With the fasting month of Ramadan in its final days, many Muslims around the world prepare to fulfil another essential pillar of their faith – giving zakat.

Zakat is a compulsory form of charity in Islam, aimed at supporting the needy and promoting economic equality.

In this visual explainer, we answer seven common questions about zakat to help you understand its purpose, calculations and benefits.

What are zakat and sadaqah?

Zakat is one of the five pillars of Islam, making it a core act of worship. The word zakat means purification or growth and is commanded in the Quran as a means to purify wealth, promote social justice and help those in need.

Zakat is mandatory for Muslims who meet the financial threshold, known as nisab, and is given annually at a fixed percentage of 2.5 (one-40th) of one’s wealth. More on how this is calculated, later.

Sadaqah, on the other hand, is a voluntary charity of any amount that can be given at any time.

Who is required to give zakat?

Zakat is obligatory for adult Muslims whose wealth is above the nisab threshold, the minimum amount needed to be eligible to pay zakat.

The nisab is equivalent to 85gm (3 troy ounces) of gold, or roughly $9,000 based on current market prices.

In addition to the gold standard for determining the nisab amount, there is also a silver standard. The nisab based on silver is equivalent to 595gm (19 troy ounces) of the metal. This accommodates different economic conditions and ensures that zakat is accessible and relevant to a wide range of people.

If a Muslim’s wealth remains above this threshold for a full lunar year, they must pay zakat.

What are the different types of zakat?

There are two main types of zakat: zakat al-mal and zakat al-fitr.

Zakat al-mal, meaning “zakat on wealth”, is the most commonly known form of zakat. It is an obligation requiring Muslims whose wealth exceeds the nisab threshold to donate 2.5 percent of their assets annually.

Zakat al-fitr is a mandatory charitable donation of food before the Eid prayer, marking the end of Ramadan. It is given to help those in need to celebrate Eid. The amount is generally equivalent to the cost of one meal for a person.

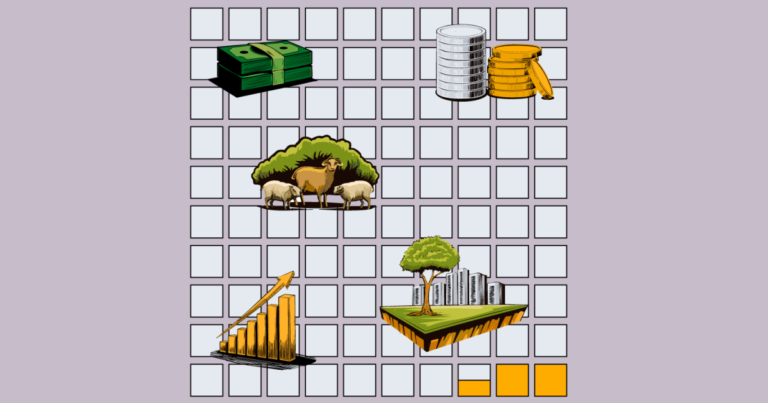

What assets are zakatable?

Zakat must be paid on assets and savings, kept to resell or profit from, including:

Zakat is not required on assets in use for daily life, such as:

How is zakat calculated?

The standard zakat rate is 2.5 percent (one-40th) of one’s eligible wealth.

For example, if one’s wealth liable to zakat is $10,000, the due amount is $250 ($10,000 × 2.5% = $250).

Who can one receive zakat?

Zakat is designed to help alleviate poverty and support the less fortunate. So it must be given to Muslims who meet the criteria of need and lack of wealth. The Quran specifies eight categories of people eligible to receive zakat:

The poor – those with little or no income

The needy – those who have some resources but not enough for a stable life

Zakat administrators – individuals or organisations responsible for collecting and distributing zakat

New Muslims – converts or those inclined towards Islam who need financial support

People in debt – those burdened by debts they cannot repay

Stranded travellers – those who lack financial support while away from home

People working in welfare – individuals engaged in religious, educational, or humanitarian efforts

Captives and slaves – historically used to free enslaved people; now applied to modern equivalents like bonded labour

Zakat cannot be given to immediate family members who are considered one’s financial responsibility (like parents, children or spouses). It cannot be given to those who have wealth above the nisab threshold either.

When should zakat be paid?

While many choose to pay zakat during Ramadan for its spiritual rewards, it can be given at any time within a year.

Once a Muslim’s wealth surpasses the nisab threshold, they are required to pay zakat, provided they have had possession of this wealth for a full lunar year (known as hawl).

For example, if someone’s wealth remains above the nisab threshold for an entire year, they are obligated to pay zakat.

However, if wealth drops below the nisab during the year, there is no need to pay zakat.

For example, if someone’s wealth exceeds the nisab for several months but then drops below it before completing a full year, they are not required to pay zakat. Only when their wealth remains above the nisab for a continuous lunar year does the obligation to pay zakat arise.

If someone misses paying zakat in previous years, they must calculate and pay it retroactively.

Zakat can be given directly to those in need or through trusted charities and organisations that distribute it accordingly. While it is encouraged to help those nearby, it can also be given internationally where there is a greater need.

By requiring wealthy individuals to give a portion of their assets, zakat prevents wealth from accumulating in the hands of a few and encourages a more equitable distribution of resources, promoting economic balance and reducing income inequality.