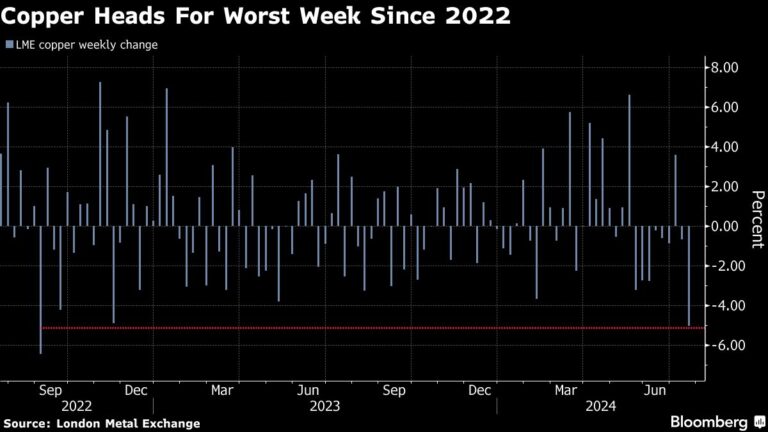

(Bloomberg) — Copper is headed for its biggest weekly drop since 2022 and iron ore continued to slide toward $100 a tonne after a Chinese policy meeting failed to signal further stimulus to bolster demand for the metal.

Most read articles on Bloomberg

Gold futures fell about 5% in London this week amid a broader sell-off that also hit aluminum, tin and nickel. Gold futures also fell on Friday due to a shift away from risk assets and a stronger U.S. dollar.

“We’re seeing some bullish positioning being unwound and some marginal short selling coming in,” said Michael Widmer, head of metals research at Bank of America.

Copper prices have fallen from highs hit in May on concerns about the strength of demand in China, where growth in the three months to June was the slowest in five quarters. Results from the Third Plenum, a key meeting of Communist Party officials in Beijing this week, have so far shown few signs of any major steps to boost demand or halt a protracted real estate slump.

“The lack of any major policy shifts in China weighed on sentiment,” ANZ Group Holdings Plc analysts including Daniel Hines said in a note. “Investors were disappointed that more focus was not placed on tackling the economy’s structural issues, such as the struggling property sector.”

Reflecting weak demand, global copper stocks have surged in recent months. Warehouse stocks tracked by the London Metal Exchange have more than doubled since mid-May to their highest level since September 2021. Most of the increase has been in Asian warehouses.

Exchange data on Friday showed a further 4,000 tonnes of copper cathode arrived at LME warehouses in South Korea and Taiwan as premiums for physical copper cathode imports into China remain extremely low.

Meanwhile, metals traders are also monitoring the impact of a magnitude 7.4 earthquake that struck 45 kilometers (28 miles) from San Pedro de Atacama, in Chile’s northern copper and lithium mining region.

As of 12:50 pm London time, copper was down 0.75% to $9,317 a tonne on the LME, its fifth consecutive day of declines. Aluminum has fallen about 4% this week, while tin has fallen more than 8%. In Australia, mining shares fell, with BHP Group closing at its lowest since late 2022.

Iron ore fell 1 percent to $103.70 a tonne in Singapore, having fallen 3.3 percent this week, driven by the outlook for Chinese demand as well as reports of increased production by the world’s top miners.

–With assistance from Audrey Wang.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP