By Ray Wee

SINGAPORE (Reuters) – Asian shares are set for a weak weekend as geopolitical and major economic uncertainties pose headwinds for investors despite the start of a global interest rate easing cycle.

It has been an eventful week for markets, with tech stocks selling off due to worsening US-China trade tensions, uncertainty over US President Joe Biden’s fate in the presidential election, disappointing Chinese economic data, and the lackluster results of the Third Plenary Session of the Central Committee casting a shadow over the global mood.

In foreign exchange markets, Tokyo’s recent intervention has also unsettled traders.

“We may just be getting a preview of what’s to come, and that’s more turmoil,” said Matt Simpson, senior market analyst at City Index.

MSCI’s broadest index of Asia-Pacific shares ex-Japan fell 0.1%, heading for its worst week in more than a month with a 2.4% drop.

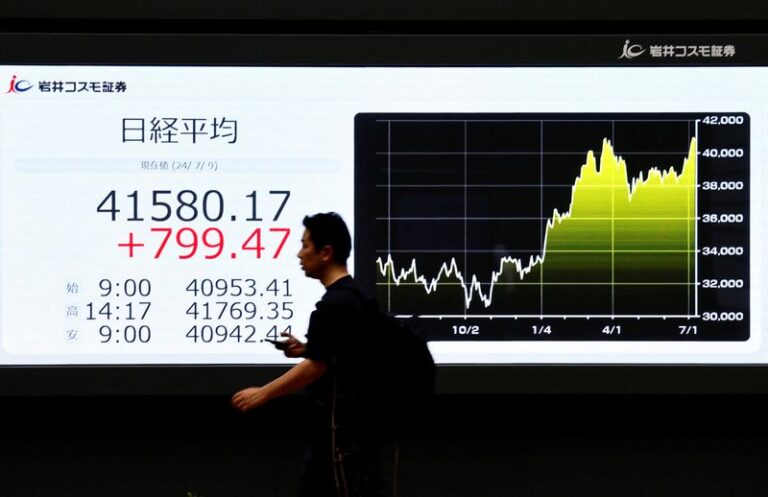

Japan’s Nikkei stock average fell to its lowest in more than two weeks, down 0.1% from the previous day and continuing a sharp decline of 2.4% from the previous trading day.

The Nikkei average is expected to enter the week down 2.7%, its first weekly drop in three months.

Tech stocks continued to struggle, with South Korea’s tech-heavy KOSPI index and Taiwanese stocks both down more than 1%.

South Korean chipmaker SK Hynix fell 0.7% the previous day, while Japan’s Tokyo Electron, a maker of semiconductor manufacturing equipment, rebounded about 2.6% after falling 8.75% on Thursday.

Shares in Taiwan’s TSMC, the world’s largest contract chipmaker, fell 1.3 percent even as the company reported better-than-expected profits on Thursday and raised its full-year sales outlook.

In China, investors were disappointed when a closely watched Central Committee plenary session concluded on Thursday without detailing implementation steps to achieve the country’s economic policy targets.

China’s blue chip stocks were down 0.08% at the open, with the Shanghai Composite Index down 0.07%. Hong Kong’s Hang Seng Index was down 1.5%.

“While more robust details are likely to be announced in the coming days, our interpretation of the initial statement is that nothing particularly meaningful came out of the third plenary session that would suggest a change in the longer-term direction of the Chinese economy,” said Brendan McKenna, international economist at Wells Fargo.

The domestic yuan opened slightly weaker at 7.2626 yuan per dollar.

Rate Focus

The euro fell 0.4% the previous day after the European Central Bank (ECB) kept interest rates unchanged as expected but lowered its economic outlook for the euro zone, leaving open the possibility of a rate cut in September, and closed down 0.02% at $1.0893.

“The policy statement revealed very little and did not signal any meaningful changes from June, and the Fed continues to emphasise a data-driven approach to policy setting,” said Nick Rees, FX market analyst at MonFX.

“We still see a September rate cut as our base case.”

Meanwhile, the dollar is strengthening, breaking away from a four-month low hit earlier this week against a range of currencies.

The pound was down 0.03% to $1.2942, while the Australian dollar was down 0.12% to $0.6698.

Strong U.S. manufacturing data and unemployment figures supported the dollar but did not signal a significant slowdown in the labor market, although traders are still pricing in a September interest rate cut from the Federal Reserve.

The yen was slightly firmer at 157.31 yen on suspicion of intervention by Japanese authorities to support the currency and on sustained expectations that an acceleration in Japan’s core inflation last month could lead the Bank of Japan to raise interest rates soon.

In commodity markets, various economic data weighed on investor sentiment, leading to a decline in crude oil prices. [O/R]

Brent crude futures fell 0.58% to $84.62 a barrel, while U.S. crude futures fell 0.81% to $82.15 a barrel.

Gold fell 0.8% to $2,425.19 an ounce, retreating from a record high hit earlier this week on the prospect of lower global interest rates. [GOL/]

(Reporting by Lay Wee and Jacqueline Wong Editing by Lay Wee