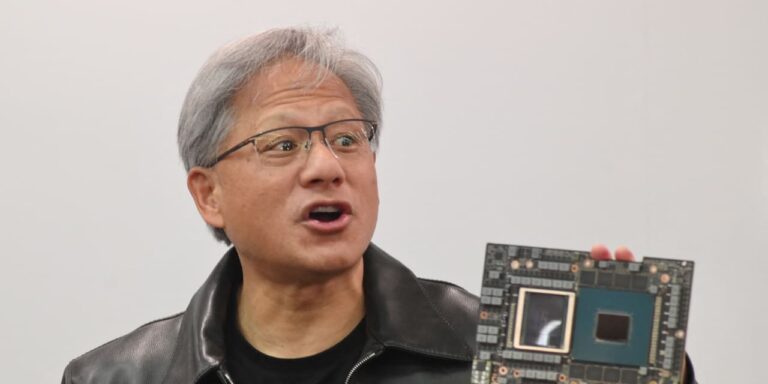

It’s a new week, a new start for Nvidia shares. After a rare downturn in several days for the chipmaker, shares rose early Monday on reports of a new AI processor aimed at the Chinese market, a reminder of the company’s innovative prowess and the political challenges it faces.

Nvidia shares rose 1.4% to $119.55 in premarket trading after falling 2.6% at Friday’s close.

Reuters reported on Monday, citing people familiar with the matter, that Nvidia is planning new artificial intelligence chips for the Chinese market that would comply with U.S. export controls. Nvidia will work with Inspur.

,

The company has reportedly signed a joint development deal with one of its Chinese distribution partners for the so-called “B20” chip.

Nvidia did not immediately respond to a request for comment on the report.

The U.S. government first announced export controls in 2022 to thwart China’s advances in AI technology. Last October, the Commerce Department expanded the restrictions, imposing licensing requirements on Nvidia for certain chips used in data centers.

Advertisement – Scroll to continue

The new chips for the Chinese market could be a boon for Nvidia, but it’s unclear whether the company will be able to stay ahead of the competition while complying with U.S. government demands. More powerful chips could raise concerns about tougher U.S. sanctions, while less powerful processors would leave it more vulnerable to competition from domestic companies like Huawei.

China will account for 14% of Nvidia’s total data-center revenue for fiscal 2024, which ended in January, down from 19% a year ago. The company has repeatedly said it expects any hit to its China revenue from U.S. restrictions to be fully offset by strong demand elsewhere.

Among other chipmakers, Advanced Micro Devices rose 1.2% in premarket trading, while Intel rose 0.6%. Both AMD and Intel have chips designed specifically for the Chinese market.

Nvidia shares have risen 138% this year through Friday’s close.

S&P 500

The index rose 18%

Nasdaq Composite Index

Advertisement – Scroll to continue

During the same period.

Email Adam Clark at adam.clark@barrons.com.