The Treasury Department this week finalized a crackdown to block U.S. investment in Chinese military technology development.

Hawks say the rules are “long overdue” and don’t go far enough, while others are skeptical that they will take away U.S. investment power from China.

The rules ban U.S. lending to some China-based ventures and require Americans to notify the government of their involvement in other ventures.

The law restricts and oversees U.S. investments in artificial intelligence, computer chips, and quantum computing, all of which have dual uses in defense and commercial fields.

Elon Musk wants people to send medical scans to his AI chatbot GROK

The rules seek to restrict “countries of concern” such as China, including Hong Kong and Macau, from using the US dollar to fund the development of advanced technologies such as next-generation missile systems and fighter jets for their own use. army. It is scheduled to take effect on January 2nd.

“Artificial intelligence, semiconductors, and quantum technologies are fundamental to the development of next-generation military, surveillance, intelligence, and certain cybersecurity applications, such as cutting-edge code-breaking computer systems and next-generation fighter jets,” said Assistant Paul Paul. Rosen said. Secretary of the Treasury.

“This final rule takes targeted, concrete steps to ensure that U.S. investments are not misused to facilitate the development of key technologies that could be used to threaten national security. It is something.”

President Biden speaks at NHTI Concord Community College in Concord, New Hampshire on October 22, 2024. (Joseph Prezioso/Anadolu via Getty Images)

Current U.S. regulations restrict exports of these products to China and other “countries of concern,” and the new regulations would clamp down on the flow of U.S. dollars into those countries.

The rule was finalized after a public comment period and is based on President Biden’s 2023 Executive Order. One category would allow the Treasury Department to investigate and prohibit “transactions that pose a particularly serious national security threat.” [their] Potentially significantly advance the military, intelligence, surveillance, or cyber response capabilities of the concerned country. ”

China plans to double its nuclear arsenal to more than 1,000 warheads by 2030, according to US intelligence agencies

It would also create a category of “notifiable transactions,” where the government would monitor transactions that “may contribute to a threat to the national security of the United States identified in the order.”

Halting China’s ambitions for high-tech supremacy is one of the few bipartisan priorities in Washington. But not everyone is on board with the new rules.

“The best-known proponent of restricting U.S. investment in China is, of course, Xi Jinping,” said Rep. Patrick McHenry (R.N.C.), chairman of the House Financial Services Committee.

“I remain skeptical of sectoral approaches to regulating foreign investment. Foreign investment has overwhelming bipartisan support.”

The outgoing chairman continued, “To have a powerful, immediate, and global impact on the Chinese Communist Party’s ability to wage war, policymakers in Congress and the administration must embrace a time-tested sanctions regime.” I will continue to oppose the efforts that are being made without my knowledge.” “We look forward to a more detailed review of this rulemaking to advance President Xi’s crackdown on Western influence in China.”

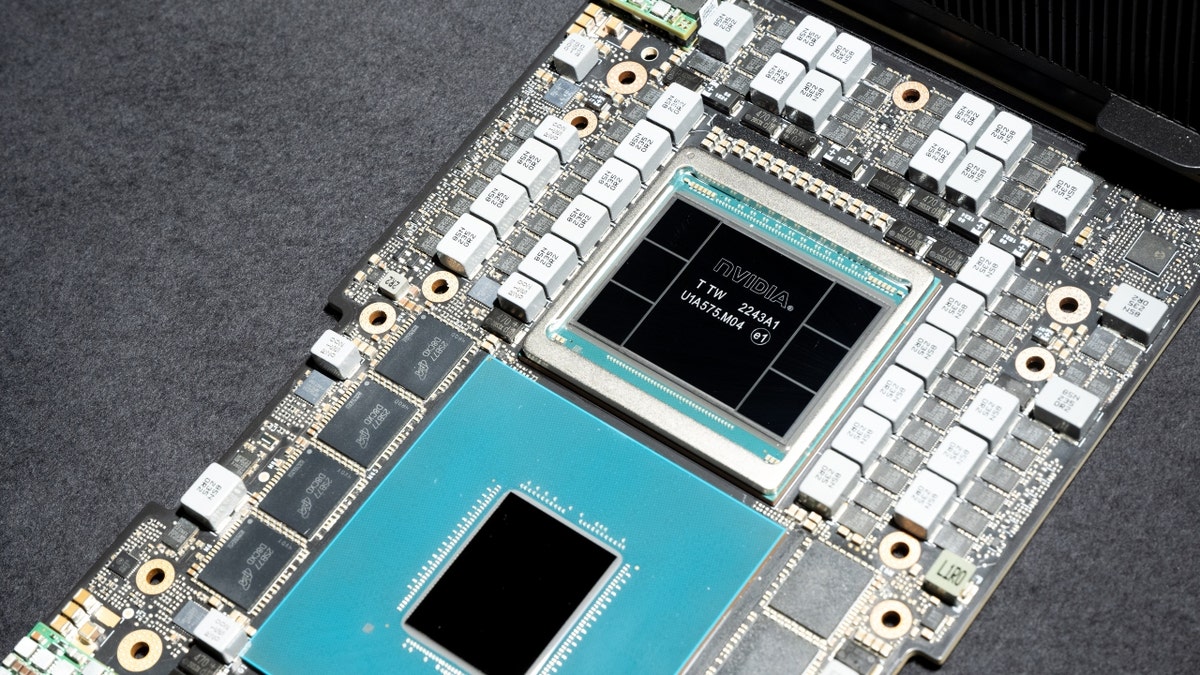

Nvidia GH200 Grace superchip used in AI processor (Marlena Sloss/Bloomberg via Getty Images)

However, some argue that this rule is not strong enough. This will allow Americans to invest in publicly traded Chinese companies or participate in venture capital or private equity funds with stakes worth up to $2 million.

“I think this was a step forward, but at the same time we missed an opportunity to show deterrence that we’re not going to continue funding the Chinese economy at a time when China is using its economic and military might to withdraw. “Going after Taiwan, going after the Philippines, going after Japan, going after all of our friends, even our military allies,” Michael Rucci, founder of global security firm State Armor, told Fox News Digital. spoke.

Rucci said the rules “should be broader than just these three categories” of AI, quantum computing and semiconductors.

China continues down vote race: report reveals which MPs are in the crosshairs

He criticized McHenry’s stance on the rule, saying it was similar to Chinese President Xi Jinping’s call for U.S. investment in China.

“Chairman McHenry’s weak approach to China’s economic war against America is pathetic. If we continue to pump money into China’s economy and support their hardships, we will somehow transform China into a free democracy. “He remains captive to the long-discredited idea that a core Marxist regime can,” he said.

“Now China is calling for investment again because Xi Jinping desperately needs American capital to rescue China’s stagnant economy. You need to.”

The rule is intended to prevent the U.S. dollar from funding technology that could be used by the Chinese military. (Ma Yue/VCG, Getty Images)

But a House Republican aide familiar with foreign investment argued that the United States should want Americans to be at the forefront of other countries’ technological development.

“You want Americans to control the company, you want Americans to be on the board of directors, you want Americans to have insight into the technologies that are being developed. “This is exactly the same argument behind wanting them to own and gain control of companies such as “TikTok, which is also a Chinese technology company,” the aide said.

“China is the world’s largest exporter of capital. It certainly doesn’t need dollars, and if it’s concerned about these technologies it’s developing, the appropriate response is to crush the companies that pose a threat to America’s national security. And the way it’s done is through sanctions or export controls.”

U.S. investment in China has been on the decline for years as relations between world powers cool. U.S. venture capital in China will reach a 10-year low of $1.3 billion in 2022, up from $14.4 billion in 2018, according to Rhodium Group.

Some have criticized the Biden administration for waiting until a week before the election to finalize such rules.

Rep. John Moolener (R-Mich.), chairman of the China Select Committee, said the new rules are “a long-awaited measure.”

“More must be done to ensure that U.S. funding no longer fuels the Chinese Communist Party’s military buildup, technological ambitions, and ongoing genocide,” he said in a statement, adding that Congress must ” “These rules should build on a broader set of issues,” he added. Technologies and transactions that threaten our national security. ”

“Just one week before the election, the Biden-Harris administration finally decided it was time to get tough on China,” said Rep. Andy Barr (R-Ky.).

CLICK HERE TO GET THE FOX NEWS APP

Barr and Rep. French Hill (R-Ark.) are the two front-runners for the top Republican seat on the Financial Services Committee in the next Congress. They stressed the need for Congress to take further steps to limit U.S. investment in Chinese technology.

“House Republicans are working to develop the most effective legislative approach that adequately addresses the concerns many have about U.S. investment in Chinese-controlled dual-use technology while ensuring it does not negatively impact the economy. “We continue to work on this,” Hill said. rule.