MLF rates have remained flat for 10 months, even as borrowing costs elsewhere in the economy have plummeted.

“Credit supply has become very volatile and even turned negative at times,” said Zhou Hao, chief economist at Guotai Junan International. The new operation shows “the PBOC wants to maintain a strict range on funding costs to maintain policy credibility.”

–With assistance from Felix Tam, Cormac Mullen, Tania Chen, and Helen Sun.

(We will update you on bond market trends and other details as they occur.)

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP