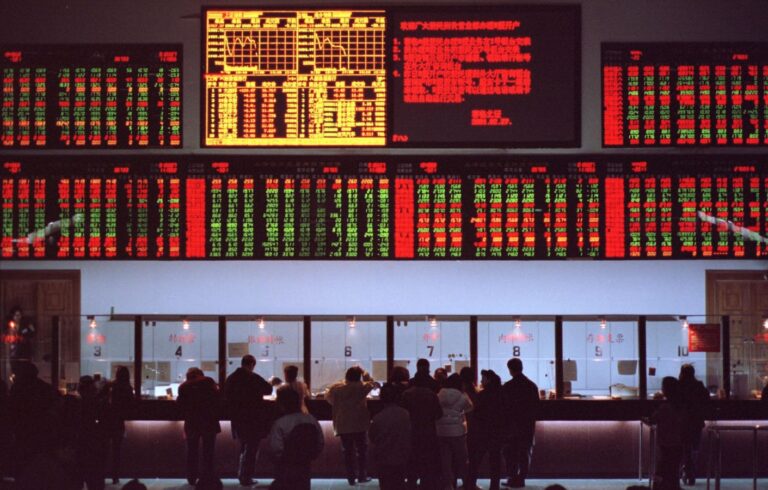

386035 03: A view inside the stock exchange in Beijing, China, on February 27, 2001. … [+]

Family offices have undergone significant transformation in recent years, adapting to a rapidly changing financial environment and the evolving needs of ultra-high net worth families. In our latest, third edition, the UBS Family Office Quarterly Report examines the current state of family offices and predicts their future. Several key trends have emerged that are reshaping this specialized wealth management sector.

The rise of family offices

Family offices have experienced explosive growth over the past decade. According to industry estimates, there are now more than 7,000 family offices worldwide managing more than $5.9 trillion in assets. This explosion is largely due to unprecedented wealth creation in recent years, particularly in the technology sector, and the increasing complexity of managing families’ vast assets.

“The family office sector has matured significantly,” said Charles Soriano, an operating partner at Humankind Capital. “What was once a relatively simple vehicle for managing family wealth has evolved into a sophisticated operation rivaling many institutional investment firms.”

current situation

Today’s family offices are much more than just wealth management institutions. Their scope has expanded to include a wide range of services, from investment management and tax planning to philanthropy and educating the next generation. This evolution reflects the changing needs and expectations of wealthy families.

A key feature of the modern family office is that it is more professionalised yet still retains family involvement.

1. Improve expertise: Family offices are increasingly recruiting top talent from investment banks, hedge funds and private equity firms. This trend has increased the level of expertise within family offices, allowing them to pursue more complex investment strategies. This is quite interesting because two-thirds (66%) of family offices only employ a maximum of 10 staff (20% only employ a maximum of three), which is usually insufficient to perform the full range of services from investments to bookkeeping, philanthropy, taxes and lifestyle support. The UBS 2024 Global Family Office Report also revealed that in 72% of family offices surveyed, at least one employee is a family member. For more information on single family offices around the world, check out the report.

2. Diversification of investmentsFamily offices are broadening their investment horizon: traditional assets such as stocks and bonds remain important, but alternative investments such as private equity, venture capital and real estate are growing in importance.

3. Direct Investment: Many family offices are eschewing traditional fund structures and opting to invest directly in private companies, an approach that allows for greater control and potentially higher returns, albeit with increased risk.

4. Focus on technologyFamily offices are embracing technology to streamline operations, enhance reporting, and improve investment decision-making, with many investing in advanced portfolio management systems and data analytics tools.

5. Focus on governance: As family offices become more complex, there is an increased focus on establishing a strong governance structure, including creating a formal board of directors, putting in place clear decision-making processes and developing succession plans.

6. Sustainability and impact investing: Family offices are increasingly aligning their investments with their values, leading to increased interest in ESG (environmental, social and governance) investing and impact-focused strategies.

Recent trends in shaping family offices

In recent years, several trends have emerged that will have a significant impact on the family office sector.

1. Artificial Intelligence and Machine Learning

AI and machine learning are revolutionizing the way family offices operate. From investment analysis to risk management, these technologies improve decision-making processes and operational efficiency.

“AI is turning family offices into intelligence agencies,” said Igor Zhablokov, founder and CEO of Pryon. “AI allows family offices to process massive amounts of data and generate insights at a scale and speed previously unimaginable.”

2. Growing interest in the private market

Family offices are allocating more capital to private markets. The UBS Global Family Office Report 2024 found that 71% of family offices investing in private equity do so to diversify their investment portfolio, and the same proportion believe that long-term returns are better than public equity.

3. Cybersecurity Focus

As family offices become increasingly digital, cybersecurity has become a top priority, with many investing heavily in strong security measures to protect sensitive family and financial information.

4. Talent retention strategies

Attracting and retaining top talent has become a key focus for family offices, with many implementing innovative compensation structures, including equity-based plans, to better align employees’ interests with those of their families.

5. Enhanced collaboration

Family offices are increasingly collaborating with one another by sharing deal flow and co-investing in opportunities, a trend that is particularly evident in the venture capital and private equity spaces.

6. Focus on next-generation engagement

Family offices are placing an increased emphasis on educating and engaging the next generation, including creating formal education programs and providing opportunities for younger family members to participate in investment decisions.

Future outlook

Looking ahead, several factors will likely shape the future of family offices.

1. Continuous growth: Due to continued wealth creation and the increasing complexity of managing large fortunes, the number of family offices is expected to continue to grow.

2. More specializationFamily offices are likely to become more sophisticated and rival institutional investors in terms of capabilities and influence.

3. Strengthened Regulation: As family offices grow in size and influence, they are likely to come under increased regulatory scrutiny, which could lead to more formal reporting requirements and increased oversight.

4. Technology Integration: The adoption of advanced technologies such as AI, blockchain and data analytics is expected to accelerate, which could lead to improved operational efficiencies and create new investment opportunities.

5. Focus on sustainability: ESG and impact investing are expected to become increasingly central to family office investment strategies, driven by both an alignment of values and a recognition of long-term risks and opportunities.

6. Globalization: Family offices are likely to become increasingly global in outlook, both in terms of their investment strategies and scope of operations.

7. Talent Wars: Competition for top talent is expected to intensify, potentially leading to more innovative compensation and retention strategies.

Challenges and opportunities

Although the future for family offices looks bright, they also face some challenges.

1. Succession planningEnsuring a smooth transition between generations remains a key challenge for many family offices.

2. Cybersecurity: As family offices become increasingly digital, protecting against cyber threats will be an ongoing challenge.

3. Regulation: Navigating an increasingly complex regulatory environment requires ongoing attention and resources.

4. Market volatilityManaging assets during times of economic uncertainty and market volatility will continue to be a significant challenge.

But these challenges also present opportunities: family offices that navigate these issues successfully may be well positioned to take advantage of new investment opportunities and deliver superior long-term results.

Implications for fund managers

Understanding these trends is crucial for fund managers looking to raise capital from family offices. Some key considerations include:

1. Customized approach: Family offices are increasingly sophisticated and have diverse needs, and fund managers must be prepared to offer customized solutions rather than a one-size-fits-all approach.

2. Co-investment opportunitiesMany family offices are interested in opportunities to co-invest with funds, and managers who can offer these could have an advantage.

3. Transparency: Family offices are increasingly demanding greater transparency from their investment partners, and fund managers must be prepared to provide detailed and regular reporting.

4. Alignment of interests: Family offices are looking for true partnerships, and fund managers should consider how they can align their interests with their own, including through innovative fee structures and co-investment opportunities.

5. ESG integration: Given the growing interest in sustainable investing among family offices, fund managers should be prepared to demonstrate how they are integrating ESG factors into their investment process.

6. Embracing technologyFamily offices are becoming increasingly tech-savvy. Fund managers need to ensure they have strong technology capabilities to meet the reporting and analytical needs of these sophisticated investors.

Conclusion

The family office sector is undergoing a period of rapid evolution, driven by advances in technology, the changing needs of families and a complex global economic climate. Although challenges remain, the future outlook for family offices is strong, with continued growth and sophistication expected.

It is crucial for those running single or multiple family offices to stay on top of these trends and continually adapt to their changing needs, and for fund managers, understanding the unique characteristics and changing preferences of family offices is key to successfully partnering with these influential investors.

“The family office of the future will need to be agile, tech-savvy and deeply aligned with family values,” said Mark Tepcich, family office design and governance strategist at UBS Family Office Solutions. “Those that can achieve this balance will be well-positioned to navigate the complex challenges of managing large amounts of assets in an increasingly uncertain world.”