(Bloomberg) — Asian stock benchmarks were little changed in early trade as traders waited for China to restart from its extended holiday. Mainland markets appear poised for a rally as Beijing’s supportive policy stance adds momentum to the budding bullish momentum.

Most Read Articles on Bloomberg

Australian stock indexes edged higher on Friday after a weaker-than-expected U.S. jobs report recovered and the S&P 500 rose 1.3% on expectations the Federal Reserve will cut interest rates this year. An index of Chinese stocks listed on the Nasdaq rose 5.5% last week. Japanese markets are closed due to holidays.

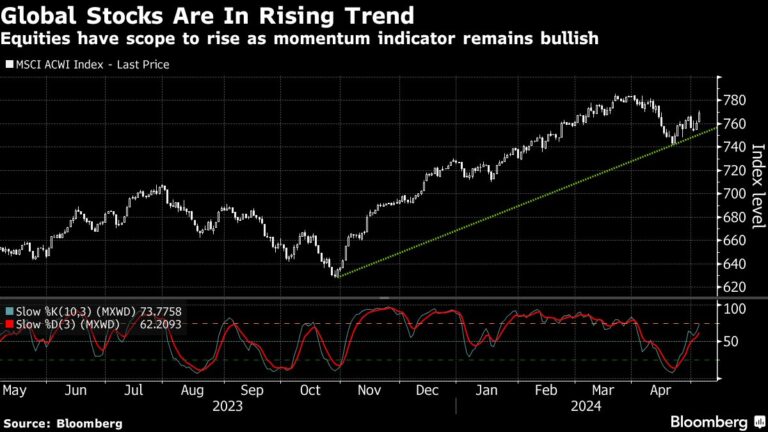

Global stocks rose last week as risk sentiment improved. U.S. Treasuries rose on the release of the jobs report, placating investors worried about “stagflation” and a recession as wages cooled. Rather, the print feed fed those who believe the economy is gradually slowing, which will allow the data-dependent Fed to begin easing policy later this year.

Oil prices rose in early trading on Sunday after Israel closed its Kerem Shalom humanitarian border to Gaza following a Hamas rocket attack. The incident threatened to derail weeks of delicate hostage-taking and ceasefire negotiations. Saudi Arabia has raised the price of crude oil sold to Asia as it seeks to tighten the oil market.

Traders will also be watching this week’s series of central bank meetings, led by the Reserve Bank of Australia, which is likely to turn hawkish on Tuesday following better-than-expected inflation data last month. Also scheduled to be released are activity data from China and inflation rates for major emerging markets.

This week’s main events:

-

China Caixin releases PMI on Monday

-

Eurozone S&P Global Services PMI, PPI, Monday

-

Australian interest rate decision Tuesday

-

Eurozone retail sales Tuesday

-

UBS Profits, Walt Disney, BP Profits, Tuesday

-

Minneapolis Fed President Neel Kashkari speaks on Tuesday

-

Brazil interest rate decision Wednesday

-

Swedish interest rate decision Wednesday

-

Toyota’s financial results, Wednesday

-

china trade thursday

-

Malaysia interest rate decision Thursday

-

Mexican CPI, Interest Rate Decision, Thursday

-

UK BOE interest rate decision Thursday

-

Canadian unemployment rate Friday

-

UK industrial production, GDP, Friday

-

Chicago Fed President Austan Goolsby speaks on Friday

The main movements in the market are:

stock

-

S&P 500 futures were little changed as of 9:30 a.m. Tokyo time.

-

Hang Seng futures rose 0.6%

-

Australia’s S&P/ASX 200 rose 0.4%

-

Euro Stoxx50 futures rose 0.3%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0763.

-

The Japanese yen fell 0.4% to 153.60 yen to the dollar.

-

The offshore yuan was little changed at 7.1983 yuan to the dollar.

cryptocurrency

bond

merchandise

-

West Texas Intermediate crude oil is little changed.

-

Spot gold fell 0.4% to $2,292.79 an ounce.

This article was produced in partnership with Bloomberg Automation.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP