One of the best things about stock investing is that you don’t necessarily need a stock price to rise in order to make a profit. Dividends allow investors to be compensated regardless of a company’s stock price performance.In some cases, dividends of Reasons to invest.

Tech companies have a reputation for being growth stocks given their success over the past few decades, but that doesn’t tell the whole story. There are also plenty of tech stocks that pay dividends. Some companies focus on dividends, while others focus on growth, where dividends yield a 1:2 return.

If you’re considering investing in tech companies that pay dividends, AT&T (New York Stock Exchange: T), meta platform (NASDAQ:Meta)and taiwan semiconductor manufacturing (NYSE:TSM) It should be on your radar.

1.AT&T

There are likely many investors who have a love-hate relationship with telecommunications giant AT&T. Meanwhile, the company’s stock price has fallen by almost a third over the past five years. Meanwhile, thanks to AT&T’s favorable dividend, the stock’s total return has been roughly flat over that period.

The quarterly dividend is $0.2775 ($1.11 per year), and the 12-month (TTM) yield is over 6.3%. This makes the company one of the highest dividend stocks in the world. S&P500.

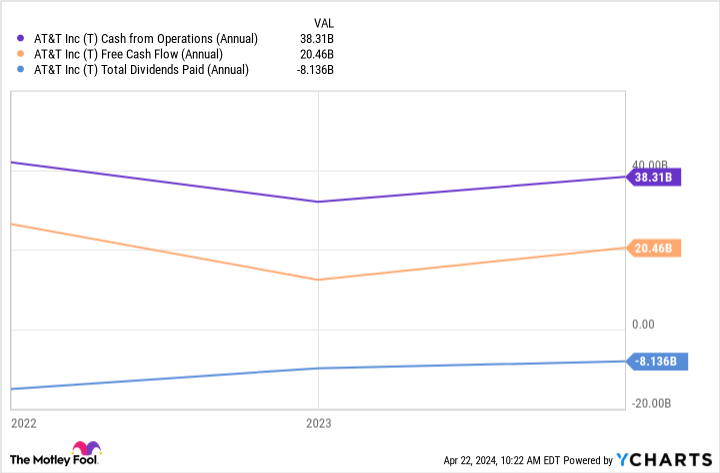

While AT&T was restructuring and disposing of its WarnerMedia assets, there were concerns that it would be unable to maintain its dividend due to its high debt. But recent results have allayed many of those concerns. Operating cash flow and free cash flow in 2023 were sufficient to cover the $8.1 billion in dividends paid.

Investors shouldn’t expect much from AT&T’s earnings growth over the next few years, but the company is positioning itself for the future by scaling back and refocusing on its core communications business. Telecommunications is an essential industry to American life, and AT&T is a large part of our infrastructure.

A favorable dividend will help give investors some patience as the company tries to turn a corner.

2. Metaplatform

If you’re not used to seeing the Meta platform in articles about dividend stocks, don’t worry. You are not alone. That’s because Meta just announced its first dividend in company history in February.

Meta’s quarterly dividend is $0.50 per share, giving it a yield of approximately 0.40%. This dividend yield isn’t exactly impressive, but given the potential for Meta stock to appreciate in price, it’s a real added bonus for investors.

Meta’s newly announced dividend comes at a time when the company is amassing a huge amount of cash. At the end of 2023, the company had $65.4 billion in cash, cash equivalents, and marketable securities. With no clear place to spend all the cash, the board and management decided it was time to start disbursing cash to investors.

Meta hasn’t paid a dividend since its initial public offering in May 2012, but it’s reasonable to assume that it wouldn’t have started paying a dividend if it didn’t believe it could continue to pay it and increase it every year. I believe it will, considering the roughly $43 billion in free cash flow the company generated in 2023. Money appears to be the least of the company’s problems at the moment, which should be music to investors’ ears.

3. Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing Corporation, commonly known as TSMC, is the world’s largest semiconductor foundry, and the competition isn’t particularly close.

The effectiveness and reliability of TSMC’s semiconductors has made us the go-to choice for top companies such as: apple, Nvidia, tesla, and many more. The company has long produced the semiconductors that power much of today’s electronics, and the past five years in particular have been a boon to the company’s finances.

TSMC’s financial strength should give investors confidence that the company will continue to reward investors with solid dividends over the long term. With a quarterly dividend of $0.51 per share, there’s no reason to believe the company won’t continue to grow, especially given the expected financial boost from AI in the coming years.

TSMC stock has risen recently, but has fallen back from its March highs. This results in a dividend yield of approximately 1.6%, making it a more attractive entry point for investors. It’s not the sky-high yield of a company like AT&T, but it’s enough to make up for a stock with good growth potential.

Although the company’s importance in the tech industry is sometimes underestimated because it doesn’t produce consumer products or services, it’s still a great business that can be a great long-term asset in an investor’s portfolio.

Should you invest $1,000 in AT&T right now?

Before buying AT&T stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Investors can buy now…and AT&T wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

when to think about it Nvidia This list was created on April 15, 2005…if you invested $1,000 at the time of recommendation. you have $487,211!*

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor will return as of April 22, 2024

Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. Stefon Walters has a position at his Apple. The Motley Fool has positions in and recommends Apple, Meta Platforms, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool has a disclosure policy.

3 High Dividend Tech Stocks to Buy in April Originally published by The Motley Fool