Image source, Getty Images

- author, Joao da Silva

- role, BBC News Business Reporter

China’s economy stalled in the second quarter, official data showed, just as the country’s top leaders gathered for a key meeting to tackle slowing growth.

“China’s economy slowed sharply in the April-June quarter,” Heron Lim of Moody’s Analytics said, adding that analysts were hopeful a solution would emerge from the third plenary session now taking place in Beijing.

China, the world’s second-largest economy, is facing a protracted real estate crisis, huge local government debt, sluggish consumption and high unemployment.

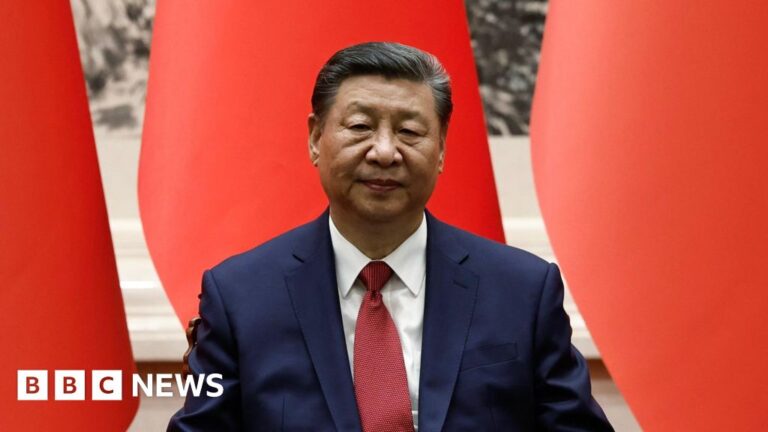

The outcomes of previous Central Committee plenaries have changed the course of Chinese history: in 1978, then-leader Deng Xiaoping began opening China’s market to the world, and in 2013, President Xi Jinping signaled a relaxation of the controversial one-child policy.

Anticipation is also high for this year’s Central Committee Plenum, where Xi will preside over a closed-door meeting of more than 370 senior Communist Party officials.

The rhetoric in state media was certainly encouraging.

An editorial in the Global Times said a “wide-ranging, reform-oriented policy” was a “key issue” that would usher in a “new chapter.” Xinhua spoke of “comprehensive” and “unprecedented” reforms. An editorial in the People’s Daily ran the headline “A New Era of Reform and Opening Up,” quoting a phrase coined by Deng Xiaoping in 1978.

But observers are unsure how much room for bold ideas and debate there is within the party under Xi’s highly centralized leadership, and some see the meeting as merely a formality, lending approval to decisions already made.

Economists are also skeptical that the meeting will produce any immediate solutions.

Vanguard’s chief Asia-Pacific economist, Cheng Wang, said the package will “have little impact on near-term growth” as the focus is on longer-term, key reforms to “unlock long-term growth potential.”

Still, analysts will be watching closely for announcements outlining the party’s economic priorities.

Image source, Getty Images

Separate data released Monday showed new home prices fell at the fastest pace in nine years in June.

It’s further evidence of the crisis that has engulfed China’s property sector and led to the collapse of major companies such as Evergrande, raising concerns it could spread to other parts of the economy.

“China has more than 4,000 banks, and more than 90% are small regional banks with large exposure to the housing market and local government debt,” said Dan Wang, a Shanghai-based economist.

She believes party leaders will “push for consolidation of small banks.”

Another issue is falling prices, which is a sign of weak demand.

Producer prices continued to fall last month, while consumer prices rose just 0.2%, the slowest increase in three months.

Meanwhile, retail sales rose just 2% in June, below expectations and suggesting consumers remain cautious about spending and worried about the future.

“The big concern is that households, businesses and investors will lose confidence in the government’s ability to navigate a dangerous economic environment,” said Eswar Prasad, former head of the International Monetary Fund’s China department.

Still, questions remain about whether Beijing is willing to offer a solution that will satisfy observers and markets.

“The government is reluctant to offer short-term stimulus measures such as cash handouts to families,” said Dan Wang. “Instead, we expect the government to refocus on strengthening supply chains and high tech.”

This coincides with the Chinese government’s bet on high-tech industries such as renewable energy, artificial intelligence and semiconductor manufacturing, as well as exports to revive its economy. Last month, China reported a record trade surplus of $99 billion (£76.4 billion) as exports surged and imports slumped.

But even that bet faces challenges: Major trading partners such as the European Union and the United States have imposed tariffs and other barriers on Chinese-made products, from electric vehicles to advanced semiconductors.