So far this month, NIO has 18,700 insurance registrations, Xpeng has 7,800, Li Auto has 43,000, Tesla has 41,900, Xiaomi has 11,400, and BYD has 257,900.

Major electric vehicle (EV) makers mainly recorded increases in shipments last week, as shipments at the end of the month typically skew upwards.

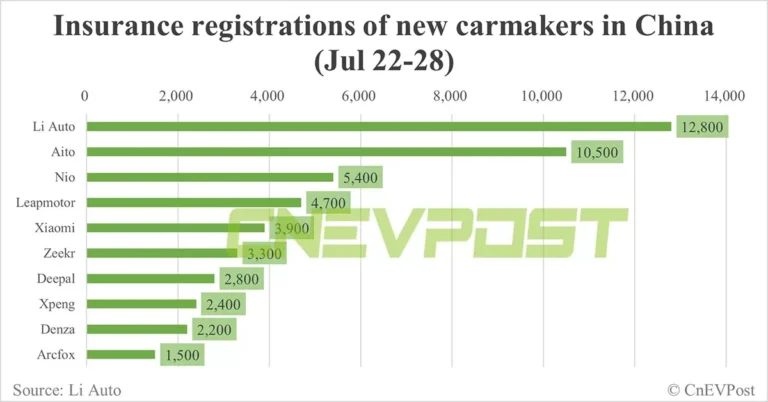

According to data released today by Li Auto (NASDAQ: LI), during the week of July 22-28, there were 5,400 insured registrations of NIO (NYSE: NIO) vehicles in China, up 17.39 percent from 4,600 the previous week.

Earlier this year, Li Auto stopped publishing its weekly insurance registration numbers after about a year of doing so. The company resumed releasing the numbers in early May.

As of July 28, NIO’s insurance registrations for this month were 18,700.

Nio delivered 21,209 vehicles in June, beating its previous record of 20,544 delivered in May for the second consecutive month.

The company delivered a record 57,373 vehicles in the second quarter, unexpectedly beating the top end of its guidance range of 54,000 to 56,000 units.

Deutsche Bank analyst Wang Bin’s team said in a July 24 research note that they expect NIO’s July retail sales to be 21,000 units, flat from the same month last year and flat from the previous quarter.

According to the team, NIO’s sales promotion activities for the first 20 days of July will be in line with its June policy, so new orders are expected to reach around 22,000 units.

Local automotive media Autohome reported on July 17 that NIO will reduce purchase incentives for some models on July 22. NIO has not denied the report, but has not officially announced the reduction in offers.

Lee Auto registered 12,800 insurance policies last week, up 17.43% from 10,900 the previous week.

So far this month, Li Auto has 43,000 vehicles in its fleet.

The company delivered 47,774 vehicles in June, second only to its previous record of 50,353 delivered in December last year.

Lee Auto delivered 108,581 vehicles in the second quarter, within its guidance range of 105,000 to 110,000 units.

Wang’s team predicted that Li Auto’s retail sales in July would be 48,000 units, up 41% from a year ago and flat from the previous quarter.

On July 25, Li Auto announced it would scale back car purchase incentives amid easing price competition in China’s auto market.

Xpeng (NYSE: XPEV) saw 2,400 insurance registrations last week, up 26.32% from 1,900 the previous week.

As of this month, Xpeng has registered 7,800 insured vehicles.

Xpeng delivered 10,668 vehicles in June, up 23.76% year-on-year and 5.14% from May.

In the second quarter, Xpeng delivered 30,207 vehicles, within its guidance range of 29,000 to 32,000 units.

According to Wang’s team, Xpeng’s domestic retail sales in July were estimated at 8,500 units, with overseas deliveries estimated at 1,500 units.

The company is scheduled to hold a tech event later today to announce a major update to its XNGP (Xpeng Navigation Guided Pilot) assisted driving feature.

Xpeng said it will debut the first model in its Mona series, the M03, on July 3, with the official launch in August.

Tesla (NASDAQ: TSLA) saw 13,500 insurance registrations in China last week, up 28.57% from 10,500 the previous week.

So far this month, Tesla has registered 41,900 insured vehicles in China.

U.S. EV makers sold 59,261 vehicles in China in June, down 20.15% from 74,212 units in the same month last year, but up 7.33% from 55,215 units in May.

Tesla China exported 11,746 units in June, down 39.67% from 19,468 units in the same month last year, and down 32.33% from 17,358 units in May.

On July 23, Tesla extended its five-year, 0% interest loan incentive in China, which was set to expire on July 31, until August 31.

Deutsche Bank expects Tesla to sell 45,000 vehicles in China in July, up 37% from a year ago but down 23% from the previous quarter.

BYD (HKG: 1211, OTCMKTS: BYDDY) saw 70,600 insurance registrations in China last week, up 5.85% from 66,700 the previous week.

So far this month, BYD’s figure stands at 257,900 units.

BYD sold 341,658 new energy vehicles (NEVs) in June, beating the previous record of 341,043 sold in December 2023.

BYD sold a record high of 986,720 NEVs in the second quarter, up 40.25% year-on-year and up 57.56% from the first quarter.

BYD launched the Song L DM-i and 2025 Song Plus DM-i on July 25 as its second hybrid models equipped with the DM 5.0 system, following the Seal 06 DM-i and Qin L DM-i hybrid sedans. Pricing for both new SUV (sport utility vehicle) models starts at RMB 135,800 ($18,770).

Wang’s team said BYD’s retail sales in July are expected to reach 300,000 units, up 8.5% from the previous quarter and 41% from a year ago.

Xiaomi (HKG: 1810; OTCMKTS: XIACY) recorded a record high of 3,900 insurance registrations last week, up 160% from 1,500 the previous week.

So far this month, Xiaomi’s figure stands at 11,400 units.

On July 2, Xiaomi EV announced that it will optimize new production lines to increase production capacity.

In a Weibo post on July 26, Lei Jun, founder, chairman and CEO of Xiaomi, said that the capacity expansion of Xiaomi’s EV factory has been completed and the full-year shipment target of 100,000 units is on track to be completed by early November.

More than 10,000 units of Xiaomi’s only current model, the SU7, were shipped in June, Xiaomi EV said on Weibo earlier this month, without giving specific figures.

Xiaomi EV had previously announced that shipments of the Xiaomi SU7 in July would still exceed 10,000 units.

Zeekr (NYSE: ZK) saw 3,300 insurance registrations last week, up 10% from 3,000 the previous week.

So far this month, Zeekr has 13,400 units in its fleet.

The company delivered a record 20,106 vehicles in June, marking the first time that monthly deliveries exceeded 20,000 units.

Zeekr delivered a record 54,811 vehicles in the second quarter, up 100.05% from the same period last year and up 65.8% from the first quarter.

On July 19, Zeekr launched the upgraded Zeekr 009 MPV (multi-purpose vehicle) and its right-hand drive version in Hong Kong.

Deutsche Bank expects Zeeker to report retail sales of 15,000 units in July, up 25% from a year ago and down 25% from June.

Leap Motor (HKG: 9863) registered 4,700 insurance registrations last week, down 4.08% from 4,900 the previous week.

So far this month, Leap Motor’s fleet stands at 17,900 vehicles.

Leap Motor delivered a record 20,116 vehicles in June, bringing second-quarter deliveries to 53,286.

On July 22, the company announced that the number of orders for the six-seater SUV “C16,” which was released on June 28, exceeded 10,000 units in the first month after its release.

Deutsche Bank expects Leap Motor to sell 21,000 units in July, up 46 percent from a year ago and 4 percent from the previous quarter.

The number of insurance registrations for the Aito brand, jointly developed by Huawei and Ceres Group, rose 12.9% last week to 10,500 from 9,300 the previous week.

So far this month, Aito’s fleet stands at 37,100 units.

AITO announced yesterday that two and a half years after the launch of the new brand on December 2, 2021, its 400,000th vehicle has rolled off the production line.

According to Deutsche Bank, Aito’s retail sales in July are expected to be 43,000 units, up about 865% from a year ago and flat from the previous quarter.

Fact Table: China EV Insurance Registrations July 22-28

Become a CnEVPost member

Become a member of CnEVPost to enjoy an ad-free reading experience and support us in producing more quality content.

Become a member

Already a member? Sign in here.