- XRP saw a liquidation of over $3 million in the last trading session.

- The trend of falling below the short-term moving average continued.

XRP has seen mixed price action in recent days, which has affected interest levels in the asset. The recent drop has reduced the amount of interest, leading to a surge in long liquidation volumes.

XRP price falls

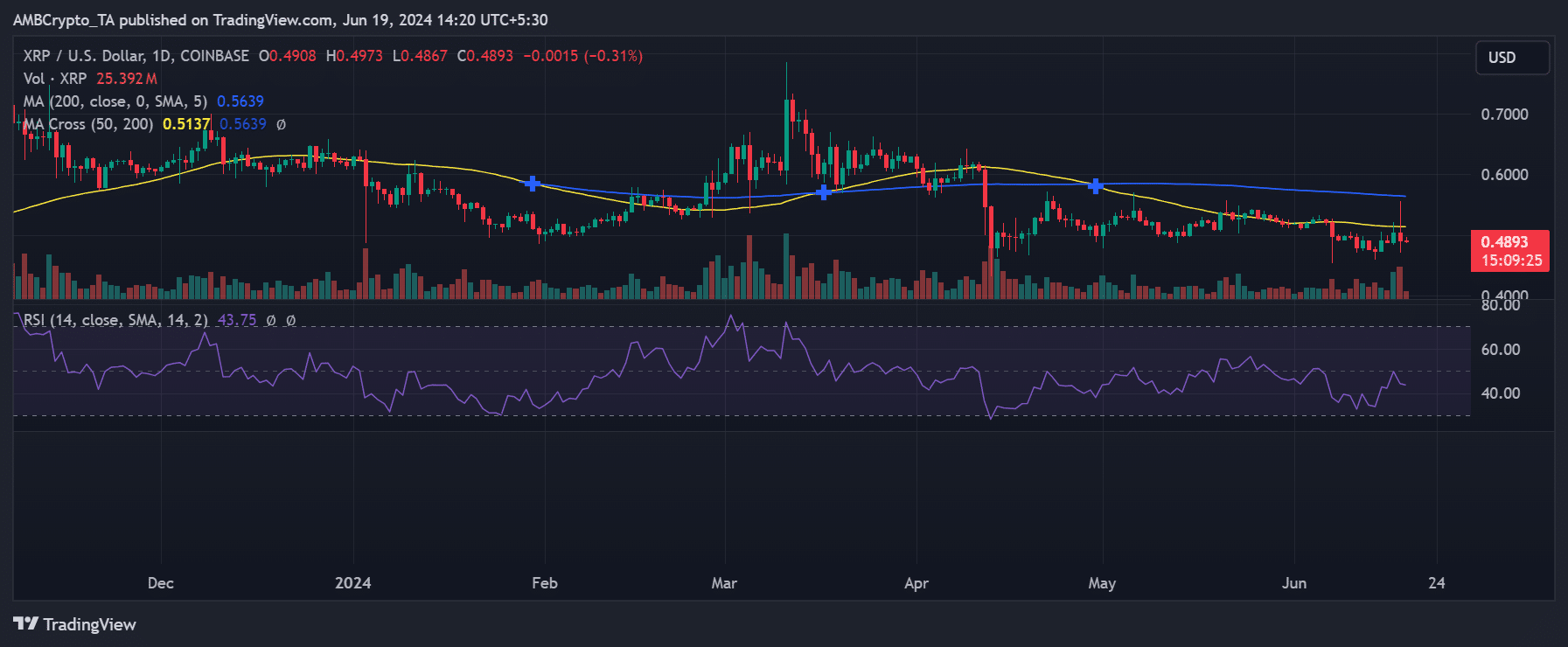

Analysis of XRP’s price movement shows that it rose 3.21% by the close of trading on June 17, with the price reaching $0.50.

However, by the next trading session on June 18, most of those gains had evaporated.

Source: TradingView

According to daily timeframe chart analysis, XRP fell 2.73% on June 18th, trading at around $0.49.

The analysis also indicates that the trading trend is continuing below the short-term moving average (yellow line), which has been acting as resistance near the $0.51 level for some time.

As of press time, the decline continues and XRP is trading around $0.48. Furthermore, analysis of the Relative Strength Index (RSI) indicates that the bearish trend is continuing as the RSI is below the neutral line.

The chart also showed that the long-term moving average (blue line) is acting as a long-term resistance level at around $0.56, with the blue line above the yellow line further highlighting the weakness of XRP price at the moment.

XRP Liquidation Exceeds $3 Million

The drop in XRP’s price led to a surge in liquidation volumes: an analysis of Coinglass’ liquidation charts showed that more than $3 million was liquidated by the close of trading on June 18th.

According to the chart, long liquidation volume was approximately $2.79 million and short liquidation volume was approximately $343,000.

Declining interest in Ripple

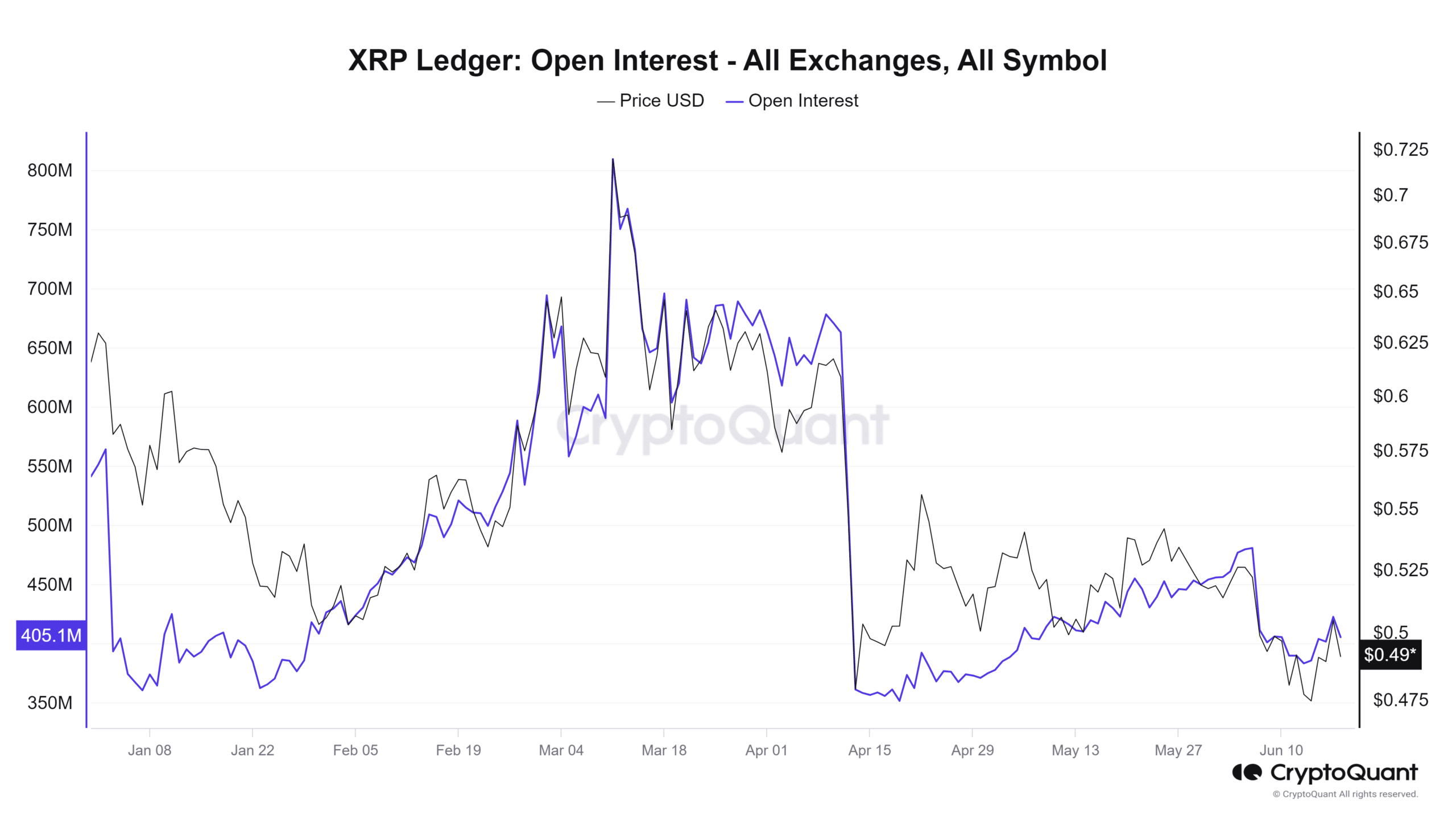

Analyzing XRP open interest, we noticed that the price drop also influenced the trend: Looking at the CryptoQuant chart, we saw that open interest spiked when XRP price rose by more than 3% to the $0.50 price range.

The chart shows that open interest rose to more than 422 million.

Source: CryptoQuant

Whether this is realistic or not, here is the market cap of XRP in terms of BTC:

But as prices fell, so did open interest: As of this writing, open interest has fallen to around 405 million, according to the chart.

This indicates that some traders closed their positions as the price fell. Although the overall trend is still positive, the open interest has decreased significantly.