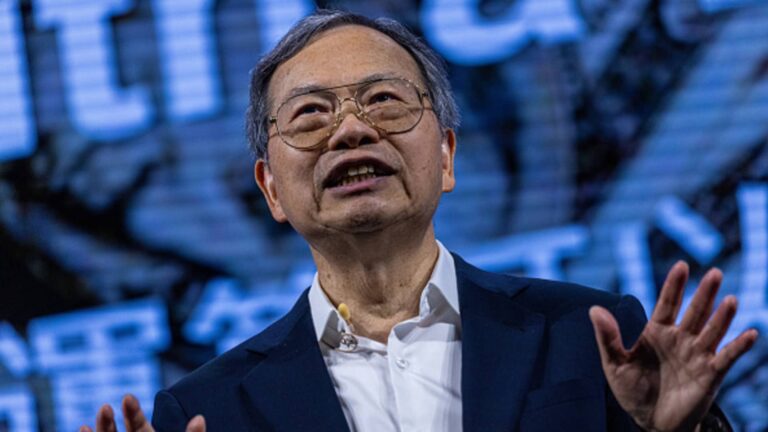

Charles Liang, CEO of Super Micro Computer Inc., during the Computex conference in Taipei, Taiwan, on June 5, 2024.

Annabelle Chih | Bloomberg | Getty Images

Super Micro Computer shares plunged as much as 10% in extended trading on Tuesday after the server maker issued weaker-than-expected results for the fiscal first quarter.

Here’s how the company did in comparison with analyst estimates compiled by LSEG:

Earnings per share: 35 cents adjusted vs. 40 cents expectedRevenue: $5.02 billion vs. $6 billion expected

Revenue fell 15% from $5.94 billion a year ago, Super Micro said in a statement. The report comes about two weeks after Super Micro issued preliminary earnings and said it expected revenue of $5 billion for the quarter, down from prior guidance of $6 billion to $7 billion.

Net income fell by more than half to $168.3 million, or 26 cents a share, from $424.3 million, or 67 cents a share, a year earlier.

In its partial report last month, Super Micro said “design win upgrades” pushed some expected first-quarter revenue to the second quarter. The company said it now expects sales of $10 billion to $11 billion in the current quarter, above the $7.83 billion average estimate, according to LSEG.

Super Micro has been a big beneficiary of the artificial intelligence boom, as its servers come packed with graphics processing units from Nvidia. But after growth soared from late 2023 through last year, the business has flatlined, with some analysts saying that Dell has taken market share.

Prior to Tuesday’s report, the stock was up 55% for the year.

WATCH: Going short on AI is a bad idea