Boeing is said to be considering selling parts of its legendary space business as its manufacturing practices come under intense scrutiny, machinists go on strike and losses pile up. But few industry analysts believe Boeing will take up the massive El Segundo satellite project.

Boeing’s new chief executive, Kelly Ortberg, said on a recent earnings call that the aerospace giant is considering shedding assets outside of the company’s core commercial aviation and defense businesses. added, “It’s better to do less and do better than to do more and do nothing.” That’s good. ”

That could mean Boeing has no future for its troubled Starliner spacecraft, which was developed to service the International Space Station. The Arlington, Va., aerospace giant is exiting the United Launch Alliance, its joint launch venture with Lockheed Martin. Both programs face stiff competition from Elon Musk’s SpaceX, which recently announced it would move its headquarters from Hawthorne to Brownsville, Texas.

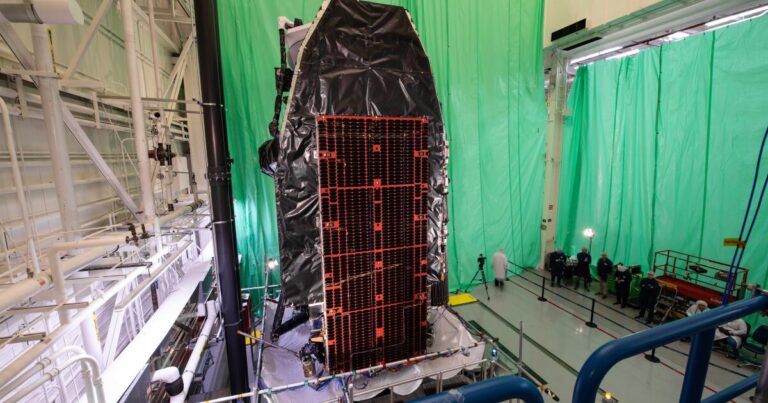

However, any asset sale is not expected to include Boeing’s satellite manufacturing business in El Segundo, which includes the number of assets acquired in 2000 when it acquired Hughes Electronics’ space and communications business. It includes a 1 million square foot factory with 1,000 employees. .

“It’s not a fast-growing business, but there’s no reason for Boeing to exit any time soon,” said Marco Caceres, an aerospace analyst at Teal Group. He pointed out that demand for satellites continues.

Eliminating part of its space operations would be a landmark decision for Boeing, which has deep ties to Southern California’s space program. The company has made parts for rockets, the X-37 spacecraft and the space station there.

Mr. Ortberg’s comments came amid concerns in the manufacturing industry over the company’s flagship 737 commercial jet program and the machinists’ strike, which is estimated to cost the company $50 million a day. Boeing this week raised $21 billion in stock sales to shore up its balance sheet.

Boeing has also been the target of multiple whistleblower lawsuits alleging lax safety and manufacturing practices that led to quality control problems.

The Wall Street Journal first reported last week that Boeing was considering selling part of its space business. A Boeing spokesperson said the company “does not comment on market rumors or speculation.”

The El Segundo Satellite Factory manufactures large satellites for commercial, government and military customers, including the O3b mPOWER communications satellite for Luxembourg telecommunications company SES. Other programs include a $440 million defense contract Boeing signed in March to build another broadband global satellite communications satellite that will provide high-speed, secure communications to the United States and its allies.

Caceres said that while building large satellites remains lucrative for now, the trend is toward networks of thousands of small satellites, such as SpaceX’s Starlink broadband network.

“It’s still a good business, but it’s going to decline because the future really is these big mega-constellation systems,” he said.

In 2018, Boeing acquired a small satellite maker called Millennium Space Systems, also based in El Segundo, whose operations are partially integrated with Boeing’s existing factory. The company has been awarded U.S. defense contracts for satellites to detect new threats such as hypersonic missiles.

Other Boeing space businesses in the region, including Schirmar subsidiary Spectrolab, which makes solar cells for satellites and other space applications, are expected to survive the restructuring. Boeing is also expected to continue participating in the Space Launch System, a giant rocket developed in Huntsville, Alabama, that NASA plans to send astronauts back to the moon.

Analysts agree that the most obvious option for potential sale or termination is the Starliner capsule, which was built to provide crew and supplies to the International Space Station. The spacecraft will be built at Kennedy Space Center in Florida and launched from nearby Cape Canaveral Space Force Station.

Boeing won a $4.6 billion contract to develop the plane in 2014 and has suffered cost overruns of about $1.5 billion, but the plane has not yet been certified. Meanwhile, SpaceX won a small contract to develop a manned capsule based on its existing Cargo Dragon capsule, which has made more than a dozen trips to the station.

In a blow to Boeing, NASA announced in August that the two people carried by the Starliner to the space station in June were suspended after the capsule developed propulsion problems while docking on Starliner’s third test flight. decided to return the astronauts to SpaceX. Starliner returned via remote control in September, but NASA and Boeing are still investigating what went wrong.

Boeing’s participation in the United Launch Alliance, a joint venture it formed with Lockheed Martin in 2006, is also considered expendable. The company claims a perfect mission success rate with over 150 military and commercial launches. ULA is based in Denver and launches from Cape Canaveral and Vandenberg Space Force Base in Santa Barbara County.

This year, the venture introduced a new Vulcan Centaur rocket that is partially reusable and reduces launch costs to about $110 million. It’s more powerful than SpaceX’s competitor Falcon 9, but its rockets feature fully reusable boosters and flight costs start at less than $70 million.

There has been speculation in the space industry about who would buy ULA, with Jeff Bezos’ space company Blue Origin rumored as a potential buyer, but no deal has been reached, perhaps because the price is too high. No, said Laura Folchik, the company’s executive director. Space industry consulting firm Astralytical.

Although business is not as strong as it used to be, ULA’s reliability, lack of launch vehicles and technological advances in new rockets can still attract business, she said, adding that “the demand for launch services is very high.” added.