- Bitcoin prices have fallen by more than 6% over the past seven days.

- Some indicators suggested the market was at a bottom, while others suggested it wasn’t.

Bitcoin [BTC] Last week, we saw a significant price correction, which caused anxiety among investors. However, the trend could reverse and things could turn around soon. This seems likely as BTC is mimicking the price trend of 2017.

Bitcoin Historical Trends

Last week, investors were unable to make profits as BTC’s chart remained in the red. CoinMarketCapBTC has fallen by over 6% in the past seven days, with the price once again falling below $67,000.

At the time of writing, BTC is trading at $66,896.42, with a market cap of over $1.32 trillion.

Meanwhile, popular cryptocurrency analyst Milkybull recently posted a tweet highlighting an interesting development. TweetBTC was mimicking the trend that followed in 2017 before the bull market began.

The tweet makes it clear that BTC price is about to hit a market bottom, which could then trigger a bull market for BTC price if history repeats itself. Moreover, the index was also showing a bullish divergence, similar to 2017.

There was more good news: AMBCrypto’s analysis of Glassnode data also revealed bullish indicators.

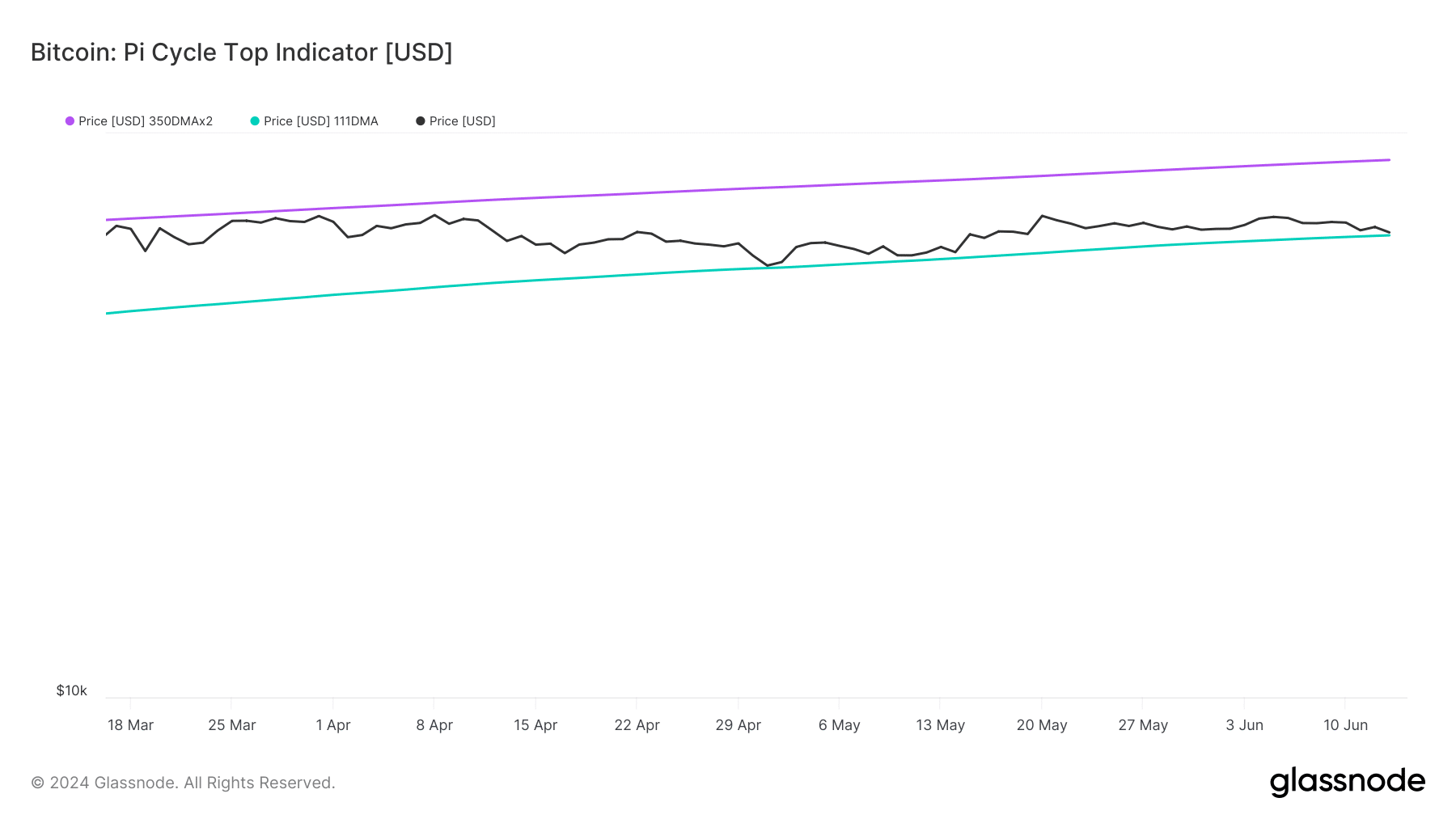

According to the BTC Pi Cycle Top indicator, Bitcoin price is hovering at the market bottom and could quickly reach $89,000 if a trend reversal occurs.

Source: Glassnode

Is BTC gearing up for a rally?

AMBCrypto then became the data To see if the indicators are pointing to a price increase. Exchange reserves for BTC are decreasing, meaning there is less selling pressure on BTC.

Source: CryptoQuant

The Binary CDD was also in the green, which means that long-term holders have performed below average over the past seven days, so they have an incentive to hold on to their coins. However, other indicators were bearish.

For example, BTC’s aSORP suggests that more investors are selling at profit, which could cause further problems for BTC’s already bearish price movement.

In addition, BTC Fear and Greed Index At the time of writing, it is at 63%, indicating that the market is in the “greedy” phase. When this indicator hits this level, it signals that prices are likely to move lower.

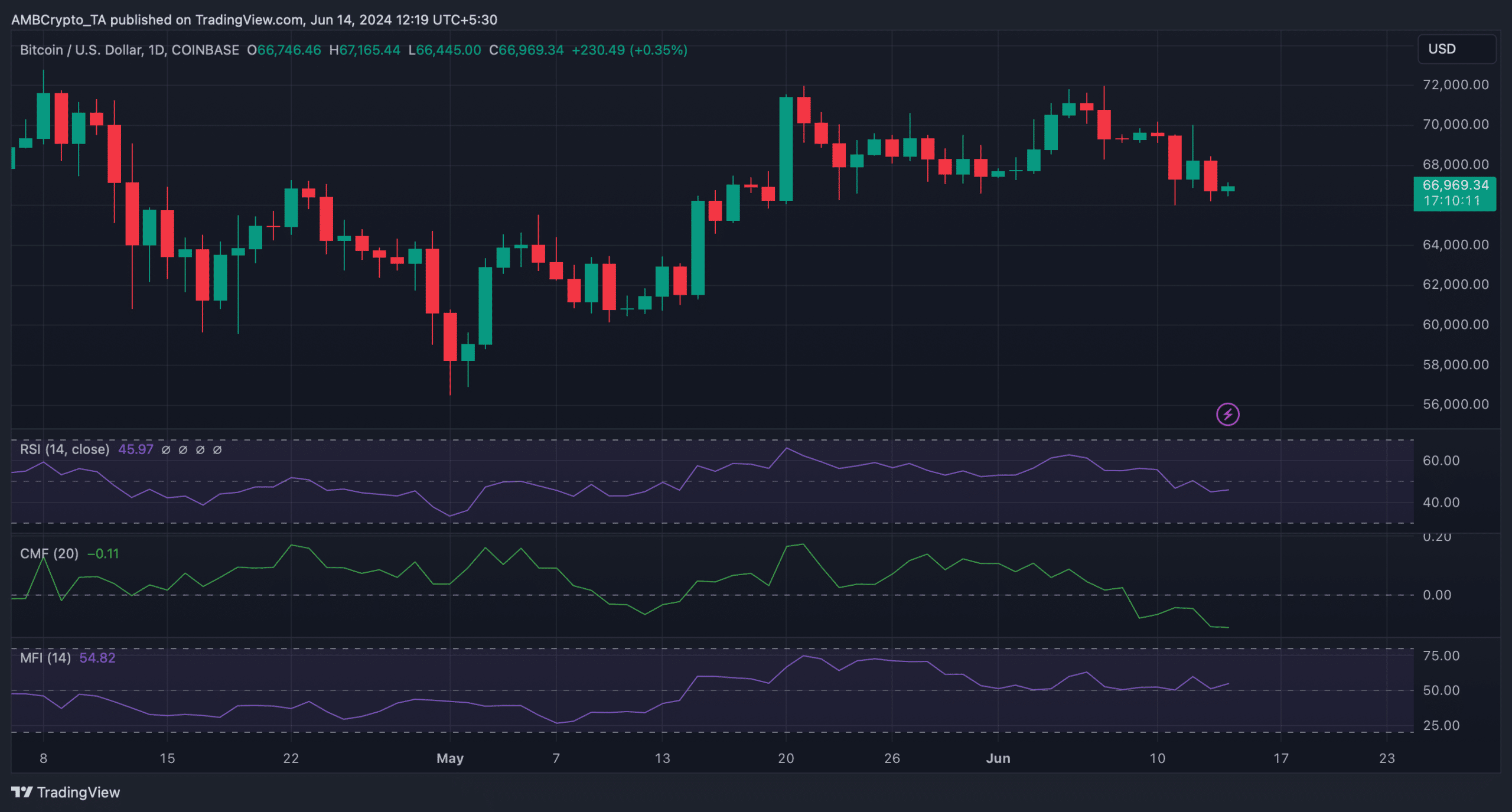

Some market indicators also looked quite bearish, for example Chaikin Money Flow (CMF) recorded a sharp drop.

read Bitcoin [BTC] Price Prediction 2024-2025

Moreover, the relative strength index (RSI) is also below the neutral level, suggesting a further decline in prices.

Nevertheless, the Money Flow Index (MFI) rose from the neutral levels, supporting the bulls.

Source: TradingView