President Biden has warned that a new surge of cheap Chinese goods poses a threat to U.S. factories. Official trade statistics show little sign of that, with China’s steel imports down sharply since last year and the gap between what the United States sells to China and what it buys at its lowest post-pandemic level. It shows.

But the president’s aides have ignored those numbers and focused instead on what they call troubling signs from China and Europe. They include data showing China’s growing appetite to mass-produce big-ticket items such as cars and heavy metals far faster than domestic consumer demand.

China’s generous subsidies, including loans from state-run banks, have helped sustain companies that otherwise would have gone bankrupt in the country’s struggling economy. The result is often significant cost advantages for Chinese products such as steel and electric vehicles.

The U.S. solar industry is already struggling to compete with these Chinese exports. In Europe, the problem is even more widespread. To the chagrin of political leaders and business executives, Chinese exports are flooding the continent. These could soon pose a threat to some U.S. companies that Mr. Biden is seeking to shore up with federal aid and tax breaks, many of which will come from his 2022 Climate Change Act. US officials have warned.

To avoid a similar fate, Biden has promised new measures to protect steel mills, automakers and other U.S. companies from what he calls trade “cheating” by the Chinese government.

European officials are struggling to cope with a surge in imports, but this week the issue came into sharp focus as Chinese President Xi Jinping visited the continent for the first time in five years. European Commission President Ursula von der Leyen told Mr Xi on Monday in a meeting with French President Emmanuel Macron that he urged Mr Xi to address the wave of subsidized exports flowing from his country’s factories to Western countries. urged.

The frustrations expressed by European officials reflect concerns that Biden and his aides have conveyed to Beijing. In other words, as in past decades, they are deliberately using state aid to steal market share from key industries and drive foreign competitors out of business.

“The European market is flooded with subsidized products such as electric cars and steel,” von der Leyen said. “The world cannot absorb China’s surplus production.”

European authorities have begun imposing tariffs on Chinese electric cars, citing evidence of illegal state subsidies.

The United States has rich experience of cheap Chinese products overwhelming its market, such as the wave of solar panels that undermined the Obama administration’s efforts to foster a domestic solar power industry. This time, cheap solar panels are once again flowing into the United States, causing some manufacturers to postpone their planned investments in the United States.

Other products, such as electric vehicles, have been delayed due to tariffs and other barriers put in place by the U.S. government.

Still, Biden administration officials are closely monitoring Chinese production and price data and are seeking to block subsidized imports, particularly in industries central to the president’s industrial plan, such as low-carbon energy technologies. They are showing signs of delaying it.

Officials have complained about China’s so-called excess capacity in public and during a recent visit to Beijing by Treasury Secretary Janet L. Yellen and Secretary of State Antony J. Blinken.

Biden has proposed additional tariffs on Chinese steel and aluminum and launched an investigation into Chinese auto technology. The administration is considering a series of additional tariffs on Chinese goods imposed by President Donald J. Trump. We are also considering increasing the number for strategically important industries.

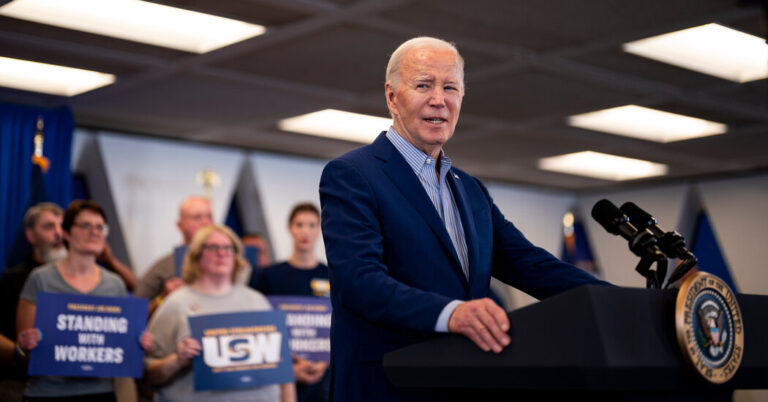

“Chinese steel companies produce far more steel than China needs, so they end up selling excess steel at unreasonable prices,” Biden told steelworkers in Pittsburgh last month. “We will release it to the world market at a price.” “And the reason prices are unreasonably low is because the Chinese government subsidizes them so much that Chinese steel companies don’t have to worry about making a profit. They’re not competing. They is cheating.”

Chinese authorities reject these charges. Foreign Ministry spokesperson Lin Jian told reporters last week that the administration’s claims are “not a market-driven conclusion, but a narrative designed to manipulate perceptions and politicize trade.”

“The real goal is to suppress China’s high-quality development and deprive China of its legitimate right to development,” he said. “What we have is not “China’s overcapacity,” but America’s overcapacity due to anxiety stemming from a lack of confidence in and slander of China.”

Biden officials said in interviews that China’s subsidized exports are starting to hurt American manufacturers, forcing some foreign suppliers of parts for American products out of business. In a speech last month, Yellen said that during a visit to China, she warned local officials that “overcapacity could harm the global economy.”

Some current and former Biden administration officials say it will take a global effort to defeat China’s export strategy. This includes increased cooperation between the United States, Europe and other wealthy allies, and is expected to be a key topic at the Group of Seven summit meeting in Italy next month.

Brian Deese, a former director of Biden’s National Economic Council and architect of the president’s green industrial strategy, said the effort also includes developing countries such as Brazil and India that are beginning to push back against Beijing’s trade practices. He said it should be included.

“What we need to do is build a broad international coalition to impose harmonized tariffs on Chinese industries that have excess capacity,” Diess said.

He said these efforts would give U.S. companies breathing room without being suffocated by artificially cheap competition and help protect investments in areas such as next-generation advanced batteries for cars and energy storage. He said it could be extremely important.

“Even if China achieves economic growth, I don’t think we can predict that China will dominate that market,” Diess said.