-

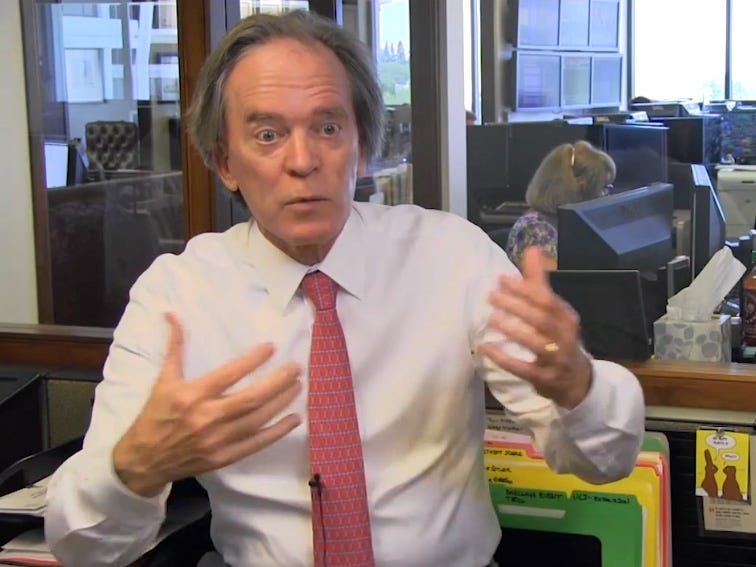

Billionaire “bond king” Bill Gross has told investors to avoid tech stocks and stick to value stocks.

-

He said if investors need to get into the tech sector, Microsoft is the only buyer.

-

Gross also questioned the rationale for holding the bonds. Yields jumped following Thursday’s GDP report.

Bill Gross says investors should avoid tech stocks.

In the post of Xthe “bond king” said, “I will stick to value stocks and avoid high-tech stocks for the time being.”

His message came as a weaker-than-expected GDP report showed consumer prices remained high in the first quarter. Bond yields soared on the news, while the tech sector fell, with the Nasdaq Composite index down more than 1% on Thursday afternoon.

If investors must dabble in technology, they should choose Microsoft, Gross said. “If you have to, MSFT is the best in technology.”

Expectations are high for the tech giant’s earnings after the bell rings Thursday, as Wall Street focuses on momentum in the company’s Azure, Copilot and Office 365 divisions.

Gross also questioned his holdings in bonds, with 10-year bonds trading above 4.7% on Thursday after the GDP report.

The billionaire investor said he owns stakes in Western Midstream Partners and energy infrastructure company MPLX.

Bill Gross is calm about the AI boom sweeping Wall Street. He previously told investors that the AI frenzy was showing signs of “overreach.”

The stock market had its worst month of the year in April. A renewed spike in inflation in March prompted a reassessment of the Federal Reserve’s monetary policy path and led Wall Street to lower expectations for interest rate cuts.

Tech companies’ profits were not enough to start a new rise. Tesla reported dismal financial results, but its stock price rose due to plans for cheaper cars in development.

However, Meta disappointed investors with a weak outlook in its earnings report on Wednesday. The stock plunged more than 10% late Thursday, leading to losses in the tech sector.

Read the original article on Business Insider