The technology sector has not only driven the market this year but over the past decade, as evidenced by the performance of indexes such as: Dow Jones Technology The index is up more than 27% year to date and has generated an average annual return of 20% over the past decade.

This makes the technology sector attractive not only to traders but also to long-term investors. Let’s take a look at two technology stocks that investors can hold for the long term.

1. Microsoft

Once considered a quaint, old-fashioned technology company, Microsoft (Nasdaq: MSFT) The company has transformed itself into one of the top technology companies leading the way in artificial intelligence (AI), and its ability to reinvent itself over the years is one of the reasons it’s a great stock to buy and hold.

The first big move that showed Microsoft’s ability to adapt with the times was moving from a one-time purchase model to a subscription model with the introduction of Microsoft 365 in 2013. The company did this incrementally, which helped drive strong growth without losing its customer base.

More recently, Microsoft has shown it is at the forefront of AI, making an early investment in OpenAI and then significantly increasing its investment to partner with the company and incorporate the technology into various products. So far, the company’s Azure cloud computing division has been a big beneficiary of this early effort, as customers have been eager to build AI applications with the help of Azure. With Azure’s consumption-based model, customers pay for what they need, which has led to significant growth for Azure and taking share from competitors.

Microsoft has been active over the years with acquisitions such as LinkedIn, GitHub, and Activision Blizzard. GitHub has been a strong performer for the company and has also benefited from AI: The introduction of GitHub AI assistant Copilot to its developer platform helped the platform grow 45% in the first quarter.

Microsoft isn’t on the radar of many investors right now, but it will be interesting to see what the company does with AI when it comes to Xbox and Activision Blizzard releasing their next video game consoles in the next few years. Given the potential advancements AI can bring to gaming, we’re looking at big growth potential in the coming years.

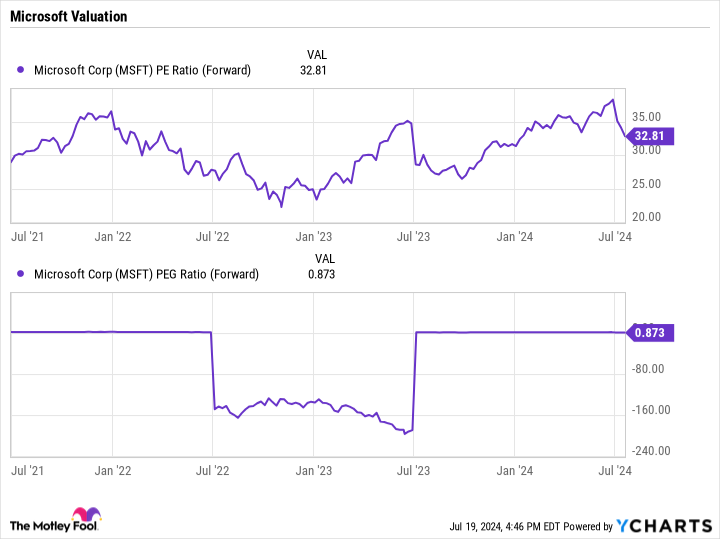

The company’s stock is trading at less than 33 times forward earnings and a price-to-earnings growth (PEG) ratio of less than 0.9, making it attractively priced given its long-term growth potential and dominance in employee productivity (Word, Excel, etc.) and PC operating systems (Windows).

1. Alphabet

Like Microsoft, alphabet (Nasdaq: GOOGL) While the company boasts a monopoly-dominant market position, its triumph is not in employee productivity tools, but in Google search, where it has an estimated 90%+ global market share.Like Microsoft, Alphabet’s cloud computing division is a major beneficiary of the AI boom.

The similarities with Microsoft don’t end there. Alphabet has also made some smart acquisitions, the best example being the company’s purchase of YouTube for $1.65 billion in 2006. With YouTube generating $8.1 billion in revenue in the first quarter of 2024 alone, it’s safe to say this was a great acquisition.

Alphabet is currently rumored to be on the verge of acquiring Israeli cybersecurity company Wiz for around $23 billion, a deal that, if completed, is expected to give Alphabet the security element it needs to land more cloud computing and AI-related deals.

Meanwhile, Alphabet’s core search business has great potential to benefit from AI. The company is already experimenting with an AI overlay that answers search-related questions, as well as ways to monetize this new feature. While the company has encountered some issues in the early stages of AI, the AI overlay opens up the potential avenues for serving ads to the majority of search results that don’t serve ads. Traditionally, the company serves ad results to only about 20% of search queries and only gets paid when those links are clicked.

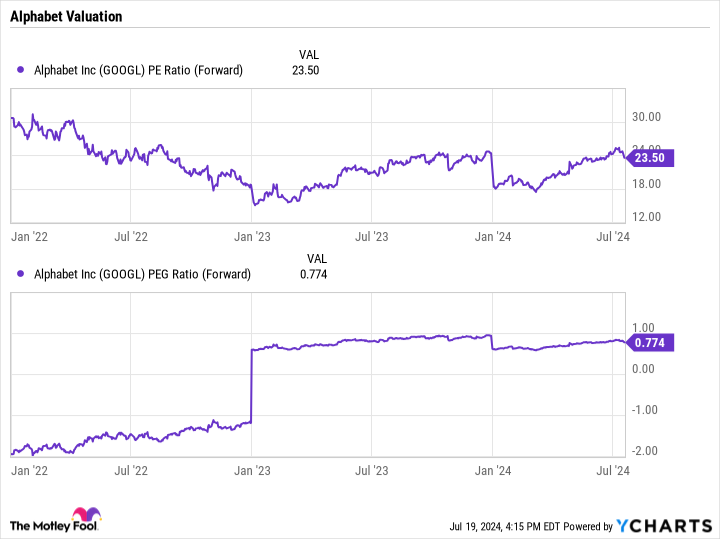

Alphabet’s stock is cheap, trading at 23.5 times forward earnings and a PEG ratio of less than 0.8. Given its future growth potential and dominance in the search market, the stock looks like a great tech stock to buy and hold for the long term.

Should I invest $1,000 in Microsoft right now?

Before you buy Microsoft stock, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now… Microsoft isn’t one of them. These 10 stocks have the potential to generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, $722,626!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of July 22, 2024

Suzanne Frey, an Alphabet executive, serves on The Motley Fool’s board of directors. Geoffrey Seiler is an investor in Alphabet. The Motley Fool has invested in and recommends Alphabet and Microsoft. The Motley Fool recommends long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Do you have $5,000? 2 Best Tech Stocks to Hold for the Long Term was originally published by The Motley Fool.